The Australian Economy - past the tipping point

Key points

• The Australian economy has slowed abruptly on the back of higher borrowing costs and higher petrol prices.

• The Reserve Bank of Australia (RBA) has gone too far on interest rates and the next move will be a rate cut, ideally before Christmas.

• High export prices and the scope for fiscal and monetary easing mean Australia is in a better position than many countries, but the risk of recession is now very high.

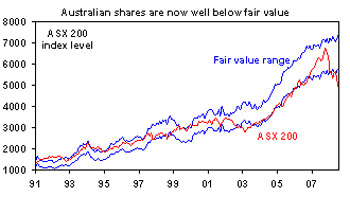

• After a 30% fall, Australian shares have priced in a lot of the bad news and are already factoring in a recession.

Introduction

Things have been pretty good for the Australian economy over the last 15 years. The last recession is a distant memory, profit growth has been solid for years and until recently, inflation and interest rates were generally benign. However, earlier this year we started to get concerned that the risk of a hard landing was rising. Our main concern was that the RBA was going too far in raising interest rates. It has since become increasingly clear that the Australian economy is slowing abruptly. This note looks at the risk of recession and implications for interest rates and shares.

Abrupt slowdown in Australia

Earlier this year the consensus was that massive iron ore and coal price increases and further tax cuts were likely to ensure that growth remained solid and that more interest rate hikes were required to offset the likelihood of further pressure on inflation. As a result, the RBA hiked rates in February and March. In the event, Australia has seen a major tightening in financial conditions over the last year.

• The RBA has increased the official cash rate by 1.00% to 7.25% over the last year;

• Bank lending rates have risen by an additional 0.5% to 0.6% reflecting an increase in the cost of funds due to the global credit crunch. As a result, the standard variable mortgage rate has increased from 8.05% a year ago to just over 9.60%. This 20% increase means that a family with a A$250,000 mortgage is now paying about an extra A$75 a week in interest payments.

• The credit crunch has slowed the amount of credit available to lend. This is set to worsen as provisioning for bad debts cuts into the lending ability of banks.

• Shares have had a 30% top to bottom fall, reducing wealth levels and confidence and boosting the cost of equity capital to firms.

• House prices have started to top out and fall, further cutting into wealth levels and confidence.

• The surge in petrol prices has added about A$20 a week to a typical family’s weekly petrol bill.

All of this has put a big squeeze on the economy. The surge in commodity prices is great if you have shares in resources stocks or work in mining related jobs, but for the rest of the economy, the trickle down via, say, tax cuts has now been more than offset by the impact of higher mortgage rates and petrol prices. The July tax cuts and other Budget measures were worth about A$50 a week for a typical family but this compares to an extra A$75 in interest payments and an extra A$20 in petrol bills. Not everyone has a mortgage or drives a car – but the key grouping that determines consumption spending at the margin does. The result has been an abrupt downturn in the economy.

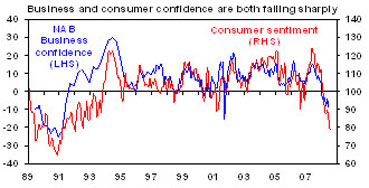

• Consumer and business confidence have fallen back to recessionary levels.

Source: Thomson Financial, AMP Capital Investors

• Retail sales volumes have fallen at an annualised rate of 1.8% so far this year after rising 5.6% last year;

• Housing related indicators are uniformly weak with falling building approvals, falling housing finance commitments, weekend auction clearance rates running about 20 to 30 percentage points lower than a year ago and generally falling house prices.

• While the pipeline of investment projects yet to complete is huge, new projects are starting to slow.

• The rate of growth in private sector credit has slowed dramatically and housing credit is growing at its slowest pace in over 21 years;

• Softening job vacancies, business hiring plans and job growth indicate the labour market is slowing.

Given the lags involved from tightening financial conditions to their impact on the economy, it’s likely we will see a further deterioration in growth. In fact, our leading indicator based on building approvals, business and consumer confidence, the share market, the shape of the yield curve and money supply growth is still falling.

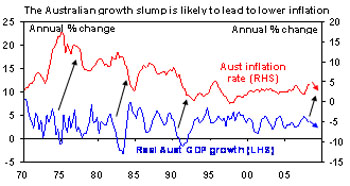

Source: Thomson Financial, AMP Capital Investors

Several other considerations are adding to the downside risk. First, housing is arguably the Achilles’ heel of the Australian economy. Australia has had a far bigger housing bubble than the US. The ratios of both house prices and household debt to household incomes are far higher than in the US, suggesting a significantly greater risk of major problems as already high mortgage stress continues to rise, made worse by rising unemployment. Because Australian mortgages are full recourse in contrast to US mortgages where the borrower’s liability is generally limited to the property itself, a US style surge in foreclosures is unlikely. But this could just mean that mortgage stress will show up in a sharper slump in consumer spending, and this is possibly already getting underway.

Secondly, the terms of trade boost does not provide guaranteed protection for Australia. Other economies with terms of trade boosts (albeit smaller) are flirting with recession, such as the UK and New Zealand. In fact New Zealand is now having to cut interest rates having increased them too far. It should also be noted that even China, India and the rest of Asia are now slowing and this is likely to put some downwards pressure on commodity prices in the short term, undermining some of Australia’s terms of trade boost. China’s growth rate has already slowed from around 12.0% last year to 10.1%. Growth in India looks like slowing back to around 7.0% this year from 9.0% last year.

Not all doom and gloom

The good news is that Australia is in better shape than many other countries. The strength in the terms of trade is providing a boost to national income whereas many countries have seen their terms of trade fall. Moreover, rural production is likely to receive a boost this year, there is still a huge pipeline of investment projects yet to complete, Australia has an undersupply of housing (unlike the US which has an oversupply) and the Government’s big budget surplus and the high level of official interest rates mean that there is plenty of scope to ease policy to stimulate growth if need be. These considerations suggest that while the risk of recession is now significant at say around 40%, it’s still likely that we will avoid it – but with growth slowing to a still weak 1% to 2% over the next year, enough to push unemployment above 5% by June 2009.

What about inflation?

To be sure, inflation remains high and contrary to popular opinion it is broader than just food and energy. Letting it get out of hand would be a mistake. But our view is that the tightening in financial conditions has done more than enough to reduce inflation. If history is any guide, the downturn in growth now underway will lead to a sharp fall in inflation over the year ahead. Falling oil prices will likely add to the downwards pressure on inflation.

Source: Thomson Financial, AMP Capital Investors

Where to for interest rates?

While inflation remains high, it is yesterday’s story as the abrupt slowdown in growth indicates that the tightening in monetary conditions that has occurred (and is continuing with banks under ongoing pressure to raise lending rates) is now at significant risk of tipping the economy into recession. Ideally the RBA should be cutting interest rates now just to offset the continuing increase in bank lending rates. But while RBA Governor Glenn Stevens has indicated the Bank will not wait for inflation to return to target before easing, it may take a while for it to become comfortable to start cutting. We believe that cash rates will start heading lower later this year and by the end 2009 the official cash rate will be back down to around 6.00%.

What does this all mean for investors in shares?

Sharp economic downturns are bad for shares for the simple reason that they are bad for profits and investor confidence. However, the Australian share market is arguably already priced for recession. It is now trading well below fair value as indicated in the next chart. The market’s forward PE is now just 11 times and a 30% slump in profits is required to bring it back to its ten year average of 15.2 times. As such there is a good buffer already priced into shares and we remain of the view that they are great value from a longer term perspective.

Source: Thomson Financial, AMP Capital Investors

However, the next few months are likely to see the news flow remain poor – with more earnings downgrades, more bank provisioning for bad debts and more bad global news. So the ride is likely to remain rough for a few months yet.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors