House prices and debt - Australia's archilles heel

Key points

- How house prices behave over the year ahead is likely to be a key determinant of how well Australia weathers the global financial crisis and recession now embracing the rest of the world.

- Falling interest rates, increased home owner grants and a housing undersupply are positives for house prices. However, these are offset by poor affordability, overvaluation, low rental yields & rising unemployment.

- On balance, we see average house prices falling another 10% to 15% over the year ahead.

Introduction

In several ways, Australia is better placed than many other countries to withstand the global recession now underway. We have plenty of scope for fiscal and monetary stimulus, our financial system is still operating comparatively well, and while growth in our trading partners is slowing, it will be higher than in the US, Europe and Japan. However, there is one area where Australia is particularly vulnerable and this is the intersection of high household debt levels and high house prices. If house prices slide too much, we risk entering a debt-deflation spiral where sliding house prices trigger further falls in spending, which in turn trigger further increases in unemployment, further falls in house prices and so on. So far this year, the Australian housing market has started to slow with house prices off by 2% to 4% from their recent high.

US & UK house prices on the slide

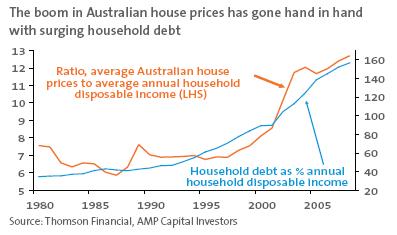

The last decade has seen a massive surge in house prices in many countries. The surge in Australian house prices relative to income levels has gone hand in hand with a substantial rise in household debt, as evident in the chart below.

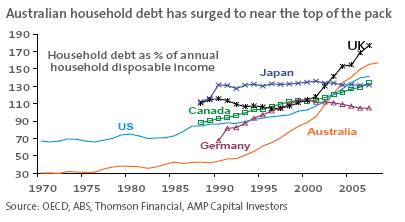

This has been the same in other countries, except that the rise in household debt has been much faster in Australia. We have therefore gone from the bottom of the pack, in terms of comparable countries, to the top. Refer to the chart below.

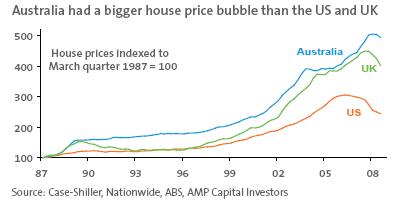

Similarly, the gains in Australian house prices have been greater than in many other countries. Refer to the chart below.

From their highs, US house prices are off 20% and UK house prices have fallen approximately 12%, and are still falling. The slump in house prices is weighing heavily on consumer spending in both countries, as it leads to a loss of wealth and has halted the phenomenon of mortgage equity withdrawal.

The case for optimism on house prices

Despite all this, many would argue that there are good reasons for optimism regarding Australian house prices. Firstly, while America’s housing boom ended because of an oversupply of housing, Australia has a huge shortage. This is reflected in approximately 1% vacancy rates for rental properties, and 10% per annum rental growth.

Secondly, whereas the US housing boom saw a huge reduction in lending standards with more marginal borrowers obtaining finance, in Australia the surge in borrowing was focused on existing home owners trading up who tend to be older with higher incomes.

Thirdly, the slump in US house prices may have been accentuated by non-recourse mortgages which result in a strong incentive for home owners to hand over the keys once the house value falls below the value of the loan. This is not the case in Australia where full recourse mortgages provide a powerful incentive to keep servicing the loan.

Further, it is argued that the fall in mortgage interest rates of nearly 2% since early September, combined with increased first home owners’ grants, will spur an upswing in Australian house prices.

Finally, if the economy is in a better position to deal with the global recession for the reasons noted in the introduction, demand for housing should be underpinned.

Reasons for caution on house prices

There are however, several reasons to expect further weakness in house prices going forward.

Firstly, despite the turn in the cycle to falling mortgage rates, most housing related indicators remain very weak. Housing finance is continuing to fall, new home sales are decreasing and weekly auction clearance rates are running 20% to 30% below year ago levels, even 2 months after the first rate cut.

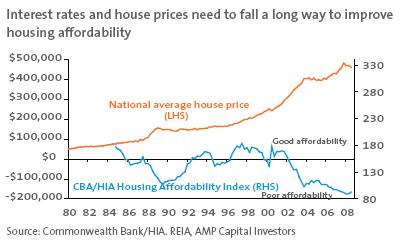

Secondly, past periods of house price strength have commenced when housing affordability is good, whereas affordability today is poor despite falls in mortgage rates. This is because house prices remain so high.

Thirdly, despite recent softness, Australian housing remains highly overvalued, by an average 23%.

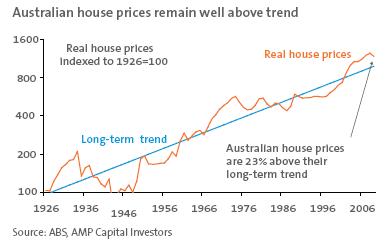

- In real terms (ie after inflation), Australian house prices remain well above their long-term trend (by 23%). Over the last 80 years, the trend rate of growth in real house prices has been 3.1% per annum. This is consistent with long-term real gross domestic product (GDP) growth around the same level. However since the mid-1990s, house price gains have been well above trend growth. Refer to the chart below.

- Average Australian house prices remain very high relative to average weekly wages and need to fall about 22% to return to more normal levels. The ratio of house prices to median household income in Australia is more than double what it is in the US.

- Despite strong growth in rents, rental yields remain very low. Gross rental yields of 3.6% for houses and 5% for units are well below the 6.5% plus net rental yields available on directly held commercial property, the 10% distribution yields on listed property trusts and a grossed up dividend yield of over 7% available on Australian shares. House prices would need to fall about 25% to bring the ratio of house prices to rents (adjusted for inflation) back to its long-term average.

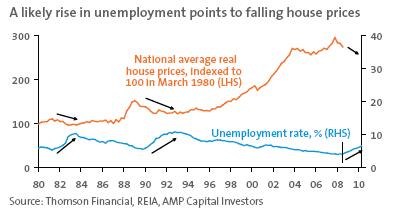

Finally, at a time when housing affordability is poor, household debt levels are high and house prices are overvalued, rising unemployment poses a significant threat to house prices. Into 2010 we see the unemployment rate rising to 6.5% or higher. This is likely to result in an increase in mortgage delinquencies and greater caution on the part of prospective new home buyers who are likely to be less certain about their future employment. The chart below shows the relationship between real house prices in Australia (house prices adjusted for inflation) and the unemployment rate. As indicated, the rise in unemployment associated with the early 1980’s and early 1990’s recessions contributed to significant falls in real house price. While this was masked by much higher inflation at the time, real house prices fell 12% in the early 1980s and by 20% in the early 1990s.

This time around, we don’t have the same high level of inflation to mask falling house prices in real terms. More importantly, while the quality of Australian mortgagees may be higher than in the US, the level of indebtedness underpinning the housing market is much greater than prior to the last 2 recessions, and house prices were not as overvalued. This would suggest that house prices may now be much more sensitive to rising unemployment than in the early 1980s and early 1990s.

Concluding comments

Earlier this year, the housing market was threatened by rising interest rates. Now it is the economic downturn and rising unemployment. Coming at a time when affordability is poor, housing is overvalued and debt levels are very high, our assessment is that house prices are likely to fall further over the year ahead. Barring a very deep recession or depression, 40% falls in house prices are unlikely. But with the economy on track for a mild recession, and if not then a very serious slowdown, house prices are likely to fall 10% to15% over the next year or so. This in turn will put further downwards pressure on consumer spending and drive further sharp interest rate cuts.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.