Housing prices – history unlikely to repeat

With 2008 bringing a fall in share prices of the same magnitude as the stock market crash of October 1987, can we expect residential housing prices will behave in the same manner next year as they did in 1988? In the months that followed the stock market crash 2 decades ago, residential property prices went through an unprecedented boom. By the end of 1988, median house prices across Australia were some 47% higher than they were 18 months earlier as investors flocked out of the stock market and bought into residential property.

There are other similarities between 1987 and today. In both periods interest rates have been on a downward path. Another relevant parallel is that both periods where characterised by subdued housing construction leading to a shortage of residential dwellings relative to underlying demand growth.

However, whilst history does have a habit of repeating, there was a crucial structural change in the way the mortgage loan industry operated in the late 1980s that is likely to have been a defining and unique factor. In the lead up to 1987, money market interest rates had been at very high levels. With bank mortgage interest rates still regulated and capped, the supply of home loans had dried up as banks could not profitability make finance available at the capped rate. A combination of falling interest rates and the removal of the 13.5% cap on new bank mortgage loans in April 1986, led to a surge of new loans being made available to fund residential property purchases. By July 1998, the value of new loans written to fund residential property purchases was running at double the level of 2 years previous.

The lack of finance available for residential home purchases in the early to mid 1980s also led to a situation where housing had become quite cheap. In June 1987, Australia’s median dwelling price was equivalent to 1.6 times mean annual household income. Today, this same ratio is set at 3.4 times. Hence, in relative terms housing was exceedingly cheap prior to the 1987 boom but is today still particularly expensive.

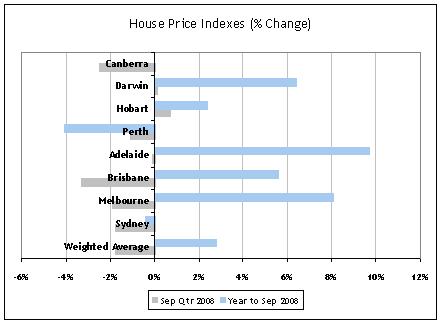

Early housing price data does suggest that the script defined over the late 1980s is not currently being followed. As can be seen on the chart below, median house prices across Australia fell by 1.8% in the September quarter of 2008. On an annual basis, however, price movements remain positive.

Source: Australian Bureau of Statistics 6416

Whilst the late 1980s may have been the dawn of the period of greater availability of housing finance, there are now suggestions that the aftermath of the sub-prime loan crisis is likely to be a period in which housing finance becomes considerably more difficult to obtain. Massive losses on mortgages in the US, where housing prices have weakened considerably over the past year, may prompt local banks to tighten up on their lending criteria and reduce the proportion of the population to whom they are willing to lend. Certainly, the demise of some of the local non-bank lenders may take some housing loan supply out of the industry and make it easier for banks to maintain market share without having to compromise on lending standards.

Australian banks are still increasing the size of their housing loan portfolios and have certainly not put up the shutters completely. This ongoing supply of finance, combined with improving affordability from lower interest rates, may underpin prices - particularly at the lower end of the market where the chronic shortage of rental properties should see a steady stream of new home buyer aspirants as affordability improves. Properties in more expensive suburbs could be more affected by the prevailing economic conditions, with lower executive pay rises and bonuses and a more circumspect financial sector taking some purchasing power away from prospective buyers.

Published by Hillross Financial Services Limited ABN 77 003 323 055. We are part of the AMP Group of companies. No remuneration or other financial benefits are paid to us or our related companies or associates for providing this publication. Any advice in this publication does not take account of your personal circumstances. Before relying on it to make a decision, you should consider how it applies to your overall circumstances or speak to a financial planner. Before deciding whether to buy or continue to hold any financial product including those referred to in this publication, you should obtain and consider the Product Disclosure Statement for the product, which is available from your financial planner. Although this information was obtained from sources considered to be reliable, we do not guarantee it is accurate or complete. Past performance is not an indication of future performance.