Risk and portfolio construction in the aftermath of the GFC

Key points

- The global financial crisis (GFC) highlighted that quantitative measures of the riskiness of assets and the correlations between them are highly unstable.

- There is a role for alternative and more exotic investments in portfolio, but their diversification benefits should not be exaggerated. Quantitative estimates of risk and diversification need to be combined with qualitative assessments and there is no real substitute for government bonds as a defensive asset class.

Introduction

The events of the past 18 months provide many lessons for investors. Many of these relate to risk management and the way investment portfolios are created.

Risk control – from the old to the new and back again

Risk is a rather esoteric concept that has different meanings. It may be seen as the risk of a capital loss, the volatility of an investment, or the risk a portfolio won’t generate enough returns for a comfortable retirement. There is no simple definition but most tend to focus on the volatility of an asset as the best guide to risk.

Traditionally, a key approach to managing the risk of an investor’s portfolio was to combine ’defensive assets‘, where the bulk of the return comes from income (eg cash and government bonds); with ’growth assets‘, which have potentially higher returns from rising capital values, but also more volatility (e.g. equities and property). This approach sees investment funds categorised according to their mix of defensive and growth assets. For example, super funds with 30% defensive assets and 70% growth assets are aimed at investors with a longer time horizon, whereas funds with 70% defensive assets and 30% growth assets are aimed at investors closer to retirement.

However, for a variety of reasons this approach was called into question, giving way to a more sophisticated approach which was less constrained by the growth/defensive pigeon-holing of assets, focusing rather on risk control via a more diversified asset mix. Several factors drove this:

- A search for higher investment yields, as cash and bond yields were lower than 1970s and 1980s levels

- The realisation that the growth/defensive categorisation has become increasingly blurred. For example, property investments have some bond-like characteristics and fixed interest now includes private sector debt, which is more related to equities.

- The bursting of the IT bubble in 2000, which encouraged investors to follow the lead of endowment funds such as those at Harvard and Yale to invest in a wider range of risky assets than just equities and property

- Computing power and growth in sophisticated quantitative techniques for measuring risk, which encouraged more sophisticated risk controls than just the pigeon-holing of assets into defensive or growth.

The result was a range of developments, including:

- The use of real estate investment trusts (REITs) as a partial replacement for government bonds on the grounds they would provide a higher yield-based return than bonds but with just a bit more risk

- The use of funds of hedge funds as a replacement for government bonds on the grounds they would provide a cash/bond plus return with low correlation to equities

- Private sector debt in fixed interest portfolios

- Increased exposure to more exotic investments such as various credit-based investments (CDOs and CLOs), emerging market equities and debt, private equity, commodities and infrastructure, on the grounds they would provide more diversification.

Such adjustments were validated by quantitative risk analysis, often based on short periods of data, which showed that such investments were relatively low risk or had low correlation to equities and could reduce portfolio risk. Risk budgeting (the allocation between competing investments based on their contribution to a portfolio’s target volatility) became a key buzzword. This quantitative measurement of risk gave investors confidence the riskiness of their portfolio was under control.

Enter the global financial crisis

While the global financial crisis was an extreme event, it indicated that there is still a role for the traditional growth/defensive approach to risk control. It also highlighted issues with purely quantitative measures of risk. Share markets in developed countries have fallen 50% to 60% from their 2007 highs. However, many of the so-called diversifiers also had big falls - emerging market shares and commodities lost nearly 60% of their value and private equity funds had losses of around 20% (depending on whether asset values were marked-to-market). In contrast, government bonds had good returns last year (Australian bonds returned 15% and cash 7.6%). ‘Alternatives’ to bonds and cash did poorly:

- In some cases, supposedly well-diversified investments in CDOs, (which in turn invested in US sub-prime mortgages) lost most of their value. A big mistake here seems to have been the reliance on a short period of default history for US mortgages.

- Corporate credit related investments had losses ranging up to 26% for US high yield debt

- REITs, which had long been viewed as a relatively safe investment, lost 70% to 80% of their value

- Funds of hedge funds lost around 20% of their value.

Lessons in risk management

None of this is to say that investment portfolios shouldn’t seek to have a broad range of investments, including exotic assets, or that quantitative measures of risk have no value. But it does highlight several important lessons when it comes to managing the risk of an investment portfolio.

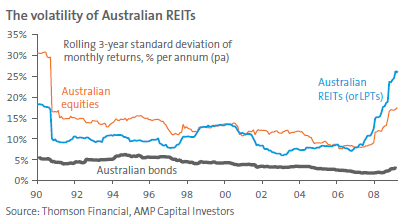

First, quantitative measures of risk and correlation are inherently unstable. This can be clearly seen in the next chart which shows the volatility of Australian REITs.

Over the last 2 years, the volatility of Australian REITs has more than doubled. In fact, REITs have become more volatile than shares and increased their correlation to shares. Several factors have driven this, including increased debt levels and a greater focus on non-property management activities.

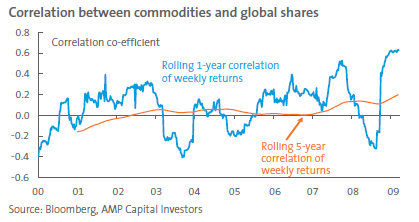

The next chart is another example. It shows the correlation coefficient between the S&P Goldman Sachs Light Energy Commodity Index and global shares as measured by MSCI. Up to 2007, the rolling 5-year correlation between the 2 was close to zero, suggesting commodities would be a good diversifier in a portfolio with shares. However, the one-year correlation since then is far more volatile and surged higher in the second half of last year. Hence, an investor using commodities as a diversifier to their share exposure would have found that it did not work when they needed it to. This phenomenon was also evident across emerging market equities, credit investments and hedge funds.

Several factors drove the increase in correlation between shares and other, including the severity of the crisis and the economic slump, and the impact of liquidity between asset classes. In tough times when you can’t sell what you want, you sell what you can. This certainly occurred over the last year, which spread the crisis between asset classes. While correlations between assets may be low in more normal times, the experience of the last two years is a reminder that it is likely to shoot up in tough times.

The desire to summarise things in a number (what some call ’physics envy‘) is endemic in the investment world. However, unlike in physics, the ’number‘ is less reliable. As Warren Buffett recently warned "investors should be sceptical of history-based models…using esoteric terms such as beta, gamma, sigma and the like, these models look impressive. Too often, though, investors forget to examine the assumptions behind the symbols. Our advice: beware of geeks bearing formulas".

Second, the inherent reality is that risk and correlations between assets are not a given but rather are influenced by the actions of investors themselves. For example, the more investors that observed that A-REITs were relatively stable and commodities had low correlations to shares, the more investors jumped into both asset classes, a factor that ultimately contributed to their collapse.

Third, it is clear from all of this that there is a lot of value in the rather simplistic, albeit old fashioned, approach to risk control. Government bonds and cash did provide good diversification last year. Assets such as REITs, hedge funds and credit are much higher risk.

Fourth, risk cannot be divorced from valuation risk. The more an asset’s price goes up, the higher the risk of an eventual fall. Unfortunately, historical measures of volatility cannot capture this, although there is some evidence that low volatility in an asset class and the complacency it may beget could be a precursor to price falls.

Finally, this experience shows that diversification doesn’t necessarily justify a higher exposure to risky assets.

Conclusion

There is a role for alternative and more exotic investments in portfolios, particularly given their medium-term return potential. But their diversification benefits should not be exaggerated and quantitative estimates of risk and diversification need to be combined with qualitative assessments. Finally, there is no real substitute for government bonds as a diversifier and defensive asset class.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.