Super funds and negative returns

Key points:

- The slump in financial assets has led to negative returns for super funds. While disconcerting, occasional negative returns in superannuation funds are a normal part of the investment cycle.

- Reacting to the current turmoil by moving to cash will lock in losses and only lead to lower long term returns.

- The wisest approach is to have an appropriate long term investment strategy and to stick to it.

Introduction

The last financial year has been pretty bad for investors. Shares have had their worst financial year since 1981-82 and this has seen superannuation funds record sharp losses. The situation for investors is made worse by the uncertainty surrounding the outlook. I think the outlook for the next few months is messy, with oil now the key. However, I believe that shares have seen the bulk of the damage and should be back on to a sustainable rising trend by later this year as oil prices eventually fall back to earth and investors look forward to better conditions ahead. Moreover, they will start to take advantage of attractive share valuations. There are plenty of experts though who are saying that the bear market has only just begun. Given the uncertainty of the times it’s useful to put things into their historical context.

Equities and super

According to a recent survey, nine out of 10 Australians did not know that the fall in share markets over the last year will reduce the value of their super. The fall in super fund values should not come as a surprise though to those who have shown an interest in their super and have sought advice. The key driver of returns for an investment portfolio is the asset classes in which the funds are invested. The most common diversified funds have 70% of their funds invested in growth assets (most of which are shares and property). This also applies to many separately managed portfolios. The logic behind this allocation is that over the long term, growth assets provide higher returns than most other asset classes.

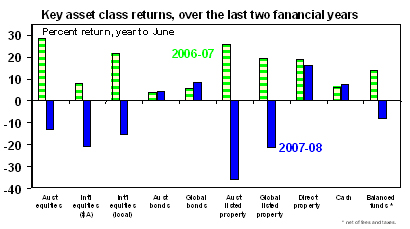

Over the last year shares have fallen sharply on the back of the sub-prime mortgage crisis in the US, the credit crunch and more recently the surge in oil prices. This saw global shares lose 21%, Australian shares lose 13% and Australian listed property trusts lose 36% over the year to June (see the next chart). The generally positive return in other assets has not been enough to offset these falls and so investment portfolios with a balanced growth bias have seen declines in value.

Source: Thomson Financial, Intech, AMP Capital Investors

Negative returns are not that unusual

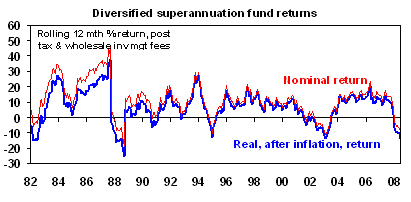

The most important thing to note is that periodic negative returns from a diversified mix of assets are normal. The next chart shows rolling annual returns for traditional balanced and growth funds provided by fund managers since 1982. The historical record indicates that diversified portfolios of assets (cash, bonds, property & equities) have negative returns every 6 years or so. The chart only relates to super funds provided by fund managers. This is because surveys including industry and corporate funds do not have a long history, but the results would be pretty similar. However, it’s likely that the greater exposure of industry funds to unlisted assets – which have so far been less affected by the turmoil in financial markets – would have seen them have lesser falls over the last year.

Source: Mercer Investment Consulting, Intech, AMP Capital Investors

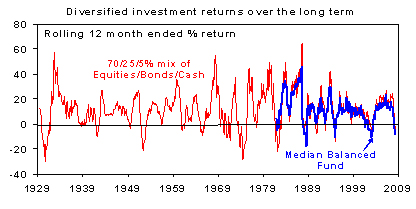

Since balanced funds only came into existence 30 years ago, the next chart shows a simulated balanced fund from 1929. This is constructed on the basis of 70% in Australian equities, 25% in Australian bonds and 5% in cash. The simulated series tracks the median balanced fund return pretty well, suggesting that it’s a good proxy. An investment in this mix of assets would have seen negative returns in 1929-31, 1938-39, 1941-42, 1949, 1952, 1956, 1960-61, 1964-65, 1970-71, 1972-74, 1981-82, 1987-88, 1990, 1994, 2001-03.

Source: Global Financial Data, Mercer Investment Consulting, AMP Capital Investors

It’s clear that a period of negative returns every few years is a normal event. In the midst of many of these periods it would have seemed like the “worst ever crisis”, but shares always recovered to resume their rising trend pushing returns back into positive territory. With shares and growth assets, periodic negative returns are the price we pay for the higher long term returns they provide.

Mean reversion

The next table shows a comparison of “balanced fund” returns over 2003 to 2007 to those over the long-term.

Super normal investment returns in recent times

| Period | Nominal, %pa | Real , %pa |

| 1901-200740/30/20/5 % mix of Aust equities, global equities, bonds and cash * | 9.4 | 5.5 |

| Dec 1982 – Dec 2007Median balanced and growth fund # | 11.9 | 7.8 |

| June 2003 – June 2007Median balanced and growth fund # | 14.5 | 12.2 |

* Individual sector returns from E Dimson, P Marsh, M Staunton, Global Investment Returns Yearbook, 2008 and Triumph of the Optimists, 101 Years of Global Investment Returns, Princeton University Press, 2002.

# Mercer Investment Consulting Pooled Fund Survey, pre taxes and fees

Between June 2003 and June 2007, the median balanced fund had a real return over 12% pa, whereas the long term average return above inflation since 1901 was just 5.5%. In other words the average balanced superannuation fund in the 2003 to 2007 period experienced both nominal and real rates of return well above what may have reasonably been expected on the basis of asset class returns over the past century as a whole. While the average super investor may have lost a nominal 6% to 8% or so over the last year, the last five years have seen their superannuation savings grow by around 57%.

Switching to cash will likely reduce long-term returns

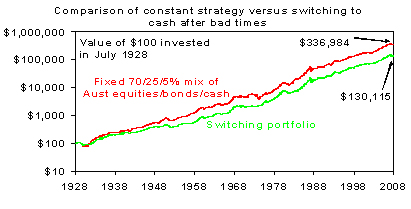

After a loss, it’s tempting to switch to a more conservative strategy. But, this will just lock in the loss and will invariably result in lower long term returns. The following chart shows the cumulative return to two portfolios since July 1928:

- a fixed balanced mix of 70% Australian equities, 25% bonds and 5% cash;

- a portfolio which starts off with the above mix but which moves 100 per cent into cash after any negative financial year and doesn't move back until after the balanced portfolio generates one financial year of positive returns (assuming an investor who switches to cash after a down year will require a year of positive returns to get confident again). We have assumed a two-month lag. This is called the “switching portfolio”.

Source: Global Financial Data, AMP Capital Investors

The switching strategy does produce better short term results when there were two consecutive financial years of negative returns from the fixed balanced mix as in the early 1930s, mid 1970s and earlier this decade. However, over the long run it produces an average return of 9.4% pa versus 10.7% pa for the balanced fund. This compares to returns of 5.4% pa for cash, 6.9% pa for bonds and 12.0% pa for equities. On a $100 investment in 1928 the switching portfolio would have grown to $130,115 by June 2008 compared to $336,984 for the constant balanced mix. The conclusion is clear – switching to cash after a bad year is not the best strategy for maximising wealth over time.

Psychology through the cycle and long term investing

I recently read a story about how “100 is the new 80”; Australians are now living longer and it is becoming increasingly normal to spend 20 years in retirement. But this means that both superannuation members and retirees need to maintain a decent exposure to shares and other growth assets or else risk not being able to meet their lifestyle expectations through retirement.

This means that superannuation and investments in growth assets generally have to be seen as a long term proposition. Having all of one’s savings in cash may make for a good night’s sleep at times, but given its lower long term return potential it’s unlikely to provide enough for a decent retirement. Yes returns on cash are now quite high but they are unlikely to be sustained as the slowdown in Australia’s economic growth suggests that interest rates may be cut.

One of the key ingredients for successful investing is for an investor to be aware of how their psychology is being affected by movements in investment markets. Typically, investors tend to be “despondent” after a period of strong falls in the value of their investments. This results in selling or “capitulating” at the bottom of the investment cycle when in reality the opportunities for capital gain are at their greatest. Given the difficulties in timing though, for most investors the best approach is to adopt an appropriate long term investment strategy and to stick to it.

Conclusion

No one likes to see their investments fall in value. That includes me. But occasional bouts of negative returns are the price we have to pay for the higher returns that growth assets provide over time. Switching to cash may make sleeping at night easier when markets are falling, but it’s likely to ensure lower long term returns. The key is to adopt an appropriate long term strategy and stick to it.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors