Market update as at January 2007

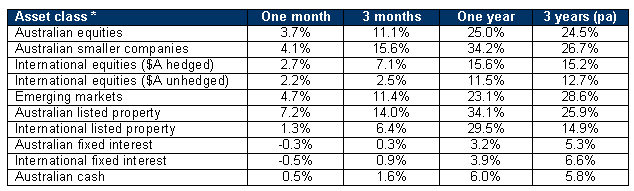

The table below provides details of the movement in average investment returns from various asset classes for the period up to December 31 2006.

Australian shares hit another new high

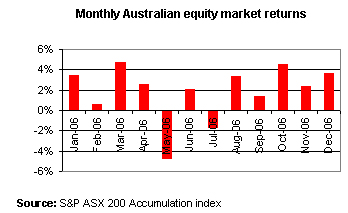

The Australian market finished the year on another record high, with the market advancing 3.7% over December. For 2006 as a whole, investor returns have averaged 24%. This is the third* consecutive year in which returns have exceeded 20%.

Virtually all sectors of the sharemarket recorded solid price gains during December. Mining stocks were again the exception, as the market continued to shift towards a slightly softer outlook for commodity prices. Resource giant, BHP Billiton, was 3.5% lower over the month, whilst Rio Tinto was flat.

Telstra was a major contributor to the market’s increase with its share price rising 10%. At $4.14, Telstra has reached a cyclical high and has been buoyed by market expectations that future restructuring will deliver improved shareholder value. Qantas also had another strong month with a 5.5% rise. The Qantas board provided support for the proposed acquisition by Airline Partners Australia, increasing the likelihood that the company will be successfully taken over by the private equity group.

Smaller companies again outperformed the general market with the smaller companies index rising by 4.1% over the month. For 2006 as a whole, smaller companies have provided investors with an average gain of 34%.

International shares remain solid

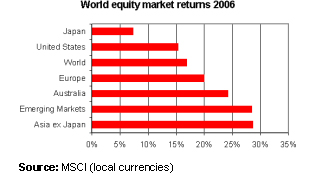

All major share markets provided positive returns over December with returns for investors with hedged currency positions averaging 2.7% for the month. Further appreciation in the value of the Australian currency restricted the growth in unhedged international share investments to 2.2%. For the calendar year 2006 as a whole, international share returns averaged 16% for hedged investments, and 12% for unhedged investments.

The Asian region posted the largest increase last month. A recovery in the Japanese market saw the Nikkei Index advance 5.9%, whilst the Hong Kong market was 5.3% higher. Also consistent with investor support for those economies with the strongest economic growth prospects was a 4.0% gain in emerging market share prices. Emerging markets, which includes countries such as China, Brazil and India, generated a 23% increase over the course of 2006.

In the more developed economies, the European region continues to outperform the United States (US). Last month, price increases across Europe averaged 3.9%, bringing the annual growth to 16%. In the US, movements were more modest with the S&P 500 Index gaining 1.3% over December and 14% for the year. Although not of the same magnitude as in China and several emerging economies, both Europe and the US continue to enjoy solid economic growth at around the 3% level.

Interest rates on the rise

There was some reversal in December of the downward movement in longer-term interest rates that had taken place over most of the second half of 2006. Although the US Federal Reserve Bank left cash interest rates unchanged in December, their most recent statement did pave the way for possible additional interest rate increases. The central bank suggested that “readings on core inflation have been elevated, and the high level of resource utilisation has the potential to sustain inflation pressures.” Reflecting a slightly higher probability of increased interest rates, the US 10-year bond yield rose from 4.5% to 4.7% over December.

Most major bond markets followed the lead of the US in pushing up longer-term interest rates. The small increase in global interest rates led to a decline in bond prices, which saw average investor returns drop by 0.5% over the month. Annual 2006 returns for international bonds were positive 3.9%.

Interest rates in Australia moved in line with the trends overseas last month. The 10-year Government bond yield rose from 5.6% to 5.9% over December. This is the highest level reached by bond yields since August 2006. Higher yields also occurred at the shorter end of the yield curve, implying that market expectations of an interest rate increase early in 2007 firmed slightly. The jump in interest rates generated a negative return to fixed interest investors of 0.3% over the month, bringing annual returns to 3.2%.

There was no change to the Australian overnight cash interest rate in December, which remains at 6.25%.

Listed property

Despite the higher interest rates in place, listed property prices continued to rally last month. Australian listed property prices finished December some 7.2% higher.

The listed property sector has now risen 12.5% over the past 2 months. This is at least partially in response to the growing presence of private equity investors in the Australian market and the perception that listed trusts may offer ideal investment opportunities. The increase in price has been recorded right across the sector. Of particular note over the past 2 months has been an 18% rise in the price of the retail trust Centro and a 19% jump in the price of the diversified General Property Trust.

Overseas listed property has also continued to grow in popularity as an asset class for Australian investors. Increasingly, properties in major international economies are being unitised and listed on stock markets in the same manner as much of the Australian property universe. As has been the case domestically, returns have been impressive with the Citigroup Global REIT Index showing a 29% gain for 2006, following a 1.3% return over December.