The global economic cycle, risk premiums & super returns

Key points

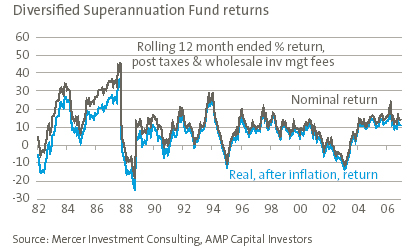

- Superannuation and diversified investment funds had another year of solid returns on the back of strong profit growth and declining risk premiums in some assets.

- Our base case is for more normal returns this year, but the chance of another upside surprise on the back of benign economic conditions and plentiful liquidity is high.

Another year of strong super returns

The past year saw another year of strong returns from diversified (or balanced) growth investment funds with median gains of 14.4% (after taxes and wholesale investment management fees).[1] This followed 15.0% in 2005 and 16.1% in 2004.

Yet again most investors, including myself, have been surprised at the strength of returns. After such a strong run it is natural to question if it can continue at this pace.

Best to assume a return to more normal returns

Our base case is for returns to slow to around 11% this year.[1] This would be closer to long-run normal returns of 5% to 6% above inflation, with the last few years being a typical cyclical recovery after a bear market and a return to more normal rates of profit growth. As always there are risks on the down side – e.g. higher interest rates, a slump in profits, geopolitical turmoil - but there’s also a significant risk that returns will surprise on the upside again.

Strong profits and declining risk premiums

Looking behind the strong returns from most asset classes (excluding fixed interest over the last few years) there have been two fundamental drivers. First, very strong profit growth in the order of 20% plus for most major share markets. Second, a reduction in risk premiums for risky assets – notably corporate debt, non-residential property whether listed or unlisted, infrastructure assets and private capital. The risk premium has various definitions but in this context is taken to mean the prospective excess return offered by risky assets over safe assets like government bonds. A guide to the risk premium is the gap between the yield on risky assets and government bonds, and for most assets, with the exception of shares, this has been narrowing over the last few years.

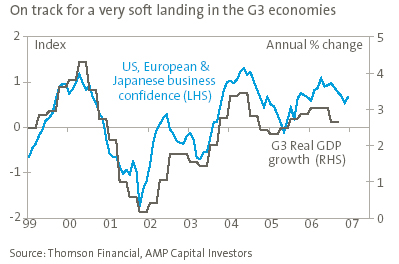

Beyond an exogenous shock – such as a conflict with Iran – a slump in profit levels or a rise in risk premiums pose the biggest risk to investment returns going forward. The bears’ case is that profits will slump on the back of a housing-lead hard landing in the US and/or risk premiums will blow out resulting in capital losses for investors. The two are interrelated as a slump in profits will lead to corporate defaults (pushing up corporate bond yields), reduce property returns (causing investors to reassess the recent fall in property yields) and cause problems for private equity investors. So far there is little evidence to support the bears’ view. Firstly, the global economy appears to be undergoing the softest of soft landings:

- The US economy is crucial in setting the direction for the global economic cycle and there is very little evidence of a profit-crunching hard landing there. Yes, the housing sector has slumped. But against this, consumers are still happily spending on the back of a strong labour market and falling energy bills and the corporate sector remains strong on the back of past strong profits and strong balance sheets. What’s more, US housing indicators are showing signs of bottoming and this was the case even before the recent bout of unseasonably warm weather in the US. If anything the US economy appears to be undergoing a “perfect landing”.

- The European economy is still motoring along at a reasonable pace.

- The Bank of Japan has adopted a very gradual approach to raising interest rates – Japanese interest rates are still just 0.25% - and this is helping to ensure the flow-on from the US slowdown to Japan is modest. Business conditions indicators for the G3 (the US, Europe and Japan) have softened from a year ago, but there is little evidence of a hard landing. In fact they may be starting to bottom out. See the next chart.

- While the Chinese economy has slowed from 11.3% over the year to the June quarter last year it’s still growing at around 10%.

- Growth in Asia generally has slowed but still remains robust.

- It’s a very similar story in Australia – yes growth has slowed, but economic conditions are still reasonable as reflected in unemployment remaining at a 30 year low and consumer confidence rebounding in January.

In many ways it seems as if the global economic cycle has become somewhat self-stabilising. Last year the combination of higher oil prices, higher bond yields and rising interest rates led to a moderation in economic growth (which was otherwise threatening a rise in underlying inflation). In turn, the moderation in growth contributed to lower oil prices, lower bond yields (which helped cushion the US housing downturn) and a slowing in the pace of global interest rate increases. This in turn has all cushioned the slowdown in growth and may have contributed to an up-tick in some leading growth indicators.

Taken together the extremely soft landing in global growth suggests a very soft landing in profit growth. We remain of the view that overall profit growth will slow from around 20% in 2006 to around 10% in 2007. There is certainly no sign of the sort of cost pressures/economic slump required to push profits backwards.

Secondly, there is no sign of a generalised rise in risk premiums around the corner:

- The growth slowdown in the US may see an increase in corporate defaults which may see credit spreads rise a bit, but it’s hard to see a major blow-out as the growth slowdown is so mild.

- The moderation in global growth along with lower oil prices has taken pressure off inflation which in turn suggests interest rates will remain relatively low. Sure, interest rates may rise a little further in Europe and Japan, there may be talk of another rate hike in the US and the risk is for one more move in Australia, but broadly speaking interest rates will remain relatively benign. The “global liquidity gusher” will remain pretty strong. As a result, the flow of global capital – from cashed up countries in Asia, cashed up companies and cashed up high net worth individuals – looking for decent investment returns will remain high. This will continue to benefit non-residential property assets and equity assets both directly from individual and institutional investment flows and indirectly via private equity buyout activity.

- Finally, the relatively stable economic environment remains consistent with relatively low volatility in investment markets and as a result relatively low risk premiums.

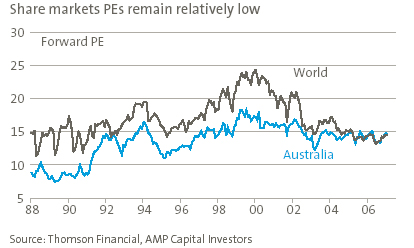

None of this is to say there won’t be corrections along the way. There will be, and after the strong 18% or so gains in global and Australian shares since their last correction low last June, it is reasonable to expect a decent correction in the next few months. A swing back to interest rate concerns in the US may well prove to be the trigger. The recent rise in bond yields is a negative from a valuation perspective for share markets, although most share markets are still reasonably valued.

But the broad trend in risky assets such as shares and non-residential property is likely to remain positive. Equity bull markets normally go through three phases – an initial recovery from excessive pessimism and extreme undervaluation, profit driven strength and then a shift towards overvaluation as speculation and “irrational exuberance” takes over. The current bull market in share markets got underway in March 2003 and we have moved through the first two stages. But there has been little sign of the third speculative phase, at least in terms of overall price to earnings multiples. Forward PEs remain relatively low and are a long way from the extremes of the late 1990s.