Emerging market opportunities

The recovery on global equity markets is not taking place in a uniform manner. One area of disparity surrounds the performance of a group of countries known as “emerging markets”. Although share prices in emerging markets fell by more than developed markets as the financial crisis unfolded, emerging markets have recovered earlier and stronger than in developed markets, and there are various reasons why the emerging markets may continue to out perform developed markets into the medium-term.

What are emerging markets?

Emerging markets generally refer to developing economies with relatively low levels of income per person, but with the potential to significantly increase income over time. To meet the “emerging market” definition from an investment perspective, these economies will also typically have a local stock market that is available to foreigners for investment.

Examples of countries included in the emerging market definition are China, Brazil, Russia, India, Indonesia and Korea. Historically, share markets in these markets have experienced more volatile price movements than those in developed markets.

Often, mainstream international equity investment vehicles will have very low allocations to emerging markets, unless they are a specific or specialist emerging market fund. To obtain a meaningful exposure, investors will normally need to invest in a fund that specialises in, or has a specific allocation to emerging markets.

Recent performance of emerging markets

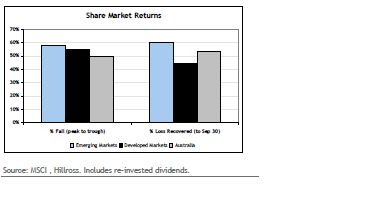

The chart below looks at the fall in equity market returns during in the financial crisis, and compares emerging markets with those in overseas developed markets (eg Europe and the US) and those in Australia. The chart also shown is the extent to which returns have bounced back in each market type in the recovery phase to the end of September.

As can be seen on the chart, emerging market returns fell by 58% during the financial crisis, around 60% of these losses have since been recovered. In contrast, although experiencing a fall of a similar magnitude, developed markets around the globe have only recovered 44% of their lost value.

Are emerging markets now too expensive?

Given that emerging markets have experienced a stronger recovery than their developed market counterparts, investors may fear that the emerging markets are now too expensive on a relative basis. However, there reasons as to why developed markets should come out of the global financial crisis with relatively lower share market valuations than emerging markets:

· The financial crisis originated from “developed economies” and it is here where future adjustments are most needed. At some stage, the European, US and Japanese economies will need to re-tighten fiscal and monetary policies to more normal levels after these have been left excessively loose as a strategy to manage the financial crisis. The need to re-tighten these policies is likely to constrain economic growth into the medium-term. Similarly, households, particularly in the US, are likely to need to lift savings levels and cut consumption to manage debt – again this is likely to lead to a lower economic growth scenario.

· Adjustments are far less relevant for emerging markets, where household and Government debt is typically low. With fewer constraints on economic growth and some natural drivers of new economic activity (such as urbanisation and industrialisation), the probability is that emerging markets will continue to experience relatively higher rates of economic growth for a number of years ahead.

Although emerging markets have bounced back strongly, valuations suggest share price are still no more expensive than in developed markets. The ratio of share prices to annual earnings in both types of markets is currently around 15 times. With the possibility of higher company earnings growth being an outcome of stronger economic growth in emerging economies, it could still be argued that emerging markets are attractively priced on a relative basis.