Confidence that global inflation was under control continued to improve over November. As a result, expectations that the US Federal Reserve would maintain current interest rate settings strengthened. This allowed bond yields to fall with the US 10-year bond yield dropping from 4.6% to 4.5%.

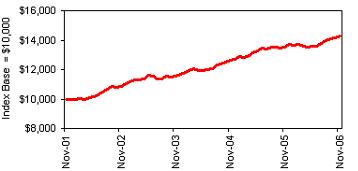

International Fixed Interest – Salomon Brother World Bond Index (Hedged $A)

The lower bond yields led to a rise in the price of fixed interest securities. As a result, average international fixed interest returns were positive 0.8% for the month, with the annual return now standing at 5.4%.

Ourview

The low longer-term interest rates currently on offer fail to take into account the risk that higher inflation may be sparked by increased manufacturing costs across the globe over the next few years. We maintain its tactical underweight recommendation to international fixed interest investments.