The implications of Barack Obama’s election victory

Key points

- Barack Obama’s historic election victory is likely to see the US shift towards more interventionist economic policies, a more progressive approach to the environment and a less unilateralist foreign policy.

- We are also likely to see a more aggressive approach to dealing with the financial and economic crisis now gripping the US.

- With economic policy under Obama likely to be pragmatic, and Obama offering a breath of fresh air after the troubles of recent years, there is no reason to suggest that the new US administration will be negative for shares. If anything it is likely to be positive over time.

- It is worth noting that US shares normally do better under Democrat presidents than under Republicans.

Policy platform

In a historic election, Barack Obama has won the US presidency on a platform of change. While an Obama presidency will step back from the pro-business, almost laissez-faire, neoconservative approach of the Bush administration, an extreme lurch to the left is unlikely. Rather, Barack Obama is likely to prove as pragmatic as President Clinton was. Key aspects of an Obama administration are likely to include:

- A new fiscal stimulus package, much larger than the one seen earlier this year. This is likely to be enacted early next year. However, given the US Government’s already large borrowing program (reflecting the existing deficit plus numerous measures to deal with the current crisis), Obama’s scope to stimulate is limited.

- More active government intervention to prevent home foreclosures and increase bank lending, particularly by banks receiving government assistance.

- Tax cuts focused on low and middle income earners, but tax increases for high income earners, back to pre-Bush top marginal tax rates.

- An increase in tax rates on dividends and capital gains from 15%, but possibly only to a top rate of 20%.

- Increased regulation of business, particularly the financial sector (this is inevitable in most countries after the current crisis).

- Increased government spending in areas such as health, education and infrastructure.

- A commitment to free trade, but more incentives for US companies to create jobs in the US.

- More concern about the environment and the introduction of a carbon emissions reduction scheme.

- A more multilateral approach to the ‘war on terror’ and to foreign policy in general.

It is also worth noting that the Democrats’ increased majorities in both Congress and the Senate put President-elect Obama in a good position to implement his policies. It will also enable the US Government to have a more decisive approach in dealing with current financial and economic challenges. This is in contrast to the debacle seen in late September / early October as it attempted to pass the bank rescue program.

Investor reaction

The conventional view is that a Democrat victory would be negative for shares (via higher taxes and increased regulation). For example, in a recent survey, only 17% of US investors thought that a Democrat victory would be positive for profits compared to 55% who thought that a McCain victory would be positive. 54% of investors thought that shares would fall in November and December if Obama won, compared to only 14% who thought shares would fall if McCain won.

Statistical evidence suggests that US shares do better in the year after an election when an incumbent Republican party wins, as opposed to when an incumbent Republican party loses. However, the difference is not all that great. There is also some historical evidence to suggest that US shares do better between election day and year-end when a Republican president is elected.

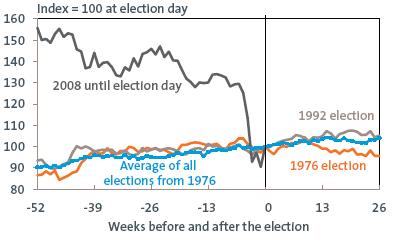

However, there are several points worth noting in regards to all this. Firstly, this year’s presidential election has been a side show with shares plunging in response to the turmoil that the US sub-prime mortgage crisis has caused. This is very different to the broadly sideways range trading that prevailed in the lead up to the last two elections, when incumbent Republicans lost to Democrat presidential candidates in 1976 and 1992. Refer to the chart below, which shows US share prices as measured by the S&P 500 from one year before until six months after US elections from 1976. Given the scale of the problem now facing the US, it is likely that developments in relation to the credit crisis will continue to dominate politics in terms of share market impacts.

US equity markets around election days

Source: Thomson Financial, AMP Capital Investors

Secondly, the chart above also indicates that a Democrat victory does not necessarily mean a negative outlook for the market. In the aftermath of the 1976 Carter victory over a Republican incumbent, shares performed below par, but did better than normal after Clinton’s victory in 1992.

Thirdly, it is possible that a change of Government in the US will be welcomed by investors. The Bush administration has lost credibility after having prevailed over 2 bear markets, 2 recessions, a big policy failure with the sub-prime mortgage debacle and after becoming bogged down in Iraq. In the post-war era, this track record is only on par with the record of Richard Nixon. This loss of credibility may have harmed the US Government’s ability to deal successfully with the recent financial turmoil. Having a change in direction with the Democrats may be seen as offering a positive new start.

Further, with the private sector now in retreat in response to the credit crunch and a loss of confidence, many investors might see more interventionist government policies as necessary at this time.

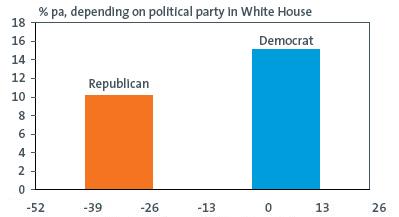

Finally, the historical record indicates that US shares have actually done better under Democrat presidents. Since 1945 the average return from shares, as measured by the S&P 500 under Republican Presidents, has been 10.2% per annum (pa) versus 15.1% under Democrats.

US share market returns 1945 - 2008

Source: Datastream, AMP Capital Investors

For these reasons, Barack Obama’s election victory may well turn out to be positive for US shares, or at least there is no reason to see a negative impact. Given the key role that the US share market plays in setting the direction for most global share markets, including Australia’s, the same would apply to them as well.

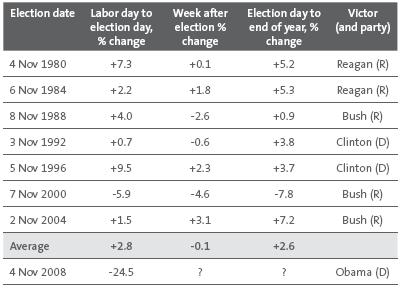

For those focused on the very short term, the next table shows the short term performance of US shares around the last seven US elections.

US shares (S&P 500) around presidential elections

Source: ISI, AMP Capital Investors

On average, shares have gone sideways in the week immediately after the last seven elections, but have rallied into year-end. The only time this did not occur was in 2000, after the election of President George W. Bush (which was a sign of things to come!).

Conclusion

Given the economic crisis now facing the US and the world, the latest US presidential election was perhaps the most significant in many years. Barack Obama’s victory is likely to see a shift towards more interventionist economic policies and a more aggressive approach in dealing with the current crisis. Given the current situation, such an approach is probably appropriate, and over time, may well be seen by investors as providing more confidence in an eventual economic recovery.

It is also likely that the decision of Americans to elect Barack Obama as their next President will radically improve the way the rest of the world views and interacts with the US, which can only be a positive thing. But of course, given the scale of the crisis facing the US, none of this will necessarily prevent a continued rough ride for shares in the short term.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, fi nancial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, fi nancial situation and needs. This document is solely for the use of the party to whom it is provided and may not be reproduced without permission from AMP Capital.