Oil prices and the economic outlook

Key points

Onwards and upwards

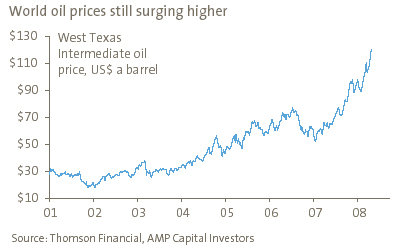

One of the big surprises this year is that despite all the uncertainty about the global economic outlook and turmoil in financial markets, the world price of oil surged through US$100 a barrel and has kept going, reaching US$120 in the past week. This is a long way from just above US$10 in 1998.

-

Oil prices have been pushed up by several factors this year, in particular:

-

Ongoing strong demand for oil from emerging countries, notably China where oil imports were up 8% over the year to March;

-

Continuing supply worries with the latest being in Nigeria and the North Sea;

-

The slide in the US dollar (US$) which has pushed up the value of commodities, such as oil, which are priced in US$ and increased their demand as a hedge against the falling US$. In fact the oil price and euro/US$ exchange have had close to a 96% correlation lately. (But it’s worth stressing that the rise in oil prices is not just a phenomenon of the falling US$. In euros and Australian dollars oil is up 13% so far this year versus a 20% rise in US$); and

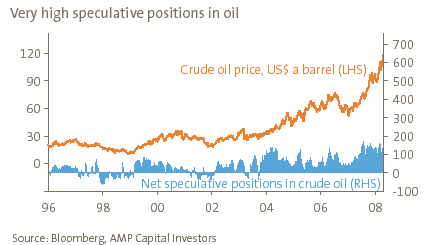

- Increased speculative and hedge fund interest.

The big question is where to from here for the oil price? Has it risen to a level that it will now threaten global growth and the oil price itself? And what is the longer term outlook?

The long term trend is likely to remain up

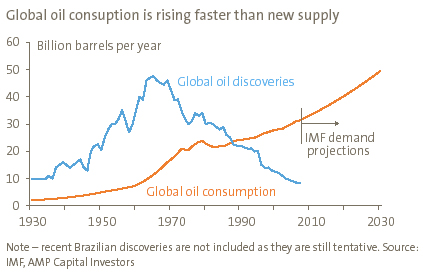

The key driver of the rising trend in oil prices this decade has been solid growth in the underlying demand for oil relative to its supply. The basic problem is illustrated in the following chart which shows an uptrend in global oil consumption but a downtrend in global oil discoveries.

Note – recent Brazilian discoveries are not included as they are still tentative. Source: IMF, AMP Capital Investors

This dynamic is likely to remain in place for many years to come. Global demand for oil is expected to rise around 1.5% to 2.0% annually over the next few decades (even allowing for alternatives and efficiencies) as countries like China and India continue to industrialise, leading to higher energy usage (eg: via higher car ownership).

At the same time, while global oil production is rising it is likely to continue to struggle to keep pace with demand. Rapidly expanding oil production capacity in OPEC and non-OPEC countries along with recent possible massive oil field discoveries in Brazil highlight that “Peak Oil” claims of an imminent peak in global oil production are likely to be proved very wrong (yet again). However, the expansion in oil production now occurring is only being made possible by ever higher oil prices and new technology. In fact the technology to pump oil from the giant Carioca-Sugar Loaf field just announced in Brazil (which may have 33 billion barrels, but is up to six kilometres below sea level), is yet to be invented. And it may be a decade before it comes on stream.

Strong long term growth in demand but constrained supply means the long term trend in the oil price will remain up. It’s likely we will see US$200 a barrel in the next five years.

Short term stresses should mean short term relief

Fortunately, some relief is likely over the next six months:

-

The slowdown in global growth now underway is likely to lead to a sharp slowdown in demand for oil. OECD oil demand has stalled and slowing growth in China and other emerging markets is likely to see growth in their demand for oil also slow down.

-

-

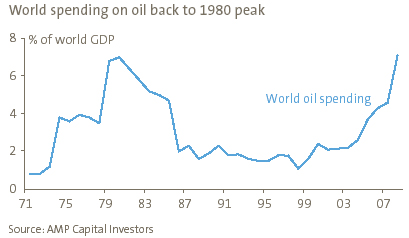

The surge in the oil price is also sowing the seeds of a correction in oil prices. At current levels world oil spending expressed relative to global GDP is now back to the levels that created problems for global growth in the early 1980s. Rising oil prices are acting as a tax on consumer spending at a time when consumers in many countries, including Australia, are already struggling.

For these reasons we see oil prices falling over the next six to 12 months, possibly back to around US$85 a barrel before the long term rising trend resumes.

Implications

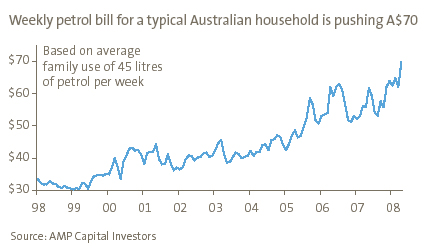

The latest spike in the oil price has several implications. First, Australian petrol prices have already pushed through A$1.50 a litre at the highpoint of the weekly cycle and are likely to push up to A$1.60 a litre as the further rise in the oil price over the last few weeks feeds through.

Second, the latest spike in oil prices is likely to add to worries about the global and local economic outlook. The threat to inflation is already apparent globally and in some countries (eg the Euro-zone), is having the effect of preventing central banks from responding to signs of slower growth. But more importantly at a time of weak economic conditions is the tax on consumer spending that higher oil prices result in. The rise in petrol prices has seen the weekly petrol bill for a typical Australian household rise around A$14 over the last year. This translates to an extra A$700 a year which is coming on top of a big rise in mortgage payments, which means less discretionary income will be left over to spend on other things.

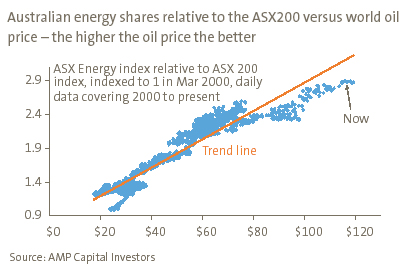

Third, the rising trend in oil prices remains good news for energy shares. As can be seen in the scatter plot below a higher oil price usually results in the outperformance of Australian energy shares relative to the broader share market. A US$10 rise in the oil price should see energy shares outperform the broader market by 15%. Right now energy share prices have a bit of catching up to do, running well below the trend line in the chart below, probably owing to equity investor scepticism about durability of the strength in oil prices over the last year.

Finally, while higher oil prices are good news for energy shares, the surge this year has the potential to cause further volatility in share markets as investors fret about the broader economic impact. Lower oil prices over the next six months should help though.

Conclusion

The long term trend in oil prices is likely to remain up, but barring a major supply shock some relief is likely over the next six to 12 months as the global economy slows down leading to slower demand for oil.

Dr Shane Oliver

Chief Economist and Head of Investment Strategy, AMP Capital Investors