Shares – is the bear market over?

Key points

-

Shares have rebounded sharply from the panic lows in March. Investors were assuming the worst two months ago, but recent economic and financial news has mostly been better (or at least less dismal) than feared.

-

Shares are likely to have a short term pull-back. There is still more bad economic and profit news to come, the May to October period is often rough for shares and shares have run too hard and fast from their March low.

-

The bottom has likely been seen and the broad trend is likely to remain up so by year-end shares will likely be higher still (around 6350 on the ASX 200).

-

Shares up since March panic

-

Since the panic lows in mid-March global shares are up 15%, Australian shares are up 17% and Asian shares are up 19%. The rebound begs the question: have we seen the low or is it just a bear market rally?

The current state of play

In mid-March share markets were down 20% or more from last year’s highs and investors feared the worst. Commentators fell over themselves trying to portray how bad the credit crisis was, and some even made off the wall comparisons to the 1930s. However, the world has turned out quite differently than feared and the sky hasn’t fallen in after all (at least not so far). Specifically, the rebound in share markets reflects a range of factors:

-

Credit markets have improved from the dark days in mid-March. Credit borrowing spreads have contracted, bank asset write downs have slowed down, there is evidence that leverage buyout deals are returning and there are some signs of life in mortgage-backed securities markets. It would appear that the actions by the US Federal Reserve (Fed) to put a firewall around troubled investment bank Bear Stearns and make sure that other investment banks don’t run into the same trouble (they can now borrow cheaply from the Fed) marked a watershed in the credit crisis. This along with other actions by central banks to inject liquidity into their money markets looks to be working. The Fed and US Government sent a strong signal that a re-run of the debt deflation spirals of Japan in the 1990s, or worse still the 1930s, would not be tolerated.

-

Whilst the US economy has slowed sharply, it has not plunged into recession as generally feared, even by me. March quarter gross domestic product (GDP) growth was positive and looks like it will be revised up. Consumer spending hasn’t collapsed and should benefit from tax rebates, the trade sector is providing a strong boost and monthly employment data is above recessionary levels.

-

Profit results beyond US banks and home builders have held up very well. Non-financial US companies saw profits rise 9% over the year to March.

-

While leading indicators in Europe and Japan have softened so far, economic growth in both regions has come in better-than-expected.

-

The world is split between what some have called “fire and ice”, i.e., weaker conditions in rich countries, but strong growth in the emerging world. For example, growth in China this year is on track to be around 9.5%, with rebuilding following the devastating Sichuan earthquake another reason to expect its growth to hold up. This is all evident in commodity prices continuing to rise despite the US slowdown.

- Strong commodity prices and merger and acquisition activity have provided an additional boost to Australian shares, even though rising local interest rates are a drag on domestic conditions.

Essentially, after the big falls into March, shares became very cheap. However, the news flow over the last two months didn’t justify this so share markets rebounded.

Reasons to be cautious in the short term

There are a number of reasons for short term caution:

-

We have yet to see the full economic fall out from the credit crunch, the US housing slump and the rise in interest rates locally. High oil and petrol prices are only adding to consumer stress. As a result, more bad economic news is likely along with further profit downgrades over the next few months.

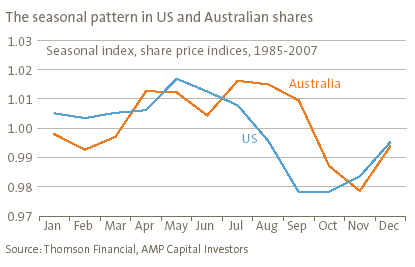

- The May to October period is often difficult for shares. The typical pattern is for stocks to strengthen from around October/November until around May (or July in Australia’s case) of the next year and then weaken into September/October on the back of US tax loss selling and other influences. See the next chart. US presidential election uncertainty will likely add to volatility around October/November.

-

From a technical perspective, both global and Australian shares are looking overbought after their strong rally from mid-March. The narrow focus of the rally on bank and resources shares is a concern. Also, shares are up against technical resistance associated with their trailing 200 day moving averages.

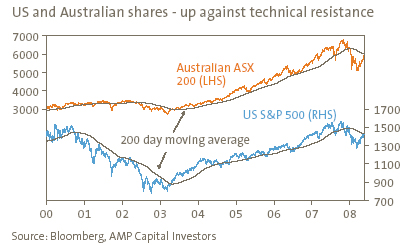

Bears would argue that the recent rally proves nothing. The chart below shows US and Australian shares since 2000, against their trailing 200 day moving averages as a guide to the trend. During bull markets, shares generally stay above the 200 day moving average, but during bear markets shares often have rallies (these are capped by the 200 day moving average). In fact, there were three such rallies with gains of 10% to 20% during the bear market in US shares earlier this decade. The bears would argue that the rally over the last two months is nothing more than a bear market rally and that new lows still lie ahead.

Whether the rally since March has been a bear market rally or not, it’s likely that shares will go through some consolidation or correction over the next few months.

Reasons to expect the trend in shares to be up

Our assessment is that what we have seen is not a bear market rally, and that while there may be a pullback in the months ahead, shares should hold above their March lows and be higher by year-end.

Firstly, the low in shares in March had many of the hallmarks of a classic bear market low: extreme investor bearishness, ‘blood on the streets’ (with the collapse of Bear Stearns, Northern Rock, several brokers in Australia, etc) and extreme share market undervaluation.

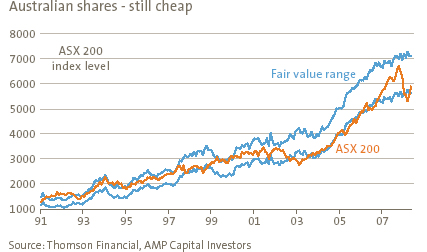

Additionally, despite the recent rally shares remain cheap.

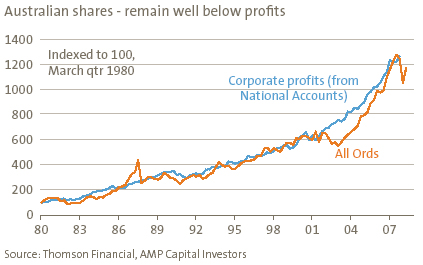

Global shares are trading on a forward price to earnings multiple of 13.7 times compared to a ten year average of 17.5 times. Australian shares are trading on 14 times versus a ten year average of 15.2 times. As the previous chart shows, despite the recent rally, the Australian share market is still trading towards the lower end of its fair value range. This suggests that there is still plenty of upside before the market becomes overvalued again. The chart below shows another way of looking at this. The Australian share market normally moves in line with profits. However, the recent slump took shares way below the level suggested by profits. The current situation is very different to 1987 when it took shares over six years to make new highs because that’s how long it took profits to rise to a sufficient level to justify the 1987 high.

Furthermore, right now a profit slump sufficient enough to justify the current level of share prices is unlikely. Thanks to economic stimulus, low inventory levels, a lack of corporate over-investment and a strong contribution to growth from exports, the US downturn is unlikely to be deep and should be over by year-end. While growth in the rest of the world (including Australia) will slow, it is unlikely to collapse. In Australia’s case, industrial shares are certainly vulnerable to downgrades, but resources earnings are being upgraded consistent with the huge rise in iron ore, coal and other commodity prices. Resources sector profits are likely to rise by 60% to 70% in 2008-09.

Finally, monetary easing in the US is providing a significant boost to global liquidity and some of this will find its way into shares. The experience since the early 1980s has been that US interest rate cuts are positive for shares on a one year horizon except when the US has a recession (so far so good) or when shares are overvalued - they weren’t this time around. Thus, if credit markets gradually continue to improve this should also be positive for shares.

Concluding comments

The road for shares is unlikely to be smooth. Credit markets will return to normal only gradually, inflation remains a problem (although there should be some relief while global growth remains sub-par and benign wages prevent second round effects from high oil prices), the US presidential election has the potential to create volatility given the Democrats tax policies, etc. But then again, the road for shares is never smooth.

After the January falls, my assessment was that the best approach for long-term investors was to sit tight and that for those with spare cash, the best approach was to average in over six months. I see no reason to change this. It’s likely that the low has been seen but of course there are no guarantees and the next few months may see a bit of a correction. However, shares remain cheap and profits are unlikely to collapse, suggesting further gains over the next year.

Dr Shane Oliver, Head of Investment Strategy and Chief Economist

AMP Capital Investors