Are house prices set to boom following the share rout?

Key points

-

While the turmoil in shares may see some investors switching from shares to property, a housing boom like that after the 1987 share market crash or the bear market in shares earlier this decade is unlikely.

- Housing fundamentals are currently very mixed. Australia has a shortage of housing, but against this it is very overvalued,affordability is terrible, mortgage stress is at record levels and interest rates are rising.

Introduction

With shares hitting a major air pocket due to problems in the US economy, it is natural to wonder whether property will boom as it did after the 1987 share crash and after the bear market in shares earlier this decade. This note looks at the outlook for residential property. A subsequent note will look at non-residential property.

What’s been happening to house prices?

National average house prices rose by around 12% in 2007, with 20% or so gains in Brisbane, Adelaide and Melbourne, a modest recovery in Sydney and softness in Perth after several years of very strong gains.

This meant residential property had similar capital gains to Australian shares last year (although shares came out ahead in total returns due to higher income yields).

Shares and housing

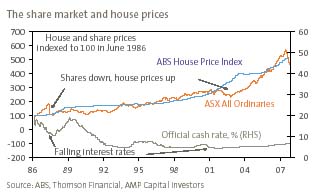

The 1987 share price crash (which saw Australian shares fall 50% top to bottom) and the bear market in shares earlier this decade (which saw global shares fall 50% between March 2000-2003) contributed to house price booms in 1987-1989 and 2001-2004 as investors switched from shares to real estate. See next chart. Australian average house prices rose nearly 50% between December 1987 and December 1989 and they rose by 60% between December 2000 and December 2003.

With global share markets in turmoil and Australian shares down 20% or so from their high last November, it is natural to wonder whether history will repeat itself and whether we will see investors switching from shares to housing, causing a nationwide housing boom in the next few years.

A shortage of housing is a big-plus for house prices

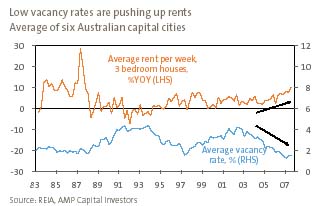

The big positive for Australian house prices is the chronic lack of supply. Housing construction is currently around 30,000 dwellings per annum (pa) below annual underlying demand. The resulting shortage of housing is evident in very low rental vacancy rates and rising rents.

Rental property vacancy rates are far lower, and growth in rents is stronger today than it was in 1987 and 2001. Australians may also have become used to higher mortgage rates in recent times with low unemployment, solid wages growth and tax cuts providing an offset.

Other housing fundamentals are not so positive

While there are a number of positives for house prices there are negatives as well and conditions today are certainly very different to the situation in 1987 or 2001.

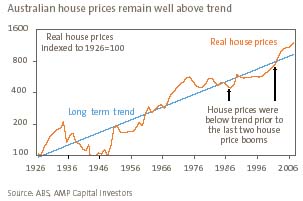

Firstly, Australian house prices haven’t corrected the overvaluation from the housing boom earlier this decade. This took them well above their long-term trend and they remain about 29% above trend. See chart below.

In 1987 and 2001 house prices were running below trend. Similarly, house prices remain very high relative to household income. Median house prices are running around 6.5 times median household income in Australia compared to a ratio of around 3.5 times in the US.

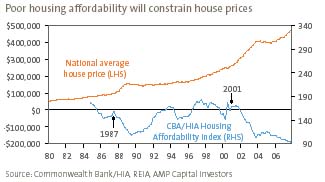

Reflecting all this, housing affordability today is very poor whereas in 1987 and in 2001 it was reasonable. The key drivers of affordability are house prices, interest rates and household income. The interest rate increases of the last few years along with the recent rises in house prices relative to wages have pushed housing affordability back down sharply. According to the Commonwealth Bank/Housing Industry Association Housing Affordability Index, housing affordability fell to a record low in the December quarter. See the chart below.

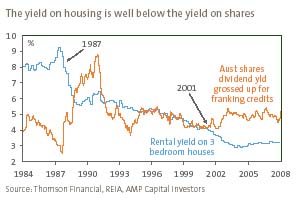

Thirdly, despite rising rents housing rental yields remain extremely low. Rents may be rising strongly but according to the Australian Bureau of Statistics (ABS), growth in rents of 6.4% last year is still less than the 12.3% rise in average house prices. Consequently, the average gross rental yield remains just 3.2% for capital city houses and 4.4% for units. This compares to a 5.1% grossed up (for franking credits) dividend yield on shares. With housing rental yields so low, investors are very dependent on continued capital growth to get a decent return.

In 1987 the rental yield on housing was well above the dividend yield on shares and earlier this decade they were about equal. Today the rental yield on housing is well below the dividend yield on shares. In other words housing is now expensive relative to shares. See the next chart.

Finally, interest rates are still rising in Australia with the Reserve Bank of Australia (RBA) indicating more hikes ahead and the banks increasing lending rates due to an increase in funding costs flowing from the US sub-prime mortgage crisis. This is in stark contrast to the 1987 situation and earlier this decade when interest rates were falling. See the second chart on the first page. The risk this year is that if house prices rise strongly, it will only add to the likelihood of more interest rate increases to the extent that rising house prices are a reflection of strong demand in the economy and hence broader inflationary pressures.

Housing is arguably the achilles heel of the Australian economy. The problem is that mortgage stress is already at record levels and is getting worse as interest rates continue to rise. This increases the risk of a rise in delinquencies and forced sales, at some point, starting to put more generalised downwards pressure on house prices. While higher interest rates haven’t yet caused major problems for Australian homeowners, the risk is growing. Although Australia does not have the sub-prime problem or housing oversupply of the current US economy, we have higher levels of household debt and Australian house price to wages ratios are far above US levels – suggesting our housing is far more overvalued and hence vulnerable. The US experience now underway with national average house prices down 9% or so from their peak, highlights the risks and provides a reminder that housing is not always safe.

For these reasons, we think a big swing from shares to housing investment causing a housing boom similar to the 1987-1989 and 2001-2003 episodes is unlikely.

Conclusion

A large and growing shortage of housing is clearly supportive of Australian house prices, and stands in complete contrast to the housing oversupply now troubling the US housing market. However, another housing boom similar to the one that occurred after the bear markets in shares in 1987 and earlier this decade is most unlikely as Australian housing remains very overvalued, housing affordability is terrible, housing rental yields remain low and interest rates are rising. The most likely outlook for Australian house prices remains for modest gains on average. However, a growing risk for the Australian housing market is that the RBA ends up going too far on interest rates triggering broader economic problems and feeding back to increased mortgage stress, rising delinquencies and forced sales putting generalised downwards pressure on house prices.

Dr Shane Oliver, Head of Investment Strategy and Chief Economist

AMP Capital Investors