Australian versus international shares

Key points

- Australian shares continue to provide better return prospects than mainstream global shares (dominated by the US, Europe and Japan).

- Australian shares pay higher dividends. As such, they should benefit from the stronger growth potential of the local economy and improved after tax returns which are boosted by franking credits.

- It is not surprising that Australian shares are trading on a higher multiple to earnings than global shares.

Introduction

The relative success of Australia in navigating the global financial crisis is now widely recognised. In fact, it follows several episodes where Australia seems to have miraculously escaped from a perilous situation - having also sailed relatively smoothly through both the Asian crisis of the late 1990s and the tech wreck earlier this decade. It is also the only major developed country not to have had a recession (defined as two consecutive quarters of negative economic growth) since the early 1990s. This can be attributed to both good luck (sub-prime mortgages not having taken hold, exposure to China, etc) and good economic management (years of budget surpluses, sensible monetary policy and economic reform resulting in a more flexible economy).

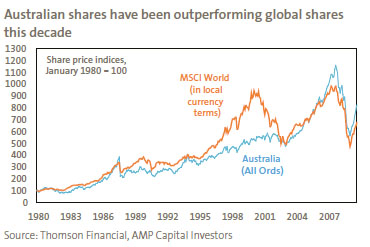

However, what does this mean for investors in shares? Does it mean Australian shares are a better bet than global shares? Or has it already been factored into share markets? For example, over the last 10 years Australian shares have dramatically outperformed global shares – returning 9.5% per annum (pa) over the last 10 years versus a loss of 0.2% pa from global shares in local currency terms.

In fact, once an allowance is made for the rise in the Australian dollar, global shares have lost 2.3% pa over the past 10 years. Can this outperformance continue?

The theoretical case to have more global shares

The standard arguments for Australians to have a greater exposure to global shares are as follows:

- local shares are just 4% of the global sharemarket;

- greater exposure to global equities and foreign currency provides ’diversification benefits’;

- the Australian share market has limited exposure to technology and consumer stocks and is over-represented by financials and resources;

- significant international exposure provides an offset to our high foreign liabilities and our high exposure to domestic assets via residential real estate; and

- global shares offer more scope for fund managers to ’add value’.

The trouble is that such arguments are highly theoretical. The benefits of global diversification are hard to explain given the poor returns from global shares over the last decade. It is also debatable whether the extra opportunities offered by global equity investing have ever been consistently realised by fund managers. And when compared to Australian equity funds, global shares have offered similar or less value add relative to benchmark returns over time. These arguments also ignore the actual return potential for Australian shares over a more relevant time horizon of approximately five years.

…but the strategic view still favours Australian shares

Despite the theoretical case to have more global shares, for many years I have favoured Australian shares over mainstream global shares. Even though Australian shares have outperformed for the last 10 years, this remains the case for the following reasons.

Firstly, despite recent cuts in dividend payments Australian shares pay a higher dividend yield than mainstream global shares. The average dividend yield on Australian shares is 4% versus 2.6% for global shares. This is important because over long periods dividend payments constitute a significant component of the return that an investor receives. As such, the higher the dividend yield the better. High dividend yields are also a good indicator of future returns as they signal corporate confidence about future earnings. Additionally, excessive retained earnings are often wasted.

Secondly, the Australian economy offers higher growth potential than those underpinning traditional global share markets in the US, Europe and Japan. Australia is experiencing much stronger population growth, which is feeding through into much stronger labour force growth. Australian households have not seen the same deterioration in their asset to debt ratios as has occurred elsewhere. Public sector debt is very low compared to most other developed countries and we are heavily exposed to high growth Asia and strength in commodity prices. All of these considerations are likely to translate into higher growth in earnings per share for Australian companies when compared to earnings growth in traditional global share markets.

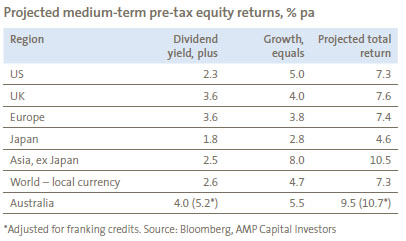

Reflecting the last two points, return projections (as seen in the table on the next page) based on current dividend yields and likely earnings growth tend to favour Australian shares. Over the medium term (say, five years), a good starting point to project likely returns is to add current dividend yields to likely long-term nominal GDP growth. This is a reasonable proxy for earnings growth and hence capital gains from shares.

Australian shares with a five year pre-tax return projection of 9.5% pa are well ahead of traditional global shares with a return projection of 7.3% pa.

Finally, franking credits should not be ignored because they add over 1% to the post-tax return from Australian shares for Australian investors. The higher dividend yield from Australian shares and franking credits mean Australian shares have a 2.5% pa return advantage over traditional global shares for Australian based investors.

While Asian shares offer similar returns to Australian shares once franking credits are allowed for, and should be overweighted. However, they also come with more risk. They are also only a very small portion of traditional global share funds and so do not alter the case for a strong bias towards Australian shares over traditional global shares. Instead, exposure to Asian shares can be better achieved through a specific Asian equities allocation rather than through traditional global share funds.

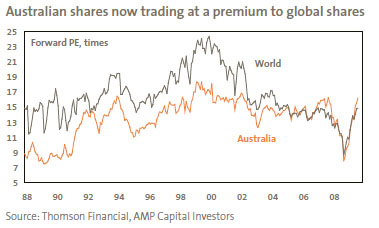

Australian shares rightly at a premium to global shares

While some fear that Australian shares are no longer good value because they are no longer trading at a price to earnings (PE) discount to global shares. Our view is that they should trade at a premium.

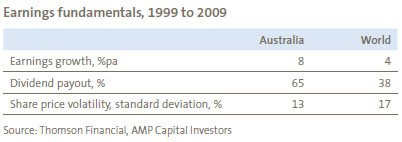

The PE discount for Australian shares that prevailed up until around 2005 reflected a combination of factors that are no longer relevant. These factors included a perception Australian shares were more volatile than global shares; post 1987 concerns about the quality of Australian companies; Australia’s past high inflation status; and Australia missing out on the late 1990’s IT bubble. However, none of these concerns are valid now. In fact, over the past decade or so, Australian listed companies have generated better earnings growth than global shares. This is despite paying out a higher proportion of earnings as dividends and with lower risk, in part, reflecting the lower volatility of the Australian economy (with no recession in 18 years). This can be seen in the table below.

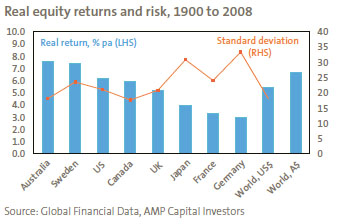

On this basis there is no reason why Australian shares should be trading on a PE discount. In fact, given their higher growth potential they should be trading at a premium. It is worth noting that despite Australian shares lacking the breadth and diversification of global shares, over the last century they have had better real returns with similar volatility. The next chart shows real returns since 1900 and standard deviations (a measure of volatility) for key share markets.

In other words, there is no long-term evidence of under performance by Australian shares on a risk-adjusted basis.On the contrary, Australian shares have a better long-term track record than most global share markets.

Concluding comments

On a strategic, or five year basis, the combination of improved likely returns and franking credits suggest investors should maintain a bias towards Australian shares over traditional global shares.

Eventually, it is possible that investor enthusiasm for Asian shares, emerging markets, commodities and Australian shares will go too far and become the next bubble… but that is several years away and in the meantime returns from such assets are likely to be strong.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.