The Greek debt debacle

Key points

• The ongoing Greek debt debacle has the potential to contribute further to a correction in shares.

• It’s unlikely the situation will seriously threaten the global economic and share market recovery. Greece is an extreme case in terms of its public finances, the risks are better known than with the sub-prime crisis, Greece is very small and so far there is no sign of any flow-on to the debt of key advanced countries.

• Shares were due for a correction but the underlying backdrop remains favourable.

The blowout in public borrowing

It seems the Greek debt saga won’t go away. No sooner than it looks like it’s resolved it keeps degenerating into high drama once again. The latest iteration has been triggered by another upwards revision to the Greek budget deficit, ratings downgrades, more worries that assistance won’t be forthcoming from Germany and intensifying worries that Greece can’t deliver on its promises to cut its deficit or may default. Of course, there is a degree of self-fulfilling insanity to all this because the more investors panic and push up Greek borrowing rates, the greater the likelihood that Greece won’t be able to deliver, and so the more investors panic!

The bottom line is that the resultant panic has pushed Greek ten-year bond yields up to nearly 10%, which is more than three times above German levels. Bond yields in other ‘at risk’ countries such as Portugal and Spain have also been pushed up and share markets have fallen in the last few days on worries the debacle will threaten the global recovery. Many fear this is another global financial crisis (GFC) in the making, with another financial meltdown just waiting around the corner. So what are the risks?

Greece is a special case

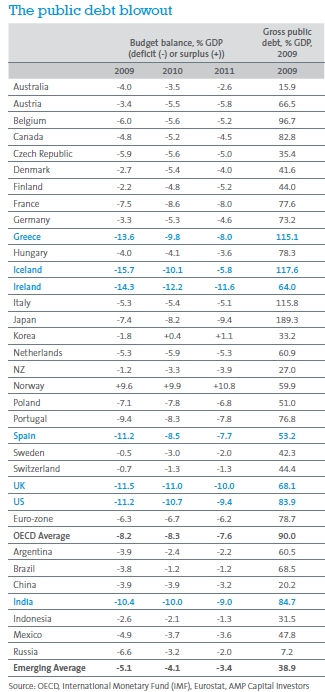

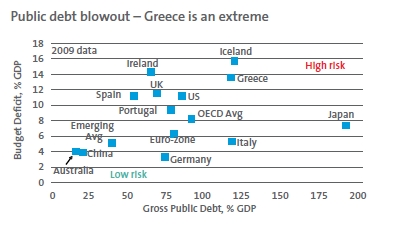

The table on the right shows budget deficits and public debt levels relative to gross domestic product (GDP) for Organisation for Economic Co-operation and Development (OECD) countries and key emerging countries. The first chart shows essentially the same thing in graph form. What is apparent is that Greece, along with a few other countries has an extreme budget deficit and public debt position relative to its GDP. What’s more, it is regarded as covering up the size of its budget deficit, was running big deficits before the GFC, and arguably hasn’t been quick enough to respond. In addition, it doesn’t have much track record in reducing its deficit in the past (unlike the US, UK and Portugal) and doesn’t have stable domestic debt holders like Japan.

Source: OECD, International Monetary Fund (IMF), Eurostat, AMP Capital Investors

While investors are now fretting about Portugal, Spain and Italy, it’s worth noting the public finances in these countries are in better shape than Greece.

Risks better known with Greece than sub-prime

Despite Greece’s dodgy public finance stats, the risks are far better known than was the situation during the GFC when financial institutions baulked at counterparty risk because they didn’t know what sort of sub-prime Collateralised Debt Obligation-related risks they might be getting exposed to. In the case of Greece’s public debt, the exposures and risks are far more transparent. Interestingly, 25% of Greek public debt is held by Greek residents while the rest is held largely by European financial institutions, notably in France and Germany. US banks have little exposure.

Greece is unlikely to derail the global recovery

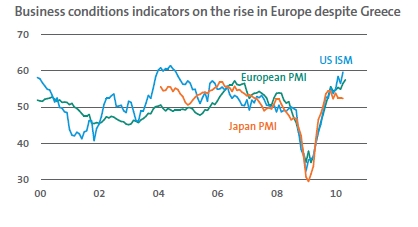

Greece is only 2.6% of euro-zone GDP and Portugal is just 1.8%. What’s more, the Greek tragedy has been hitting the headlines since late last year and, despite this, both consumer confidence and business conditions in the euro-zone have been rising solidly. In fact, business conditions readings in the euro-zone are quite close to US levels and both are at or around normal cyclical highs. It looks like the weaker euro is having a positive impact, outweighing the bad news from Greece.

Source: Bloomberg, AMP Capital Investors

More broadly, the news on the global recovery has continued to improve over the last few months despite the Greek news. This is most noticeable in the US and Asia where the economic recovery seems to be getting stronger.

No concerns over high public debt levels in key advanced countries

The more significant concern regarding public debt relates to the US, UK, parts of core Europe and Japan, and we remain of the view that it will be a medium term constraint on growth in these countries. However, at this stage there is absolutely no sign of any investor panic spreading to these countries. In fact, long term sovereign bond yields have fallen this year in the US, UK, Germany and Japan, partly due to a flight to safety from countries with high sovereign debt levels.

Public debt not really an issue in emerging world and Australia

Whereas the IMF is projecting gross public debt in advanced countries to rise above 100% of GDP this year, in the emerging world it is likely to have peaked below 40% of GDP. In Australia, the budget deficit is less than half the average OECD levels and gross public debt of around 16% of GDP is trivial compared to an OECD average of 90%. Upgrades to Australia’s growth outlook suggest budget deficit projections will be revised down.

Shares were vulnerable to a correction

After strong double-digit gains from their more recent lows in early February share markets had become vulnerable to a correction. The reintensification of Greece’s problems, concerns about increased bank regulation on top of the issues facing Goldman Sachs in the US, and ongoing worries about China’s tightening are all proving to be triggers. This is not unusual – cyclical bull markets in shares don’t go in a straight line. However, while the correction in shares may have further to run, the fundamental backdrop for shares remains strong with reasonable valuations, strong earnings growth and still relatively low interest rates globally. This all suggests the cyclical recovery in shares has further to go.

Greece nearing some sort of end game

Now back to Greece. Our sense is it is reaching some form of end game. Its borrowing rates are simply being pushed up to levels where it will either default or get assistance. Given the long term negative connotations associated with default, the more likely scenario is it will get some form of assistance, although this may still involve some form of debt restructuring to reduce near-term debt servicing costs. Worries about an intensification of contagion to other ‘at risk’ European countries will likely help speed up the granting of assistance by the European Union (EU). German Chancellor Angela Merkel has indicated that negotiations with Greece and the EU/IMF over assistance need to be sped up. However, the going will be tough and funds from the EU and notably Germany may only show up just in time and in dribs and drabs (e.g. just €8.5 billion to roll over debt in May). This will likely be enough to keep Greece going but still see markets remain on edge periodically.

European public debt problems are negative for the euro as it will likely necessitate easier-for-longer monetary policies from the European Central Bank. However, to the extent that it forces greater fiscal discipline down the track, it could become a longer term positive in a few years (whether Greece remains in or out of the euro-zone).

Concluding comments

The correction in shares that has been triggered by Goldmans and Greece may have a bit further to go yet. However, it’s hard to see Greece bringing down the global recovery. As a result the implications for Asia and Australia are likely to remain minimal.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors