2008 - what a year!

It’s been a difficult and exciting year as the world’s financial markets have fallen into unprecedented turmoil and talks of a recession in Australia are looming. There is no doubt we’re living through some extraordinary times, and it is easy to lose perspective in this environment.

We remain optimistic of better times ahead, and are working hard to continually improve our service and advice to better support you. Together we can get through these tough times and be ready for better times ahead.

The good news

With the constant negative press surrounding the global crisis and the increased likelihood of it continuing well into 2009, it is easy to forget the good news. So here are a few positives about what we are experiencing.

Long-term investment continue to provide good returns

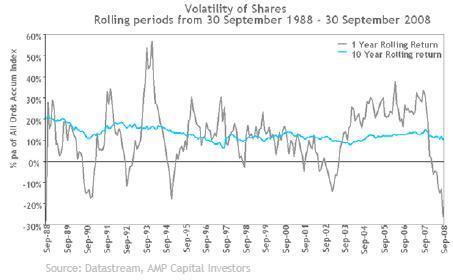

The chart below provides a snapshot of the share market over 10 years. While the one year rolling return figures are up and down, the 10-year rolling return remains relatively steady and always positive throughout time.

In simple terms, this means that although many of our investments are experiencing significant reductions in capital value, many are still delivering healthy distributions.

The share market leads the economy

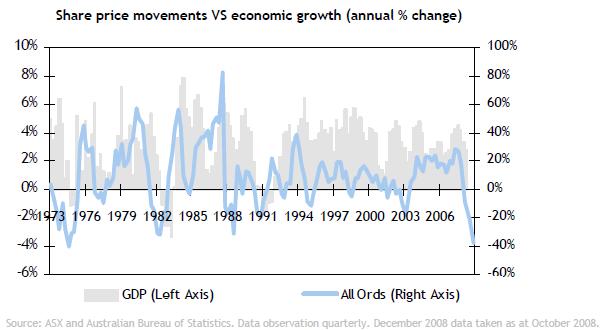

Many people believe that share markets increase and decrease in response to the economic environment. The current crisis reminds us of the high degree to which emotion drives investment returns. The chart below compares the annual economic growth rate to the annual rate of growth in Australian shares each quarter since 1973. It can be seen from this chart that the share market leads the economy (not the other way around). History indicates that the economy does not have to be growing for share markets to recover. Shares may recover before the economic environment improves.

The market will turn

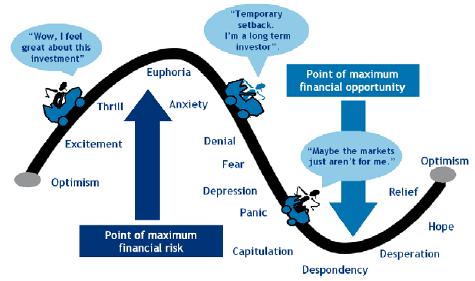

We have heard this many times, but it’s important to remember - the market will turn. History shows us that investments go through distinctive cycles. The following picture outlines investor emotion over different periods in the market. It is important to note that in times of panic and desperation, market opportunities are at a maximum.

While it is impossible to say whether we have reached or passed ‘capitulation’, from past experience it appears we are at least close.

The need for a long-term investment plan

Having an investment plan is one of the best ways to help you ride out volatility in the sharemarket and reduce the risk of you making rash decisions. Less experienced investors can be tempted to dive in and out of investments in the hope of making abnormal gains or protecting themselves from large losses.

In contrast, seasoned investors know that market volatility is inevitable. The trick is having the right investment strategy in place to ensure you have the most appropriate balance between risk and return.

If you want to discuss your long-term investment plan, speak to one of our friendly advisers.