Extreme views capture markets

For the third time this year, world share markets have been swept up in a wave of negative sentiment, and prices once again have been pushed down to levels that appear too cheap to be justified based on normal fundamentals.

The Australian share market has been hit particularly hard, experiencing the most significant price falls since the 1987 crash. As at 2 July, the overall S&P ASX 200 Index had dropped 20% from the start of the year. This number, however, is masked by the strong performance of energy and mining stocks, which if removed, mean that the remainder of the market has dived 30% over this period.

A protracted recession?

Extreme market movements like those we are currently experiencing are often driven by extreme views about the likely future state. Currently there would appear to be at least 2 “extreme” views that have permutated across financial markets and generated significant negative sentiment.

Firstly, fears have been fuelled by a view that the global economy is about to enter some form of protracted recession, where a breakdown of the financial system brings growth in the real economy to a halt.

Although somewhat isolated from the worst of the undoubted problems in the United States (US) financial system, recent share price movements imply a belief that Australia will not be spared the full brunt of this recession. A 30% fall in industrial share prices from a “reasonable” base is only reconcilable with the view that real company earnings will weaken significantly due to some form of lengthy period of economic weakness.

The facts, however, do not support such a pessimistic view. Unemployment is running close to 30-year lows; annual retail sales growth at 6% is in line with its 10-year average; export receipts are 20% higher than they were a year ago; and the Government has been able to maintain a large financial surplus largely due to the health of company profits.

Admittedly, economic data is inherently backward looking, however the above data helps highlight the extent to which conditions would have to deteriorate before the Australian economy could be described as being in poor health. The majority of economic forecasters are still predicting a slowdown in growth, rather than a contraction, in the economy. For example, the Reserve Bank in its latest monetary policy statement confirmed that its “latest view assessment continues to be that demand growth will be moderate this year.”

A commodity bubble that won’t burst?

A second and increasingly dominant view that has been generating concern in financial markets is that commodity, and in particular, energy prices will continue to escalate in the near future to levels well beyond even today’s highs. This growth in commodity prices will lift inflation around the globe, forcing central banks in the US and Europe to abandon loose monetary policies and lift interest rates sharply. The magnitude of the higher inflation and interest rates will be such that there is considerable negative impact on corporate earnings and share prices.

There is little doubt that the commodity price growth we have already witnessed is already forcing inflation higher and placing pressure on global interest rate settings. However, economies around the globe have collectively been able to absorb the impact of substantial increases in commodity prices over the past 4 years. The likelihood of a “manageable” impact on inflation has been increased as the economic outlook has generally softened.

In addition, given slower growth in the world’s largest economies, there must be some doubt over the continued upward trajectory of commodity and energy prices. It is quite easy to put forward persuasive arguments, that ignore lower demand in the developed economies, and highlight the sheer size of populations in China and India to portray an ever increasing appetite for commodities and energy. However, these arguments don’t consider that price is a function of demand and supply, and ultimately heavily influenced by the cost of supply. The fact that China is becoming increasingly dominant as a buyer in commodity markets will increase its bargaining power and ability to drive prices closer to marginal cost – in much the same way the Japanese did in earlier decades.

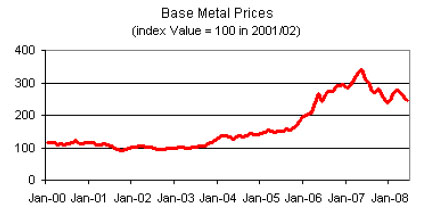

Source: Reserve Bank of Australia (in SDR currency equivalent)

We have already witnessed quite significant corrections in the price of several base metals. The chart above shows the movement in base metal prices as a group in recent years. Base metals (aluminium, nickel, copper, zinc, lead) are subject to similar demand and supply forces as other commodities and have fallen in price despite a heavy appetite from China.

Opportunities presented

Relative to expected company earnings, share prices in Australia today are the cheapest they have been for some 13 years. If negative sentiment has caused share markets to over react to various extreme or worst case scenarios, then there should be good buying opportunities for share market investors. A preparedness to focus on the long term, and weather further potential bouts of market negativity is no doubt required.

Investors may also consider skewing their share investments away from resources and energy stocks. The prospect of a correction in commodity prices places a higher risk on these sectors compared with industrial shares, where the most significant price falls have already occurred.