Superannuation is one of the most tax-effective ways of providing for your future. The 2006 Federal Budget changes only make it more attractive.

Capitalising on the key changes before & after 1 July 2007 is important!

A snapshot of the key opportunities leading up to 1st July 2007:

Tax free benefits from age 60

From 1 July 2007, there will be no tax payable on superannuation benefits, whether taken as a lump sum or pension, once you turn 60. Reasonable Benefit Limits (RBLs) are being removed as well, so there will be no limit on the amount you can accumulate in super.

After-tax contributions of up to $1 million from 10 May 2006 to 30 June 2007

This is a one-off opportunity to take advantage of your super fund’s growth potential and a tax-friendly environment. There has never been a better time to consider putting as much money as you can afford into superannuation.

If you have recently received a lump sum such as an inheritance or a bonus, you only have a short time to make the most of your opportunity. From 1 July 2007, there will be stricter limits placed on after-tax contributions.

Universal contribution limits

The current age-based limits for deductible employer contributions will also be removed from 1 July 2007. The limits will be replaced with an effective limit of $50,000 a year, regardless of your age.

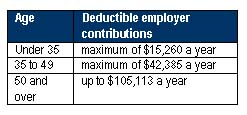

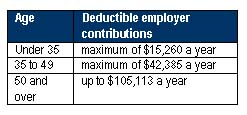

Currently, age-based limits set the maximum amount you can make in deductible contributions each year.

For 2006/2007, these are:

Previously, many people waited until they were close to retirement before increasing their savings in super.

With the changes, this will no longer be the case, and a “steady as she goes” philosophy will be needed to maximise your income in retirement.

So that people over age 50 are not disadvantaged – the amount they are allowed to contribute to super has been slashed in half with the new rules – the Government is offering a transitional period. If you are 50 or over, you will be able to contribute $100,000 a year for the period up to June 2012.

If you are 50 or over, you might like to consider taking advantage of this opportunity as soon as possible and sacrifice some of your salary into super. This will reduce your income now, but the amount you put into super will only be taxed at 15% instead of your marginal rate.

And once you’re over 55, you can convert your existing super into an allocated pension and draw an income to replace the salary you’ve sacrificed…even though you may still be working.

After-tax (or undeducted) contributions

Undeducted contributions made to super from after-tax income will also be subject to change from 1 July 2007. You will only be allowed to make undeducted contributions of up to $150,000 a year.

In the past, you could contribute as much after-tax money as you wanted. The $150,000 cap is to counter the abolition of the Reasonable Benefit Limits and the removal of benefits tax after age 60.

The Government is aware that the changes to undeducted contributions could catch people out so it will allow people to average the $150,000 over 3 years. As a result, if you were to sell a property and reap $450,000 from the sale, you could put all that money directly into your super account, but you would then be unable to make any further undeducted contributions for the next 3 years. The ability to average contributions in this way will commence from 1 July 2007.

Self-employed breaks

If you are self-employed, you will be able to claim a full deduction on all your superannuation contributions up to the effective limit of $50,000 from 1 July 2007.

Up until 1 July this year, self-employed people are at a disadvantage to employees. Currently, if you work for yourself you can claim 100 per cent of your first $5,000 of contributions, but then only 75 per cent of the balance up to your age-based limit. From 1 July 2007, you will have equality with employees and can claim the entire amount.

Also, if you are self-employed but earning less than $58,000 a year, you can take advantage of the co-contribution scheme.

Under this scheme, the Government will match a $1,000 contribution from your after-tax income with a $1,500 payment if you earn less than $28,000. The co-contribution then reduces by 5 cents for each dollar you earn above $28,000 up to $58,000.

Retiring before 60

Since tax-free income in retirement only commences from age 60, many of the existing strategies remain the same for those aged 55 to 59.

If you choose to take early retirement, you will still be faced with tax on your super benefit, so there is room for such strategies as contribution splitting and super recontribution strategies.

But even if you decide to wait until you’re 60, it’s still a good idea to make sure you put as much money as possible into the tax-free superannuation environment for your retirement.

Preparing for the 1 July 2007 deadline

There are a number of other strategies you could consider before the 1 July deadline, which may well reduce the tax you’ll pay on your super when you eventually retire, or should you die and your benefit passes to your beneficiaries. For instance, if you have super relating to a period of employment prior to 1 July 1983, or your super death benefit is likely to pass to a non-dependent child, it’s important to seek advice before the 1 July 2007 deadline to maximise the opportunities.

The above information is of a general nature only. No account has been taken of the investment objectives, financial situation or particular needs of any particular person. Before making any investment decision, individuals will need to consider (with or without the assistance of a financial planner) their own particular needs, objectives and circumstances to avoid the risk of making inappropriate investment decisions. April 2007.