The outlook for Australian house prices

Key points

-

Rising interest rates and a rise in mortgage stress to record levels have led to a deterioration in the outlook for house prices. This comes at a time when Australian housing remains very overvalued, affordability is terrible and low rental yields are making housing less attractive for investors.

-

While the housing shortage and the low likelihood of a recession should prevent sharp falls in Australian house prices, modest falls are now likely over the year ahead.

Introduction

After several interest rate hikes and increasing evidence that the Australian housing market is softening, the outlook for house prices has deteriorated. Some are still talking about big gains on the back of the housing shortage, while others are suggesting up to 30% declines in house prices as overvaluation and excessive debt levels unwind and the economy deteriorates. In the US, house prices are 15% from their peak, and they are starting to fall in the UK, parts of Europe and New Zealand, all of which is reason for concern for Australian house prices.

Australian house prices are vulnerable

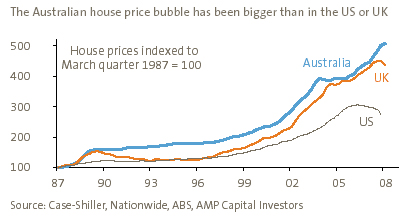

There are good reasons to believe that Australian house prices are vulnerable to falls over the next year or so. The first point to note is that the surge in Australian house prices over the last decade has been far bigger than in the US. US house prices have increased threefold over the last twenty years, while Australian house prices have increased fivefold.

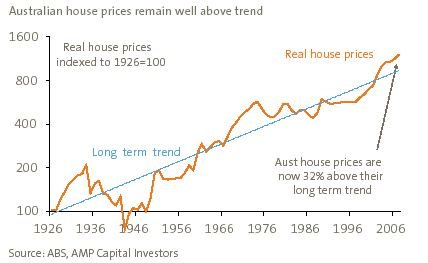

Second, and more fundamentally, the huge surge in Australian house prices has left housing very expensive and overvalued. In real terms (after removing the impact of inflation), Australian house prices have gone from well below trend in the mid 1990s to well above. House prices are currently at 32% above trend.

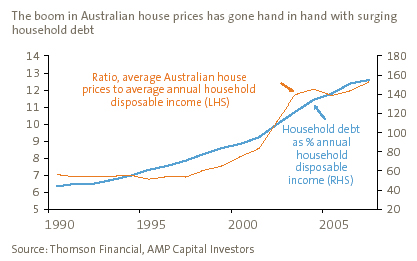

The surge in Australian house prices over the last decade has led to a near doubling in the ratio of average house prices to average household disposable incomes and record low housing affordability. Another result has been low gross rental yields – just 3.1% for houses and 4.4% for units. This is well below the 6% (plus net rental yields) available on directly held commercial property and the 7% (plus distribution yields) on listed property trusts. We estimate that Australian housing is about 30% overvalued.

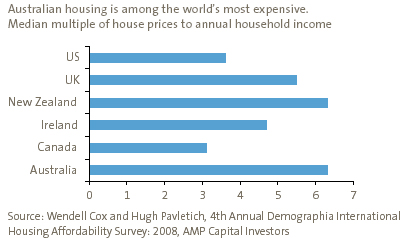

Internationally, Australian housing is among the most expensive in the world. Australia’s ratio of house prices to median household income is roughly double that in the US. With Australian mortgage rates around 9% (using the basic variable rate) and US mortgage rates around 6% (using the standard US 30-year mortgage rate), Australian housing affordability is particularly poor.

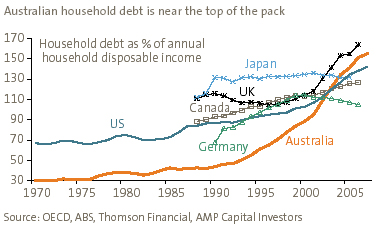

The surge in Australian house prices relative to income has gone hand in hand with a massive rise in household debt.

This is not to say that it is the rise in debt that has caused the rise in Australian house prices relative to income levels, although it has probably played a role. Household debt has also increased in the US, UK and other countries but housing in those countries is a lot more affordable. Rather, the key driver of Australia’s poor housing affordability appears to be a combination of restrictive land supply policies, high urbanisation and centralisation (i.e. we have all congregated in a few coastal cities and then put land release barriers around them). Numerous US cities have grown in size as quickly as, if not faster than, Australian cities. However, house price to income levels there have changed little over the last decade because land supply polices are far more liberal.[1] Rather, the rise in debt has mainly been an outworking of deteriorating affordability on the back of constrained land supply.

This rise in the ratio of debt to income has seen Australia move from the bottom of the pack in terms of comparable countries to near the top.

The combination of overvaluation, poor affordability and very high household debt has left the Australian housing market very vulnerable to anything which discourages buyers or threatens the ability of existing borrowers to service their debts.

Which brings us to the third point – rising mortgage rates are now proving to be a major problem for the Australian housing market, with the threat of more to come if the economy does not slow further and if funding costs remain difficult for the banks. While Australia does not have the problem with poor lending standards that is now driving a collapse in US house prices, it does have rising interest rates (leading to record mortgage stress) at a time when household debt and house price to income ratios are very high. This runs the risk of a rise in delinquencies and forced sales and puts more generalised downward pressure on house prices.

Finally, there is much evidence to suggest that the Australian housing market is now deteriorating. After rising by a strong 13.8% through 2007, average capital city house price gains virtually stalled in the March quarter, with house prices actually falling in Sydney, Perth, Hobart and Darwin. A range of other indicators confirm that the housing market has slowed significantly in the last few months. Housing finance commitments are weakening, new home sales are falling, listings are up and auction clearance rates in Sydney and Melbourne are running around 10 percentage points lower than a year ago. With a rise in the standard variable rate from 8.05% a year ago to 9.47% now, it appears that the Australian housing market has hit a brick wall.

Reasons not to get too gloomy

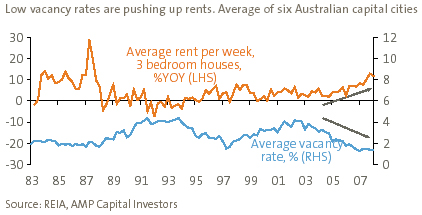

There are two favourable differences between Australia and the US. First, while America has a housing oversupply, Australia has a huge shortage. Housing construction is currently running around 30,000 dwellings per annum below annual underlying demand, which is driven by immigration and natural population growth. This is more than evident to anyone seeking rental accommodation – capital city vacancy rates are very low and rents are rising. (But with rental yields around 3% or 4%, several years of strong rental growth are required to make yields attractive for investors.)

Second, Australia is receiving a huge boost to national income from strong commodity prices. So the downside to the Australian economic outlook is nowhere near as significant as in the US, UK and Europe. This means that a massive round of delinquencies, defaults and forced selling is unlikely. These considerations suggest that a 30% fall in house prices is unlikely, however they are also unlikely to prevent modest falls.

Concluding comments

A shortage of housing, a huge boost to national income from commodity prices and higher lending standards suggest that a US-style collapse in Australian house prices is unlikely. However, rising mortgage rates (leading to record mortgage stress at a time of massive overvaluation), poor housing affordability and very high debt levels suggest that average Australian house prices are more likely to fall than rise over the next year. On balance, national house prices are likely to fall by 5% or so over the next year but, as always, this will mask a huge variation across locations.

Dr Shane Oliver, Head of Investment Strategy and Chief Economist

AMP Capital Investors

[1] See Wendell Cox and Hugh Pavletich, 4th Annual Demographia International Housing Affordability Survey: 2008