The importance of China in the modern-day global economy was clearly reinforced in recent days. Following a dramatic one-day fall of close to 10% in the price of shares listed on Chinese stock markets, the rest of the world responded with a rapid but contained price correction.

Movements in prices across the major markets were generally consistent with Europe, Japan and the United States (US) all experiencing price declines in the vicinity of 3% to 5% over the 3 days following the fall in China. Australia was no better or worse than other developed markets, with prices dropping 3.9% over the 3-day period.

Although only of moderate magnitude, the equity price declines across major markets seemed all the more sudden as they interrupted a prolonged bull-run that had been largely devoid of any upsets in recent times.

Why Chinese share prices fell

The sell-down on Chinese stock markets was triggered by the decision of the Chinese State Council to introduce a special task force to tighten controls against various illegal activities and share offerings surrounding the Chinese securities markets.

Unlike most western economies where the Government’s influence over the economy is largely carried out via monetary and fiscal policies, the Chinese Government will sometimes use more direct mechanisms such as controls on bank lending and reserve levels to help “manage” growth levels in the economy. The formation of the special task force, whilst potentially insignificant in its own right, was viewed by the markets as a signal that the Government may introduce a series of measures to address concerns over the arguably overheated Chinese stock market.

There were also rumours that a capital gains tax on shares was to be introduced in China. However, authorities subsequently denied these rumours.

Australia’s response

The fact that Australia’s response to the weaker Chinese share prices was so moderate and in line with that of Europe and the US was a little surprising. Australia, with its heavy resource sector dependency, had been a major beneficiary of the Chinese related commodity price boom. It could be argued therefore, that the fortunes of Australian companies were more dependent on the continuation of a buoyant climate in China.

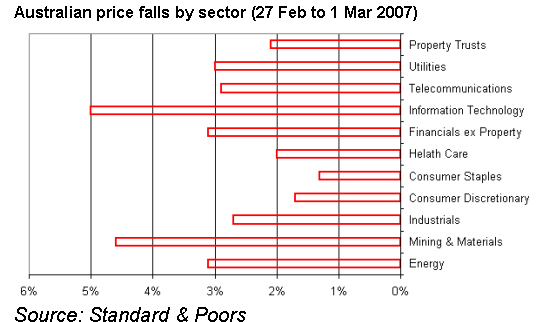

Australian price falls by sector (27 Feb to 1 Mar 2007)

Source: Standard & Poors

As the above chart highlights, the more “China sensitive” resource and energy sectors of the Australian sharemarket did fair a little worse than the general market; but not markedly so. The muted nature of this response implies that investors largely believe the hiccup in Chinese share prices will not have a major impact on the real Chinese economy and the huge demand it is generating for the output of Australian companies.

Was this response reasonable?

Overall, the Australian market response appears to have been rational. The Chinese sell-off was not triggered by any fundamental worsening in the economic outlook. In addition, the price decline was only a fraction of the 100%-plus increase that had been recorded on Chinese markets over 2006. Therefore, Australian investors’ interpretation of the sell-off as a “speed-bump” rather than a “crash” seems highly appropriate.