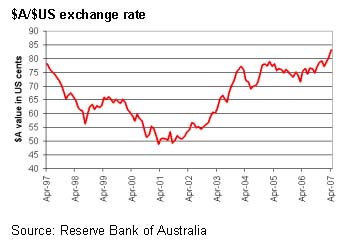

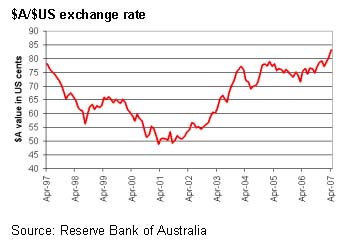

Since the Australian dollar was floated in 1983, market forces have led to our currency being volatile, and often priced at levels well outside of what would normally be considered “fair” on an underlying valuation basis.

In 2001, the Australian dollar ($A) was trading at 48 cents against the United States dollar ($US). Six years on, the $A has surpassed US 83 cents. This 73% change in valuation cannot be explained by traditional market economic theory.

In fact, over this 6 year period, inflation in Australia has been slightly above that of the US, implying that the relative purchasing power of the $A has fallen. In theory, if the $A was “fairly” valued, this reduced purchasing power should have put downward rather than upward pressure on the $A.

The end of recent stability

Notwithstanding the volatile history of the Australian exchange rate, it had been relatively stable over most of 2005 and 2006. Over these 2 years the $A traded in a 10% band between US 72 and US 79 cents.

The cause of the recent appreciation

The main driver of the appreciation in the $A appears to be the growing expectation that Australian cash interest rates will increase. If interest rates do increase, international investors will receive a greater interest return from holding Australian dollars. As a result, these investors are willing to pay a higher price for the $A and have effectively bid up its value.

The fact that the US Federal Reserve (the US central bank) announced this month that US cash interest rates would remain at 5.25% is likely to have provided investors with more confidence that a positive interest margin was available from borrowing in overseas currencies and investing in Australian dollars.

In addition to the change in interest rate expectations, the lack of any downward correction in commodity prices has been another factor supporting the $A. Booming prices for most metals and minerals have provided strong buying support for the Australian dollar; given that Australia is a major exporter of these commodities.

Investment implications

Unhedged international investments will experience the most immediate impact of the currency appreciation. A higher $A directly reduces the value of any investments domiciled in overseas currencies. International investments with the currency positioned hedged (including some international share and most international fixed interest investments) are normally unaffected directly by currency movements.

The higher $A may also have some effect on the performance of companies listed on the Australian sharemarket. Following an appreciation in currency, exports from Australia become more expensive for those overseas to purchase. Hence, a stronger currency is generally considered bad news for resource companies and other large exporters such as building materials companies. However, those businesses which purchase a large proportion of their inputs from overseas, such as retailers, will tend to benefit from a higher $A.

There may also be an indirect impact on fixed interest investments. As a stronger $A will put downward pressure on inflation (due to cheaper imports), this may keep interest rates lower than otherwise and reduce the likelihood that the Reserve Bank would need to raise overnight cash interest rates.

Brad Matthews, Hillross Economist

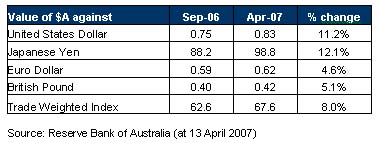

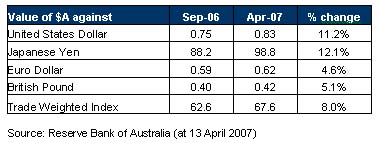

However, the upward trajectory of the $A in recent months has ended this stability. Between the end of September last year and early April this year, the $A has gained 11% to hit a new decade high. The table above does highlight however, that the appreciation in the Australian exchange rate has been less significant against European currencies than it has been against the Japanese Yen or the $US.