Four pillars of strength

They might not be popular and their interest rates might not always appear overly competitive, but in the midst of the worst financial crisis since the Great Depression, Australia’s 4 major banks form the core of a banking system that is proving to be the envy of the developed world.

The 4 pillars structure of the Australian banking system offers a number of advantages over say the United States (US) based structure, which has a myriad of State and regionally based institutions combined with large multinational institutions. With just a small number of large banks, the Australian financial sector has become relatively easy to regulate with uniform national regulations and prudential standards. Problems of non-compliance with prudential standards by banks are no doubt easier to identify early by regulators in Australia due to the close bank – regulator relationship that is made possible by the small number of banks.

Banking is also the type of industry where there are many benefits accruing from being large ie economies of scale. In addition to operational efficiencies, being large also facilitates considerable diversification in assets and loan exposures, which effectively lowers the risk profile of banks. Some would also argue that with such a small number of players, the banking system has characteristics of an oligopoly, which enables pricing to be set at levels that produces high profitability.

Although profitability has been impacted by recent events, the strategic position of the 4 large banks in Australia is likely to have been improved as a result of the financial crisis. Many non-bank lenders have either fallen away or have become less competitive due to funding costs. Banks now account for 92% of all new home loan approvals, compared to 80% at the same time last year. In addition, at least 2 major competitors to the big 4, ie BankWest and St.George, are nearly certain to be acquired by one of the big 4.

Fear of bank failures and bank failure to lend

The financial rescue package approved in the US early in October, and various forms of assistance being provided to financial institutions in Europe, have the initial objective of keeping banks liquid and solvent and restoring investor confidence in the banking system.

However, as suggested by the continued decline in global share prices even following the formulation and approval of financial rescue packages, reduction in the fear of bank failure does not necessarily lead to the removal of the fear that the real economy will move deeper into a recessionary environment. Concerns have escalated that even with the liquidity injections and purchasing of problem assets by central authorities, banks will be reluctant to lend to the private sector for some time. This may be particularly so in the US, where details over when, and for what price, problem assets will be purchased are yet to be revealed. Without this information, banks cannot determine the future health of their balance sheets nor their capital adequacy and capacity to lend.

If this reluctance to lend to the private sector continues, then spending and investment activity in the real economy slows and the private sector contracts. Higher unemployment, additional loan defaults and falling consumer spending will then follow. This recession type scenario is currently spooking global equity markets.

Australian banks are still lending

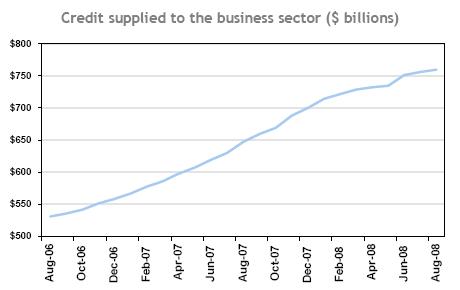

The good news for the Australian economy is that up until now, the relative strength and confidence within the Australian banking sector has facilitated ongoing lending. Although new lending has slowed overall, bank lending to the business sector has continued to grow at a fairly healthy rate. Over July and August, the value of credit made available by Australian financial institutions to businesses rose by 1.5%.

Source: Reserve Bank of Australia

In contrast to overseas banks, Australian banks have been able to continue to increase their funding and capital raisings, which has facilitated ongoing growth in lending. It is this continued injection of finance into the private sector that will be a critical element in Australia’s likely avoidance of an economic recession.

Share markets will ultimately reflect this difference

Although the Australian share market has tended to be dragged down in line with major overseas markets, the greater strength of the Australian banking system, and the more positive implications this has for the domestic economy, should ultimately be reflected in the Australian share market performing better than elsewhere.

Prior to the renewed wave of selling that has hit equity markets in early October, high quality Australian industrial and financial stocks were performing relatively well, with the majority moving off earlier year lows. The table below shows the price movement in the largest 10 Australian stocks over the 3 months to September. It can be seen that whilst the 2 large mining stocks have been driven down by lower global commodity prices, other stocks in the top 10 increased in price (with the exception of NAB). Over this period, global share market returns were down 11-12%.

|

% Price Change (Sep 08 Qtr) | |

|

ANZ |

2% |

|

BHP |

-29% |

|

CBA |

10% |

|

NAB |

-8% |

|

QBE |

20% |

|

Rio Tinto |

-39% |

|

Telstra |

2% |

|

Westfields |

6% |

|

Westpac |

8% |

|

Woolworths |

13% |

Hence, whilst it has appeared that the Australian market has broadly tracked global trends in recent months, the relative overweight of mining stocks in the Australian market has masked some underlying improvement in large industrials and financials.

“Panic” selling in early October appears to have reversed some of this recovery, however with the Australian financial system and economic fundamentals remaining sound, market support should return to higher quality Australian industrial and financial stocks, which remain cheap relative to underlying earnings prospects.

There is also some hope that Australian resource stocks will bounce back from current levels. Recent declines in the $A have more than offset the impact of lower commodity prices in general – leaving revenue prospects for our mining companies very solid in $A terms.

Published by Hillross Financial Services Limited ABN 77 003 323 055. We are part of the AMP Group of companies. No remuneration or other financial benefits are paid to us or our related companies or associates for providing this publication. Any advice in this publication does not take account of your personal circumstances. Before relying on it to make a decision, you should consider how it applies to your overall circumstances or speak to a financial planner. Before deciding whether to buy or continue to hold any financial product including those referred to in this publication, you should obtain and consider the Product Disclosure Statement for the product, which is available from your financial planner. Although this information was obtained from sources considered to be reliable, we do not guarantee it is accurate or complete. Past performance is not an indication of future performance.