Rising risk of a US recession – time for caution

Key points

- A US recession is now a 50/50 call.

- While we think the cyclical bull market in shares has further to run, risk has increased and suggests a more cautious stance is warranted over the next six months.

Introduction

Due to poor economic data and the oil price briefly breaking US$100 a barrel, the US share market has had its worst start to the year since 1904, sending reverberations through global shares. For the last five years I have been optimistic on the outlook for shares. It has been right to buy into corrections and give the bull market the benefit of the doubt. However, while I am still not convinced that we have entered a bear market in shares, the growing storm clouds hanging over the US economy and the behaviour of equity markets over the last few months indicate it would be wise to be cautious for the next six months or so.

Rising risk of a US recession

We are of the view that whilst the risk of a US recession is high at around 40%, the US economy should ultimately muddle though with 1-2% growth this year helped by a strong corporate sector, rapid action by the US Federal Reserve (Fed) and a strong contribution to growth from trade. Recent economic data releases call this into question. The US housing market remains in free fall, but more significantly:

- The Institute of Supply Management (ISM) survey of manufacturers has fallen to its lowest level since 2003;

- Durable goods orders (which provide a guide to US capital spending) are weak;

- The US labour market is starting to slow;

- Various reports suggest that holiday retail sales growth has been the weakest since 2002.

In other words, there is increasing evidence that the US downturn is spreading from the housing sector. What’s more, the latest surge in energy prices has only added to pressure on the US consumer and inflation worries have arguably slowed the Fed in cutting interest rates. These considerations suggest that it is now a 50/50 call as to whether the US will go into recession or not.

The rest of the world

So far the rest of the world has held up reasonably well, helped by the US housing sector not being import intensive. However, there is increasing evidence that the US downturn is starting to affect growth elsewhere:

- Business confidence is falling in Europe and Japan;

- Leading indicators in Japan are running at levels consistent with recession;

- Exports are slowing in many countries, including China;

- Reflecting this, the Baltic shipping freight rate index has declined about 21% from its high in October last year.

So while the rest of the world is in better shape than the US (particularly Asia and emerging markets), it is slowing down as well. A broadening in the US downturn from housing to the more import intensive consumer and capital spending sectors only adds to the risks.

How vulnerable is Australia to a US recession?

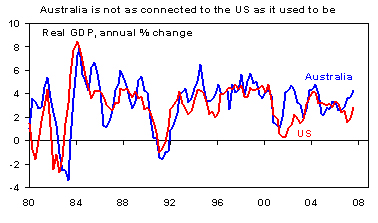

It used to be said that “whenever the US got a cold, Australia got the flu.” This is reflected in the close relationship between US and Australian gross domestic product (GDP) into the 1990s.

Source: Thomson Financial, AMP Capital Investors

Several factors have made the Australian economy less sensitive to the US economic cycle of late. These include: a reduction in the importance of the US as an export destination in favour of strong growth in Asia (the US takes just 6.4% of our goods exports); the floating Australian dollar (A$); better economic management; and a lack of exposure to information technology. Additionally, mortgage delinquency rates in Australia remain very low; Australia has a shortage of housing in contrast to the oversupply in the US; and there is a long pipeline of mining and infrastructure investment projects yet to complete. It’s also worth noting that sub-prime mortgages only constitute 1% of the Australian mortgage market versus 14% in the US.

However, Australia is not immune to the US downturn. A US recession could push growth in Australia down to around 2% in 2008-09 if it leads to substantially slower growth in China and Asia (due to a large chunk of our raw materials exported to Asia getting re-exported to the US), and also via the negative impact on local investor and economic sentiment.

Shares and US recessions

Given the high risk of a US recession, it’s worth being aware of what it could mean for shares. Recessions are normally bad for shares, as profits slump undermining valuations. Every US recession since 1960 has been associated with a sharp fall in US shares. The average decline has been 30%, spread over an average 15 months.

US recessions are invariably bad for shares

|

US recessions* |

Associated fall in US shares | |||

|

Period |

Mths |

Period |

Mths |

% Fall |

|

Apr 60-Feb 61 |

10 |

Aug 59-Oct 60 |

14 |

-13.9 |

|

Dec 69-Nov 70 |

11 |

May 69-May 70 |

12 |

-34.7 |

|

Nov 73-Mar 75 |

16 |

Jan 73-Oct 74 |

21 |

-48.2 |

|

Jan 80-Jul 80 |

6 |

Feb 80-Mar 80 |

2 |

-17.1 |

|

Jul 81-Nov 82 |

16 |

Nov 80-Aug 82 |

21 |

-27.1 |

|

Jul 90-Mar 91 |

8 |

Jul 90-Oct 90 |

4 |

-19.9 |

|

Mar 01-Nov 01 |

8 |

Mar 00-Oct 02 |

31 |

-49.1 |

|

Average |

11 |

|

15 |

-30.0 |

*As defined by the National Bureau of Economic Research in the US. Source: Thomson Financial, AMP Capital Investors

Australian shares have had a bad run through past US recessions, with an average decline of 33.8%.

US recessions and Australian shares

|

US recessions* |

Associated fall in Australian shares | |||

|

Period |

Mths |

Period |

Mths |

% Fall |

|

Apr 60-Feb 61 |

10 |

Sep 60-Nov 60 |

2 |

-23.2 |

|

Dec 69-Nov 70 |

11 |

Jan 70-Nov 71 |

22 |

-39.0 |

|

Nov 73-Mar 75 |

16 |

Jan 73-Sep 74 |

20 |

-59.3 |

|

Jan 80-Jul 80 |

6 |

Feb 80-Mar 80 |

2 |

-20.2 |

|

Jul 81-Nov 82 |

16 |

Nov 80-Jul 82 |

32 |

-40.6 |

|

Jul 90-Mar 91 |

8 |

Aug 89-Jan 91 |

15 |

-32.4 |

|

Mar 01-Nov 01 |

8 |

Mar 02-Mar 03 |

12 |

-22.3 |

|

Average |

11 |

|

15 |

-33.8 |

*As defined by the National Bureau of Economic Research in the US. Source: Thomson Financial, AMP Capital Investors

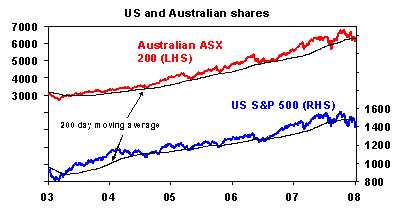

November, December and January are normally strong months for shares and the falls in shares in November and December 2007 and the slump so far this year does not provide a lot of confidence. Similarly, there are signs that the rising trend in US shares since 2003 is breaking down, with the S&P 500 starting to trace out a pattern of lower highs and lower lows and the 200 day moving average, (which provides a good guide to the trend) starting to stall.

Source: Bloomberg, AMP Capital Investors

Fortunately, Australian shares are looking healthier with a pattern of rising highs and lows and its 200 hundred day moving average still on the rise. However, on a short-term basis they do take their lead from the US.

Nevertheless, there are several points to note about this.

- Firstly, shares in the US, Australia and elsewhere have already had 10% plus falls from their recent highs.

- While the risk of recession is high there is still a good chance the US economy will muddle through or if it does go into recession it is likely to be relatively mild. The US is notJapan in the 1990s which found itself in a deep malaise because the Bank of Japan took too long to start easing monetary policy and it was suffering from the aftermath of a bubble in most asset classes – shares, housing and non-residential property. By contrast, the Fed has moved quickly to start cutting rates and the US only has to contend with the aftermath of a bubble in housing. Moreover, there has not been an overinvestment in business capital that needs to be unwound, as is the case prior to most recessions.

- If the US avoids recession or if it is mild, then any weakness in earnings should be limited and lower interest rates should enable shares to push higher through the year, by allowing higher price to earnings ratio (PE) multiples.

- Finally, we have not seen the conditions that normally precede share bear markets. Shares have not become overvalued, monetary tightening has not been excessive and share market investors have not become overly exuberant. In terms of valuations it’s worth noting both US and Australian shares offer an earnings yield above the bond yield.

Share market valuations are more favourable today

|

US share peak |

US earnings yield* less bond yield, % |

Australian share peak |

Aust earnings yield* less bond yield, % |

|

Feb 1980 |

+0.6 |

Feb 1980 |

+0.4 |

|

Nov 1980 |

-2.0 |

Nov 1980 |

-3.1 |

|

Jul 1990 |

-2.3 |

Aug 1989 |

-5.1 |

|

Mar 2000 |

-2.8 |

Mar 2002 |

-2.7 |

|

Now |

+2.0 |

Now |

+0.2 |

* Uses historic earnings. Source: Thomson Financial, AMP Capital Investors

For these reasons we don’t think the cyclical bull market in shares is over - we anticipate higher shares by year end.

What should investors do?

In the very short-term, shares are oversold and due for a bounce with anticipation of further Fed easing and possible talk of US fiscal stimulus later this month providing a possible driver. However, notwithstanding short-term gyrations, given the uncertainty hanging over the US economy, the risk of further sharp declines in shares is clearly high. As such, it’s wise for investors to be a bit more cautious than normal over the next six months. For Australian shares a retest of the August low of just below 5500 is possible if the US share market continues to decline. While we have been happy to buy into dips and give shares the benefit of the doubt over the last five years, we will now be more aggressive sellers of rallies, unless the US share market proves itself on the upside. It also means that investors should try and have a more defensive portfolio – with sectors such as telecommunications and consumer staples worth looking at. Resources and banks should provide good value on dips.

For long-term investors it’s best to just ride it through as we don’t see this as the start of a major bear market. Betting against the US consumer continuing to consume for an extended length of time is a dangerous bet.

Finally, for those looking for another reason to be optimistic about 2008 beyond all the short-term uncertainty, the number eight is considered lucky by Chinese. In Australia, years ending in eight have been up 10 times out of 12 since 1880 (excluding 1938 and 1948).

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors