Saving the Australian economy

An excess of debt and a decline in the rate of savings by households was a root cause of the events that unfolded to become the Global Financial Crisis (GFC). Whilst the GFC may have had its origins in the United States, Australia was far from immune from the symptom of household saving declines, which has characterised western economies over the past 2 decades.

Recent patterns in household savings

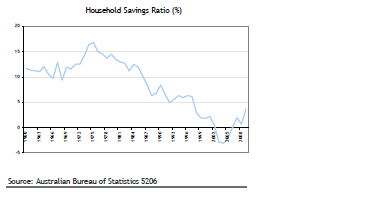

The chart below shows the movement in Australia’s household savings ratio (ie the percentage of household disposable income that is saved rather than spent) over recent years. Although savings today are much lower than they have been historically, the good news is that Australian households moved from being net borrowers to net savers well ahead of the financial crisis.

After bottoming in 2004, the savings ratio in Australia has picked up further in the aftermath of the GFC. This is possibly in part due to a shift in our attitudes to debt and also the rise in disposable income created by the Government’s cash stimulus payments.

Also providing some source of comfort around Australia’s net saving position is the apparent nature of the build up in housing debt that took place when Australian households were on their biggest debt binge in the 1990s and early 2000s. According to analysis the Reserve Bank completed in March 2007 , much of the incremental debt that was taken on by Australian households was in the form of home loans to second and subsequent home buyers. These buyers were typically “trading up” into larger more expensive dwellings, and were generally older and of higher income than average home buyers. The profile of these borrowers meant that their capacity to repay and support increased debt was relatively strong.

This pattern of home loan growth in Australia helps explain why banks here are yet to experience a substantial increase in mortgage loan delinquencies. The pattern is also in stark contrast to that which took place in the United States, where ballooning loans to first home buyers triggered the “sub-prime” loan crisis – a key component of the overall GFC.

It could be argued that there is some risk that Australia’s profile of borrowing is now changing, with first home buyers increasing their share of home loans over the past year. However, while significant on a month to month basis, the trend is yet to materially affect the overall mix of loans outstanding in the economy. None-the-less, the possibility of an “over heated” first home buyer sector should be a key consideration for authorities when considering the extent to which first home buyer incentives are continued.

More savings needed

An ongoing sizeable contribution to savings from the household sector has become a more important pre-requisite to economic health in the post GFC environment. Whereas in the past local firms could call on overseas loans to fund the shortfall of savings in the economy, the GFC has seen many of these sources of funds dry up. In addition, the Australian Government has now moved to a budget deficit position; meaning it is detracting, rather than adding as it was previously, to the pool of savings available in the economy.

Hence if household savings do not continue to grow and make up for the Government and likely international savings shortfall, the private sector may be more restricted in its ability to borrow and expand.

Given this importance of household savings, Government policy may have to become increasingly considerate of the need to encourage savings. Interest rate settings (higher interest rates encourage more net savings), rates of compulsory superannuation and tax incentives, are all policy levers the Government has available to influence the rate of household savings.

[1]Financial Stability Review, Reserve Bank of Australia, March 07

Published by Hillross Financial Services Limited ABN 77 003 323 055. We are part of the AMP Group of companies. No remuneration or other financial benefits are paid to us or our related companies or associates for providing this publication. Any advice in this publication does not take account of your personal circumstances. Before relying on it to make a decision, you should consider how it applies to your overall circumstances or speak to a financial adviser. Before deciding whether to buy or continue to hold any financial product including those referred to in this publication, you should obtain and consider the Product Disclosure Statement for the product, which is available from your financial adviser. Although this information was obtained from sources considered to be reliable, we do not guarantee it is accurate or complete. Past performance is not an indication of future performance.

is not an indication of future perform