Shares, frozen money markets and bank bailouts

Key points

- Shares collapsed last week. This appeared to be due to an investor panic regarding the freezing up of money and credit markets.

- Government moves to guarantee bank borrowing and inject capital into banks, along with US moves to buy bad debt should help unfreeze money markets and enable shares to move higher.

- While the global economic slump will ensure the ride will remain rough, with shares having had huge falls from last year’s highs this should be largely discounted.

Introduction

Trying to time the bottom of this bear market is proving very difficult. A couple of weeks ago I thought we were close to the bottom with shares looking cheap, investors in panic mode and shares having had typical bear market declines. However, I have been proven wrong with shares taking another big hit last week as problems in money and credit markets intensified. From last year’s highs to last week’s lows, Australian shares have fallen 42%, US shares 43%, European shares 49%, Asian ex Japan shares 52% and Japanese shares 54%. Commodity prices were also hit hard and this knocked the Australian dollar (A$) to as low as US$0.6450. Yet it is interesting to note that the Australian share market has fallen less recently, helped by the aggressive Reserve Bank of Australia (RBA) rate cut, the fall in the A$ and the improved state of the Australian financial system.

So what is going on?

The outlook is being driven by three key forces:

- A cyclical economic downturn that began in the US on the back of the US housing downturn, but spread globally (notably to Europe, Japan and Asia – including China) and is still unfolding

- An unwinding in the credit bubble that helped fuel the US housing bubble and easy credit generally and

- A freeze-up in money and credit markets as financial institutions, including banks, refuse to lend to each other for fear that their counterparty might go bust.

Of course these are all interrelated. The freeze-up in money markets has been a recurring theme since August last year. It has been met by various liquidity enhancing measures from central banks, but with limited success. It took a turn for the worst after US authorities let Lehman Brothers collapse because it led to enhanced fears of counterparty risk. I had thought that the US plan to buy bad debts would help settle money and credit markets, but they actually got far worse last week. As the global economy runs on credit, if this is not getting through to good borrowers, then this will affect global growth. This was evident in a further blow-out in the gap between private sector borrowing rates and government borrowing rates last week. Since credit and money flows underpin the modern global economy, the freezing up of these flows saw panic break out in share markets as investors started to fret about a deep and drawn out global economic recession. And of course, in the current environment of heightened uncertainty, the slump in shares became self-fulfilling as falls led to investor outflows which only caused more falls. Hence, last week’s slide. So in the short term, a lot depends on unfreezing the global financial system.

Grounds for hope

There are several reasons to be optimistic that a solid rally will unfold into year-end:

Firstly, while global policy responses to the crisis until recently have not exactly been successful, it is worth noting that key global policy makers seem determined to do whatever is necessary to head off a financial meltdown. This is very different to the US in the 1930s when policy makers made the situation worse by raising interest rates and taxes, and allowing banks to fail with no protection for depositors. The latest moves on the policy front have to be seen as positive.

- Interest rates are now falling in a coordinated fashion, whereas until recently the European Central Bank had been threatening to further increase rates.

- Governments are now moving to guarantee bank borrowing (both via deposits and borrowing from wholesale markets) and inject capital directly into banks. To the extent that the reluctance of banks to lend to each other reflects fears of counterparty risk, this move could prove to be very positive in helping to unfreeze global money markets. This has already been recognised with share markets rebounding around 10% so far this week.

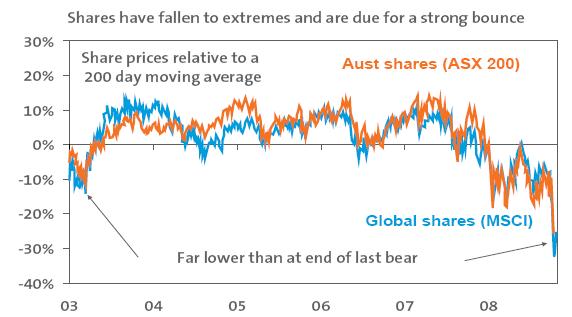

Secondly, shares remain very oversold and due for a further rally after their sharp slump since August. The recent collapse has taken them further below their trailing 200-day moving average than was the case at the end of the last bear market in 2003.

Source: Thomson Financial, AMP Capital Investors

Thirdly, measures of investor sentiment are also at bearish extremes indicative of investor capitulation, which is normally positive for shares from a contrarian perspective.

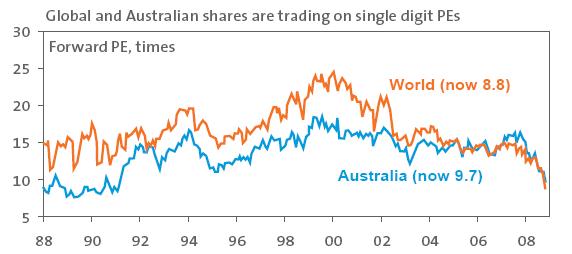

Fourthly, after top to bottom falls of over 40%, shares are now looking very cheap. Shares are now trading on single digit forward price to earnings ratios (PE). While profits will be weak over the year ahead, they are unlikely to fall as much as share markets are now factoring in.

Source: Thomson Financial, AMP Capital Investors

Finally, it’s worth noting that while October is often a volatile month, it’s usually not a negative month for the trend setting US share market. November and December are normally strong months from a seasonal perspective.

These considerations suggest that shares are great value from a long-term perspective and that there is potential for a further rebound in shares, as the risk of a complete financial meltdown recedes. However, beyond a short-term rebound, the road is likely to remain rough for a while as the deteriorating global growth outlook and efforts by households to reduce debt levels weigh on profits.

Implications for Australia

With global growth deteriorating rapidly and financial markets in disarray, the risk of Australia entering a recession over the next 12-months or so is high. There are five key avenues via which the global crisis will impact Australia.

- Reduced confidence in response to the ongoing negative news flow – this is already evident in low readings for both business and consumer confidence;

- The reduced availability of credit – credit growth is already slowing to a crawl;

- Slowing growth in China and Asia leading to reduced demand for our exports – this is already starting to become evident anecdotally in the case of demand for resources exports;

- Falling commodity prices leading to a fall in the terms of trade and hence a loss of national income; and

- The loss of wealth associated with the slump in share markets and softening house prices.

Against this, several considerations still suggest that Australia should fare better than the US, Europe and Japan and that any recession should be mild: the high level of the terms of trade is still providing a strong boost to national income; there is still a big pipeline of unfinished infrastructure projects; there is still plenty of scope to cut interest rates; the collapse in the A$ is providing an excellent buffer against the global slump; and fiscal policy is now being eased. In terms of the latter, the Government’s A$10.4 billion (or 1% of GDP) stimulus package is to be welcomed. Australia’s strong budget surpluses and zero public debt leave the nation in a strong position to provide further fiscal stimulus.

Nevertheless, it looks like growth over the year ahead could decline to 1%, with the possibility of negative growth in the December and March quarters and unemployment likely to rise above 6% over the next 12 months. The RBA is likely to cut the cash rate by another 0.5% by year-end and by mid next year it is likely to be around 4.5%.

Australian shares – Australian shares are now extremely cheap trading on a 9.7 times forward PE and nearly 40% below the level suggested by profits in the chart below. While profits are likely to fall in the year ahead, they are unlikely to fall 40%.

Source: Thomson Financial, AMP Capital Investors

This would suggest that while the ride will remain rough as the economic downturn continues to unfold, there is significant scope for the Australian share market to recover once the current global panic subsides.

The A$ – The A$ normally goes up during times of strong global growth and down when global growth is poor (like now). With global growth collapsing, the tide has gone out for the A$ in a cyclical sense. As such, further weakness cannot be ruled out over the next six months or so. Later next year though as global growth recovers, a resumption of A$ strength is likely.

House prices – Falling interest rates and increased first home buyer grants are great news for home owners and home buyers. However, over the next six months they are likely to be more than offset by the negative impact of rising unemployment. As such, with Australian house prices running about 20% overvalued, we remain of the view that house prices will fall by 10% or so over the year ahead.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

.JPG)