The “Lehman” effect

In early June, the New York based investment bank, Lehman Brothers Holdings, confirmed that it was expecting a loss of US$2.8 billion for the second quarter of 2008. Concerns over the plight of Lehman Brothers, and the potential that other financial institutions are yet to make similar announcements, have exacerbated the recent weakness on world share markets already staggering due to record high oil prices.

Financial stocks follow the leader

Upon learning of Lehman Brothers’ difficulties, the finance sector in the United States (US) was sold down heavily, and in the first 9 days of June has lost around 8% of its value. Somewhat predictably, the finance sector in Australia has subsequently led its market lower and has contracted by 6% over the same period.

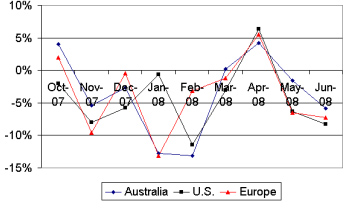

Although the fundamental profit drivers are quite different, the extent to which share price movements in the financial sector across the globe have been synchronised has been an important feature of equity markets in recent times. The chart below shows the monthly movements in finance sector share prices in Australia, the US and Europe over the past 9 months.

Finance sector share price movements

Source: Share Price Index of S&P ASX 200, S&P EUR 350, S&P 500. Australian data excludes A-REITs. June data current as at 9 June (Europe & U.S.) and 10 June (Aust).

Since the beginning of January this year, the finance sector has fallen 27% in Australia, 22% in the US and 24% in Europe. In all 3 markets, the finance sector has been the worst performing industry.

The extent of the synchronisation in global finance sector share prices has been greater than that existing in other sectors of the equity market.

Implicit in this pattern of price movement is an element of the “lemming effect” , whereby one market blindly follows another market in the absence of any real or understood rationale. Perhaps it has been the common factor of fear of unknown future finance sector losses that has driven this behaviour.

Fundamental differences

Although the fallout of the sub-prime loan crisis has systematically revised the earnings risk profile of banks and other finance sector companies around the globe, there are important differences in regional markets that need to be assessed when determining fair share price value.

In very general terms, it would appear that earnings prospects of financial institutions in Australia have been far less impacted by recent turmoil than those institutions domiciled in the US Mortgage defaults. The decline in the price of property used to secure these mortgages is a problem of a far greater scale in the US than in Australia – as is the exposure to complex financial instruments that have been used to fund these mortgages.

Although Australian financial institutions have had to cope with a moderate rise in interest rates and funding costs this year, they appear to have successfully been able to retain their profit margins by passing on higher funding costs to borrowers. Admittedly, Australian institutions will be impacted by the slowing domestic economy, which will stunt new business and lending growth. However, as share prices effectively represent the present value of all future earnings, the impact of a short term softening in profit on share prices should not be exaggerated.

In fact, it could be argued that the longer-term strategic position of Australian banks has improved in recent months. Significant competitors involved in the mortgage origination process have either ceased operating or have become significantly less of a threat as their funding costs have increased by more than the banking sector’s. In addition, the proposed takeover of St.George by Westpac is not only a demonstration of the balance sheet strength of the major banks. It may lead to the effective removal of the largest competitor to the major 4, further entrenching the strategic positioning of the incumbent institutions.

Opportunities for investors

If Australia’s financial sector has been sold down due to factors not directly related to its own earnings prospects, then the sector should represent an attractive proposition for investors. Certainly, the sector’s prospective dividend yields for 2009 of over 7% (plus franking credits) look appealing. Providing earnings hold up, this unusually high yield should ultimately generate buying support for the sector.

With the fortunes of Australia’s resource and energy shares closely tied to volatile global commodity markets, the financial sector (which accounts for around 30% of the Australian share market), is now well positioned and priced to take on a more traditional defensive role within an Australian share portfolio.

Brad Matthews, Hillross Economist

[1] Lemmings are rodents that are known to follow one another, regardless of any impending dangers