If I had a hammer...

If the Reserve Bank Governor, Glenn Stevens, could wave a magic wand and do one more thing for the Australian economy right now it is likely to be to build more houses. This was one of the clear messages in a speech made by the Governor at the end of July, in which excessive housing prices were nominated as a dangerous consequence of the current policy mix.

The following extract from this speech highlights the Governor’s fears that a mismatch in the supply and demand for housing may lead to a run up in housing prices:

“A very real challenge in the near- term is the following: how to ensure that the ready availability and low cost of housing finance is translated into more dwellings, not just higher prices. This ought to be the time when we can add to the dwelling stock without a major run up in prices. If we fail to do that – if all we end up with is higher prices and not many more dwellings – then it will be very disappointing, indeed quite disturbing. Not only would it confirm that there are serious supply-side impediments to producing one of the things that previous generations of Australians have taken for granted, namely affordable shelter, it would also pose elevated risks of problems of over leverage and asset price deflation down the track.”

Demand outstripping supply

For some time, the level of residential construction in Australia has been well below what is required to keep pace with population growth and household formation. Estimates of underlying demand for housing suggest that the nation needs to have around 14,000 dwellings constructed each month to satisfy underlying demand. Since the beginning of 2008, the average monthly number of approvals for new residential dwellings has been less than 12,000. And with demand for housing being stimulated by low interest rates, first home buyer incentives and an ongoing supply of bank finance, there is a risk that prices will be bid up as demand for housing outstrips supply.

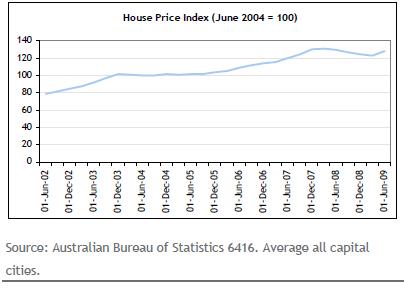

The presence of a risk of upward movement in housing prices is in stark contrast to the trends that have taken place over the past 18 months in many northern hemisphere housing markets, where falling house prices were a feature of the financial crisis. Until recently, fears had been expressed by some market commentators that a similar dramatic decline in housing prices was a possibility in Australia. However, as indicated on the chart below, this has not been the case for the general housing market in Australia.

Economic benefits of housing construction

In addition to helping to boost supply and thereby take some pressure of housing prices, a rise in residential dwelling construction would also be a positive factor for general economic growth. At a time when business investment is weak, exports are declining and the effects of the Government’s cash handouts have waned, housing construction offers a potential new source of demand and job creation within the domestic economy.

Not only would a rise in home building directly create employment and activity in the construction industry, but it would also tend to produce demand in other industries, such as white goods and furniture – making it an effective stimulus to general economic activity.

Implications for interest rates

The warnings from Glenn Stevens about the dangers of a rise in housing prices are significant and represent the first real sign of concern of an unintended consequence of the loose policies that have been put in place to stimulate the economy. The presence of these concerns may significantly reduce the likelihood that the Reserve Bank will be able to lower interest rates further. Rather, the dangers of rising house prices may see a much earlier rise in interest rates than would have otherwise been necessary.

Given that it was a housing price bubble in the United States that acted as one of the key catalysts to the Global Financial Crisis, authorities here will be highly wary of allowing their own policies to be responsible for a boom-bust scenario to take place in any major area of current, still volatile, economic landscape.