Oil Prices Still On The Way Up

Key points

- The latest surge in oil prices is a continuation of the “three steps forward one step back pattern” seen over the last few years.

- The latest spike in oil prices is expected to create further short-term nervousness, however it is unlikely to have a major lasting economic or financial impact.

- Oil prices are likely to fall towards year-end as global growth moderates, but the long-term trend will remain up and surpass US$100 a barrel in a few years.

New highs

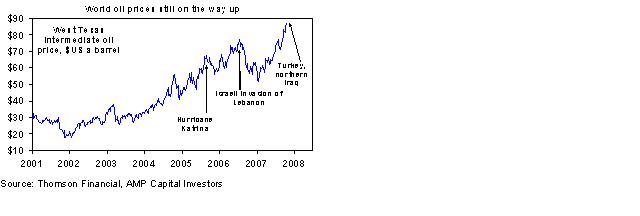

Oil prices are again concerning for global growth and inflation outlooks, with prices surging to near US$88 a barrel in the last few days on worries that Turkey may attack Kurdish separatists in northern Iraq. This is now well above last year’s record high of US$78 a barrel. However, the latest surge appears to be a continuation of the “three steps forward one step back” pattern evident in oil prices over the last few years. The broad trend is up on rising demand and tight supply. But every so often, prices spike as supply concerns take hold, before falling back by year-end ahead of a new surge the following year. This was the case following 2005’s post Hurricane Katrina surge in oil prices and the increase in July 2006 after Israel invaded Lebanon. Similarly, the latest rise in oil prices has the potential to create short-term jitters vis-à-vis the economic impact. Whilst this could push share markets down, the impact is unlikely to be lasting.

The long-term trend in oil prices remains up

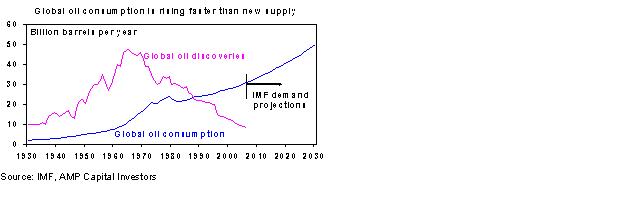

The past five years have seen a steadily rising trend in oil prices, driven fundamentally by solid growth in underlying demand (relative to supply). Oil consumption is trending up, but new oil discoveries are trending down.

- Global demand for oil is expected to rise at 1.5% to 2% annually over the next few decades, even allowing for energy efficient alternatives. If per capita oil consumption in China and India were to rise to just half of Australian and Japanese levels, this would imply an extra 39 million barrels per day (mbd) in global oil demand (which is currently 85.9 mbd).

- Global oil production is still rising, belying the alarmist imminent “peak oil” predictions*. However, supply is constrained by years of low exploration, diminishing returns and the rising cost of extracting new oil.

Strong long-term growth in demand and restrained supply suggest that the long-term trend in oil prices will remain up. In this environment, anything that may threaten the supply of oil will have a disproportionate positive impact on oil prices, as has been evident in recent days. Our assessment remains that oil prices higher than US$100 a barrel are likely some time in the next few years.

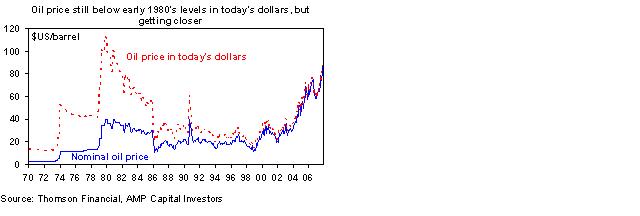

This will take oil prices back to the levels they reached in the early 1980s (in today’s dollars).

*Claims that a peak in global oil production is imminent have been unfounded for years. Basic economics will make alternatives viable long before we run out, on account of the combination of higher prices and new technologies.

The short-term outlook

Oil prices may climb even higher in the weeks ahead, particularly if Turkey enters northern Iraq. However, oil prices are likely to fall towards year-end.

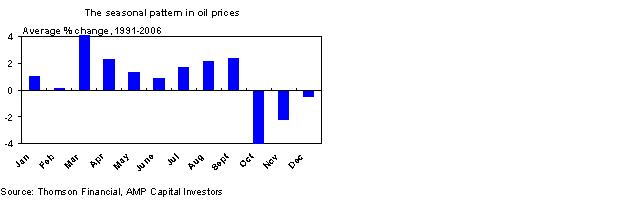

- The normal seasonal pattern is for oil prices to fall though the December quarter after the northern hemisphere “summer driving” season winds down.

- More fundamentally, growth in global oil demand has slowed to less than 1% per annum, led by the economic slowdown in the US, which has stalled oil demand. Global growth is set to moderate slightly over the coming year, which will subdue short-term oil demand.

- The market is currently fretting about Turkey’s impact on the flow of oil through northern Iraq, but only a small quantity of oil passes through that area, so any disruption is likely to be minimal. In any case, OPEC’s spare capacity is now around 3.5 mbd, while Saudi Arabia (which produces circa 8.7 mbd and has a spare capacity of 2.6 mbd) is easily able to make up any new shortfall in Iraq’s current meagre production (running at 2 mbd).

Implications

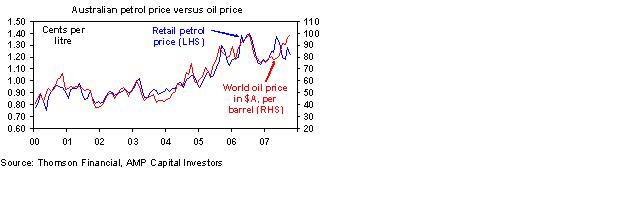

There are several implications of the latest spike in oil prices. First, Australian petrol prices are likely to push higher in the weeks ahead. The chart below reflects the close relationship between world oil prices (in Australian dollars [A$]) and Australian petrol prices. Earlier this year, Australian retail petrol prices surged on the implications of global oil prices and the A$. Since June however, they have been surprisingly low due to increased discounting after the Treasurer’s announcement of another petrol price inquiry. If world oil prices remain at current levels, a minimum increase of 10 cents per litre in the average weekly petrol price is likely over the next few weeks.

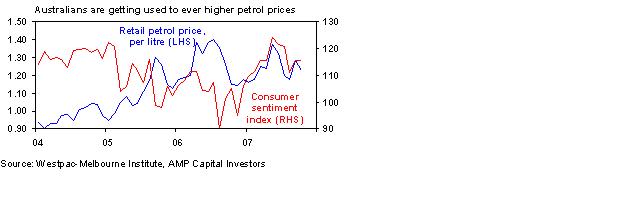

Second, while the latest spike in oil prices is expected to add to concerns about global and local economic growth, the impact is likely to be mild. The rise in oil prices still largely represents an ongoing demand shock, not a 1970s-style reduction in the oil supply. The current rise in oil prices remains orderly compared to the 1970s surges. Furthermore, Australian consumers appear to be shrugging off the petrol price shock, evidenced by the fact that consumer confidence remains at the same level as when petrol price was less than $1 a litre. The pain threshold for petrol prices has been rising steadily, both locally and globally.

Global competition will continue to minimise the inflationary effects of higher petrol prices.

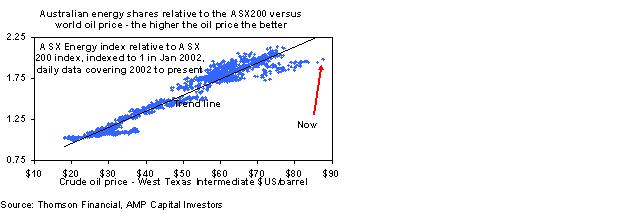

Third, the continuing rising trend in oil prices remains positive for energy shares. A US$10 rise in the oil price should see energy shares outperform the broader market by 15%. The below scatter plot shows that higher oil prices usually produce outperformance in Australian energy shares, relative to the broader share market. Right now, energy share prices have some catching up to do as they are running well below the trend line.

Finally, while higher oil prices are positive for energy shares, the latest spike has the potential to precipitate a further short-term correction in share markets as investors fret about the broader economic impact. Shares are vulnerable to a correction after rising sharply since mid-August. However, we remain of the view that shares will be higher towards year-end, aided by further US interest rate cuts and reasonable valuations.

Conclusion

The trend in oil prices is likely to remain up and the process should remain orderly, excepting a major supply shock such as a war in the Middle East. The latest spike has the potential to create short-term jitters among investors, but this is unlikely to be lasting.

Dr Shane Oliver

Chief Economist and Head of Investment Strategy

AMP Capital Investors