Inflation versus deflation

Arguably more so now than in any other period in modern history, the global economy is subject to 2 massive and potentially competing forces – inflation and deflation. Which of these forces will prevail in both the short-term and longer-term will heavily influence the outcome of returns produced in various asset classes.

The right pre-conditions for deflation

The global financial crisis has created a situation conducive to deflation ie a period of decline in the general level of prices. With huge losses being recorded by financial institutions and widespread expectations of increased loan defaults, the supply of money via new lending has been severely constrained. We have also witnessed a decline in the demand for new money in the form of loans.

Without the stimulus of new lending, the level of growth in the money supply is expected to remain low or negative. Periods in which low money supply growth are combined with generally low levels of demand in the economy provide the right pre-requisites for deflation.

“Deflation can be particularly harmful when the financial system is already fragile, with household and corporate balance sheets in poor condition and with banks undercapitalised and heavily burdened with nonperforming loans.” Governor Ben S. Bernanke. Economics Roundtable, University of California, San Diego, La Jolla, California July 23, 2003

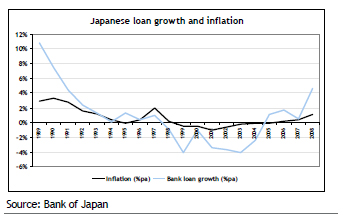

Two notable periods of deflation that are often referred to are the Great Depression of the 1930s and the prolonged period of economic weakness in Japan in the 1990s and earlier this decade. The chart below highlights the close relationship between low rates of new lending growth and deflation that has been characteristic of the Japanese economy in recent periods.

The attempts to neutralise deflation

To avoid a Japanese styled extended period of low lending activity, deflation and subdued economic activity, Governments and central banks around the globe have introduced a variety of measures. These measures include additional spending, lowering interest rates, “rescuing” bank balance sheets and most recently “quantitative easing”. Such actions by policy makers tend to be inflationary, as they stimulate aggregate demand and, particularly in the case of quantitative easing, increase the supply of money.

Quantitative easing refers to the situation where policy makers effectively “print money” and actively inject funds into the capital market by purchasing bonds and various forms of corporate and mortgage debt. As there tends to be a direct relationship between the rate of growth in the money supply and the rate of inflation, the increase in the supply of money generated by quantitative easing should ultimately lead to a lowering in the value of money ie generate inflation. However, as the Japanese experience with quantitative easing has shown, the impact on inflation from the policy is not necessarily direct or highly predictable.

Which force will prevail?

Notwithstanding the uncertainties over the inflationary impact of quantitative easing, both the massive size of stimulus now being provided, and the fact that it is highly synchronised across the US, Japan and Europe, suggests the global economy is in un-chartered territory. This makes the assessment of the relative strength of inflationary and deflationary forces particularly difficult to judge.

Certainly if there is going to be deflation, then it is likely to take place sooner rather than later, as it requires a period of weak aggregate demand. The inflationary risks are likely to be strongest once an economic recovery takes hold, suggesting that some significant policy tightening (eg higher interest rates) may be required in the relatively early stages of an economic recovery.

Investment implications

Deflation is generally considered to be particularly bad news for equity and property investments as it makes it difficult to continue to earn the same monetary value of profits or rent, and therefore can be expected to lead to a fall in capital prices. Longer term fixed interest investments would be expected to be the best performers in a period of extended deflation.

Conversely, in periods of high inflation, fixed interest investments would be expected to experience capital losses, whilst commodities (especially gold) will often provide the best returns as inflation rises above expectations.

Published by Hillross Financial Services Limited ABN 77 003 323 055. We are part of the AMP Group of companies. No remuneration or other financial benefits are paid to us or our related companies or associates for providing this publication. Any advice in this publication does not take account of your personal circumstances. Before relying on it to make a decision, you should consider how it applies to your overall circumstances or speak to a financial planner. Before deciding whether to buy or continue to hold any financial product including those referred to in this publication, you should obtain and consider the Product Disclosure Statement for the product, which is available from your financial planner. Although this information was obtained from sources considered to be reliable, we do not guarantee it is accurate or complete. Past performance is not an indication of future performance.