Income streams going cheap

Income streams going cheap

In times of abnormally high volatility, many share market investors are naturally concerned with movements in the capital value or price of their share investments. This focus is encouraged by the availability and transparency provided by the daily trading of shares on public exchanges.

Other types of investments, for example, direct property or the ownership of small businesses and private companies, provide far less transparency over movements in the underlying investment value. As a result, for these investment types, the investor’s perception of performance is determined more by the profit or income being generated, rather than any short-term movement in the capital or sale value of the investment.

Income can dominate long-term returns

Although daily share price movements can steal the majority of an investor’s focus, for investments in share markets it will normally be the income stream that provides the bulk of return to an investor over the long term.

An example of the dominance of income in share returns over the long term is provided below. The example assumes an initial $100,000 investment is made for 40 years, attracting an initial annual fully franked dividend of 4% and a share price rise of 5% per annum. It is also assumed that the investor’s marginal tax rate is 30%.

|

Initial investment |

$100,000 |

|

Value of investment at year 40 |

$721,000 |

|

After tax capital gain |

$527,800 |

|

Accumulated dividend income |

$496,800 |

The above table suggests that over a 40 year period, the investment returns generated from capital gains are only slightly higher than that generated from dividend income. However, whereas the capital gain is only available for use at the end of the 40-year period, the dividend income is paid throughout the investment period. Income received throughout the investment period can be put to uses such as debt repayment or re-invested. In order to reflect the benefit or “time value of money” of receiving income through the investment period, the table below converts the capital gain and income component of return into present value today dollar terms (using an implied interest rate or discount rate of 6.5%).

|

Present value of capital gain |

$ 40,900 |

|

Present value of dividends |

$117,800 |

Hence after adjusting for the time value of money, some 74% of returns are accounted for by the flow of dividend income.

Admittedly, the above analysis is dependent on a relatively long-term (40 years) investment typical of say a 25-year old investing for retirement. However, even under a shorter term scenario of 20 years, an investment with the same characteristics as those described above would produce some 63% of its after tax returns in the form of dividends.

The reason for the extent to which dividends account for the bulk of investment returns is not intuitively obvious, given little difference in the assumed rates of return for dividends and capital growth. In simplified terms and assuming no taxation differences, a 5% return in an interest bearing bank account is equivalent to a 5% return in a capital growth investment. However, the distinguishing characteristic of dividend income is that it is expected to increase each period. A 5% quoted dividend return is normally vastly superior to a 5% interest bearing return as the dividend rate gradually increases in size relative to the amount of the original investment.

The stability of income

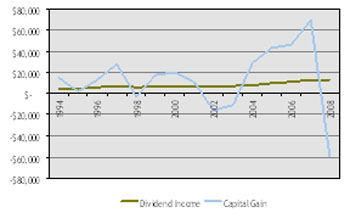

Not only does income represent a more important source of return for long-term share investors than capital price movements, it also tends to be a more stable source of return. This is highlighted in the chart below that traces the movement in the dollar value of returns from dividend income and annual capital gain on an initial $100,000 investment made in the Australian share market 15 years ago.

Share Market Returns

Source: Hillross, Reserve Bank of Australia

Supporting the stability of dividend income is the tendency for firms to maintain dividend payouts even if they experience a temporary decline in profitability. There is evidence of this occurring in the current round of profit reporting, with global and local economic factors impacting on share prices and earnings, but relatively few companies announcing reductions in dividends.

Current investment opportunities

In addition, for those investors with a specific objective of producing long term dividend income streams, current market conditions may represent a potential opportunity to establish a higher than normal level of income. Several Australian blue chip companies are currently priced with fully franked dividends in the 6% to 7% range, which may prove to be attractive for those investors willing to focus on income streams and “ignore” the unusually high level of day-to-day volatility in share prices currently being experienced.