Asian shares and global reflation

Key points

- Asian equities (and related trades such as commodities) are likely to be key beneficiaries of the more exuberant phase share markets have entered.

- They are at the centre of the China/India enthusiasm, will be key beneficiaries of the US-led monetary reflation and easier monetary conditions and are in far better shape than was the case a decade ago.

Introduction

For some time, we have been of the view that the global equity bull market that commenced in March 2003 has entered a more exuberant phase. But if we have entered a more exuberant phase it is natural to question what the focus of this investor exuberance will be.

Stage three of the cyclical bull market

Cyclical bull markets experience three stages:

- A recovery phase (from excessive pessimism), which characterised the initial share rally in 2003.

- An earnings driven phase where strong earnings growth drives share prices higher, which has essentially been the case since late 2003 into this year.

- An exuberance driven phase, where share prices rise faster than earnings as investors become increasingly optimistic, which pushes share valuations to extremes.

The third stage can last for many years. This was the case in the US in the late 1990s when IT stocks were the focus. Our assessment is that we have now entered stage three, but we are far from reaching the extremes that typify bull market tops. Stage three is characterised by slowing profit growth, rising price to earnings (PE) multiples and rising volatility. As more investors become exposed, shares begin to lose some of their earnings support. In addition, increasing investor exuberance for a key investment theme creates a narrowing of participation in the market’s advance.

The first three signs are now arguably evident:

- Profit growth is slowing in most regions.

- PEs are rising, helped by US monetary easing. Lower interest rates make shares more attractive, relative to cash, thus usually resulting in higher PEs.

- Volatility is increasing. This is clearly evident in the increasing severity of share market corrections. Corrections in the Australian share market, for example, are becoming more severe – just 3.5% in 2004, two 8% corrections in 2005, a 12% fall last year and a 14.8% decline in July/August this year.

Following a huge rebound since mid-August, it appears as though share markets are now undergoing another correction, although this one should be more modest than the falls into August as the US Federal Reserve continues to cut interest rates.

But the big question is what will be the focus of investor exuberance this time around?

The next investment mania

Every decade seems to end with some form of global investment mania that attracts major investor attention. The late 1960s/early 1970s saw a mania in mining stocks and the “nifty fifty” in the US. In the late 1970s, there was a mania in gold. In the second half of the 1980s it was Japan. In the late 1990s it was tech stocks. Our view is that the next investment mania is likely to be focused on emerging markets and related themes. The emergence of the BRICs (Brazil, Russia, India and China), particularly China and India, is the biggest economic displacement this decade. This has been a very positive force in the global economy, boosting growth and keeping inflation and interest rates down. But as is often the case, investors can end up pushing asset prices too far. In contemplating the next investment mania, emerging markets, China, Asia and related plays such as commodities are ideal candidates.

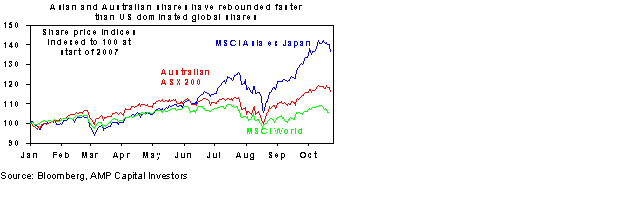

This is arguably already underway. All share markets benefited from recent US monetary easing, however Asian shares have risen far quicker from the August correction. Asian exposure has helped the Australian share market rise on the back of resources demand.

Asia now into a secular bull market versus world

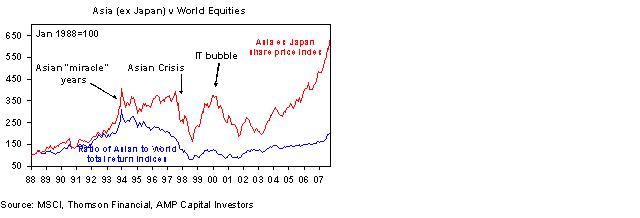

Relative to global shares, Asian shares now appear to be back into a secular bull market. After booming during the “Asian miracle” years, Asian shares spent a decade spinning their wheels. The next chart shows the performance of Asian equities in absolute terms (top line) and relative to global equities (bottom line). When the relative return line is rising, Asian shares are outperforming global shares and vice versa for falls.

Asian shares have started to accelerate (relative to global shares), however the ratio in the chart above is well below 1990s peaks, suggesting it may have a long way to go.

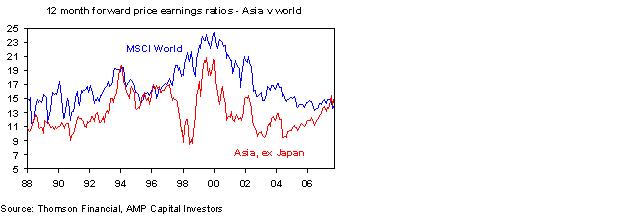

Asian shares now at a premium to global shares

Asian share valuations less compelling than they were a few years ago and are in fact trading at a PE premium compared to global shares.

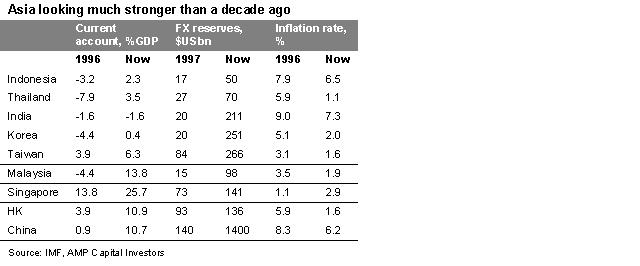

However, there are sound reasons to believe that this is sustainable. Asian economies are now in far better shape than was the case during the “Asian miracle”. In contrast to the situation ten years ago: current accounts are in surplus; foreign exchange reserves are huge; foreign debt has collapsed; Asian currencies are undervalued; and inflation rates and corporate gearing are low. There has also been significant improvement in government transparency, the availability and quality of information, prudential supervision and corporate governance.

Given Asia’s current account surpluses and huge foreign exchange reserves, macro risk has now shifted from Asia to the US (which has been highlighted by the US sub-prime crisis). This is the reverse of the situation a decade ago. In the second half of the 1990s, Asia was in trouble and the US was the place to be. Today it is the other way around. In many ways, the current environment mirrors that of the early 1990s which saw a US downturn, lower US interest rates and liquidity rush into Asia. These factors arguably helped the huge outperformance of Asian shares into the mid 1990s.

Asia also offers stronger growth prospects than developed countries which should result in higher earnings growth and see them trading on a higher PE ratio.

China and India in the driver’s seat

The current run-up in Asian shares is dominated by China and India. Hong Kong is benefiting from the boom in Chinese shares and lower interest rates flowing from its US dollar currency peg. There are several points to note. First, while valuations are stretched in both countries with Indian shares trading on a PE of 23 times and mainland China on a PE of 50 times. But, by historical standards this is not that extreme - Japanese shares peaked on a PE of 70 times in 1989 and the tech heavy Nasdaq hit a PE of 160 in 2000. Secondly, China and India offer the strongest earnings growth in Asia so it is little wonder they trade on higher PEs compared to the rest of Asia. Finally, severe monetary tightening (capable of really threatening local share markets) seems a fair way off in both countries. Non-food inflation in China remains low (at around 1%) and inflationary pressure has started to abate in India. Despite periodic corrections, this means the strength in both of these countries’ share markets could have a way to go. The China/India theme is also likely to have a positive impact on the rest of Asia as it is helping to underpin intra-regional trade and attracts capital to the region.

Expect Asia to out-perform over the next few years

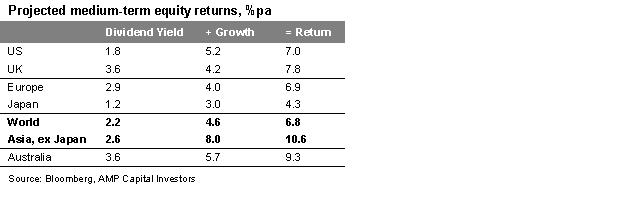

The table below provides a rough guide as to potential share market returns over the next few years. They are based on starting point dividend yields and assume share prices will rise with nominal economic growth. While actual returns are likely to be wildly different, the reasonable dividend yields and stronger growth potential in Asia support the case for several years of outperformance from Asian shares (whether it becomes a mania or not).

Conclusion

Asian shares are likely to be relative outperformers over the next few years helped by the China/India theme, US-led global monetary reflation (which will help drive investment dollars into the region) and their strong economies.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors