View from the Hill - Amber Lights on the Australian stock market June 2007

Amber Lights on the Australian stock market

A reassuring feature of the current 4-year old Australian equity market rally has been the fact that the growth in company earnings and dividends has generally kept pace with the extraordinary growth in share prices. As a result, most measures of share valuations have supported the view that the Australian market is fairly priced, albeit now in the upper ranges of reasonable value.

However, as outlined below, the combination of ongoing share price increase and higher longer-term interest rates has stretched share market valuations to the extent that they are now more expensive in relative terms than they have been at any time throughout the current cycle.

Interest rates are important

Central to most assessments of share market value are medium to longer-term interest rates. When an investor makes a decision to purchase a particular share, they are implicitly assuming the share will provide a return at a margin above the underlying risk free interest rate. This margin compensates investors for the additional risk of share investments, relative to the alternative of investing in a risk free interest bearing asset (eg Government bonds).

Hence when interest rates increase, the relative attractiveness of shares decline and investors will subsequently demand a higher return from their share investments. All else being equal therefore, share prices should fall when interest rates increase unexpectedly. Investors will be not willing to pay the same price as they did previously when the alternative interest bearing investment assets offered a less attractive return.

In additional to this general relative valuation effect, it could also be argued that the Australian share market is more sensitive to interest rates than other major overseas markets because of the high weighting that the Australian market has to banking stocks. Banks, in particular, will typically experience a lower rate of earnings growth in times of increasing interest rates as they find it more difficult to lend money, and may also experience a rise in bad debts.

Valuations becoming stretched

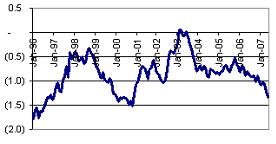

Due to a unique tax treatment of franked dividends and interest deduction on borrowings for investments, the sensitivities of the Australian investor to movements in interest rates may be somewhat different to those implicitly assumed in standard share market valuation models. For this reason, Hillross has developed a share market valuation measure known as the Hillross Yield Gap (HYG). The HYG traces the margin between the after tax dividend earnings available on the Australian share market and the after tax interest cost to an investor who is borrowing to invest1. This margin will normally be negative (as dividend yields are generally below interest rates, even after franking benefits are considered).

Hillross yield gap

Source: Hillross Financial Services

The above chart shows movements in this yield gap over time. The closer the gap is to zero, the less capital growth is required for an investor to break even if they are borrowing to invest (or just beat the return of interest bearing deposits). In a brief period around March 2003, the HYG was actually positive i.e. share prices could have fallen and investors would have still received positive returns due to the margin between dividends and interest rates. Significantly this period was a turning point in the performance of the share market and the commencement of the current bull-run.

For most of the ensuing 4 years since this turning point, the HYG has been remained reasonably steady. The maintenance of low relatively low interest rates and solid growth in dividend payouts has enabled the gap to stay narrow despite rising share prices. However, in the last six months there has been a material shift, with the HYG moving from –0.9 to –1.4. Interest rates have been on the rise, whilst dividend yields have pulled back slightly as share prices have risen. This is the largest the gap has been since October 2000, which was also a period that followed an extended period of buoyancy on the Australian market.

Caution ahead

Firm conclusions around future price movements on the stock market cannot be drawn from valuation indicators such as the HYG, particularly not in the short term. The market does have a history of being priced for extended periods at levels outside of what would normally be considered “fair value.?rdquo; However the fact that valuations appear to have deteriorated somewhat should serve as at least a note of caution for investors. The arguments for having a portfolio of well diversified assets, including a sizeable international component, are now stronger than ever.

1 It is assumed that the investor is on the top marginal tax and all dividends are fully franked. A standard 3 year fixed housing loan interest rate is assumed to be the borrowing cost.