Markets behaving badly

There was at least some logic to the correction in share prices around the globe over January. Evidence had mounted that the structural problems in United States (US) lending markets were to have significant ongoing impacts on mainstream financial institutions and therefore, the overall health of the US economy. A weaker US economy, would mean that the earnings forecasts underpinning the share price of a large proportion of the world’s corporations would come under downward pressure.

What has been less logical over the past few months, however, is the level of share price volatility and the extent to which share prices have declined in different markets.

The lost barometer

Volatility on equity markets during January was extreme. Perhaps the 7% decline (in Australia) on 22 January 2008 and subsequent reversal over the next 2 days may have been impacted by the unusual liquidation of future trading positions by France’s Societe Generale Bank. However, even after setting aside this event, the size of daily movements in share price values throughout January was often more than 2%.

With earnings, and therefore, share prices, being re-assessed following the worsening outlook for the global economy, sharemarkets have lost their barometer on what the “fair” or underlying value of stocks should be. In stable times, investors are confident of the intrinsic value of stocks and if prices dip below this intrinsic value, there is immediate buying support. In more recent times, however, this intrinsic value is being redefined according to a new set of parameters. Until this redefinition is complete, price stability will be a casualty.

There is a possibility that stocks paying attractive dividends with a stable dividend history will be easiest for sharemarkets to re-establish a measure of fair value on. This is because return in the form of a dividend appears to be more certain than capital growth in times of price volatility. It is not surprising, therefore, that smaller companies (which are typically low dividend payers) have recently underperformed larger companies. In the 3 months to the end of January, Australian small companies had declined in price by 20%, compared with a 15% drop for the top 100 stocks.

Non US markets the most impacted

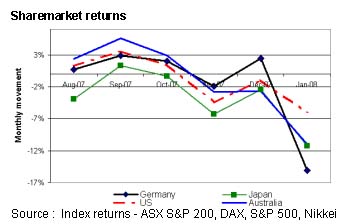

One of the more perplexing trends to emerge in recent months has been the relative outperformance of the US equity market. Since the beginning of November, the S&P 500 Index in the US has fallen 11%. In contrast, Japan (down 19%), Germany (down 15%) and Australia (down 16%) have all fared significantly worse than the US over this period.

The more dramatic fall in share prices in various markets outside of the US is clearly inconsistent with the fact that the catalyst for the global equity sell-off was evidence of a deteriorating economic outlook in the US. While a large proportion of companies around the globe will be directly and indirectly impacted by weaker consumption spending by US consumers, those most impacted are generally those companies listed on US stock exchanges.

It is possible that part of the explanation for the smaller correction on US equity market lies with the fact that the US markets were closed for the Martin Luther King public holiday on the same day that European markets led the global decline of around 7%. With global sentiment improving the following day, US markets perhaps escaped the full brunt of any price adjustment.

The global economy is still growing

Notwithstanding the economic woes of the US, there is still cause for some optimism that the wider global economy remains in a longer-term growth phase. Developing economies are accounting for a larger share of global net production growth – a trend that has much longer to run. This should continue to provide the global economy with an economic growth engine. Australia remains well position to be a beneficiary of this new source of growth in the global economy.

Investment implications

Recent heavy sell-offs in equity markets has left non-US markets looking relatively cheap. International equity investments providing a low American exposure may be preferred in this environment.

Australia is very much part of this story of cheap equity valuations. With an average yield of 4.5% and a price-earning ratio at less than 14 times, there’s no doubt about the very attractive buying opportunities amongst Australian listed stocks. For those seeking relief from the extraordinary volatility, strong dividend paying stocks could be the area of the market in which pricing behaviour first returns to normal.