Australia’s new Government – implications for investors

Key points

- Broad macroeconomic policy is unlikely to change under the new Australian Labor Government, so the outlook for the economy and Australian investment markets will be little changed. Any near term uncertainty in investment markets associated with the change of Government is likely to be short lived.

- Share market sectors that may benefit include construction, building materials, renewable energy stocks, telecommunications (telcos), child care, asset managers and retailers.

The polls got it right

After eleven years the political pendulum has swung back to the Australian Labor Party (ALP). This party has run on a campaign of economic conservatism, a wind back of recent industrial relations reforms, faster action on climate change, a high speed broadband network, action to improve housing affordability, national health and hospitals reform, improving skills and access to computers at schools, and a staged withdrawal of Australian combat troops from Iraq.

Minimal macro impact from change in Government

There is little reason to expect that the change in government will significantly alter the outlook for the Australian economy or investment markets. It has been a phenomenon of developed countries in the last two decades that once in government, political parties adopt sensible macro economic policies if they wish to deliver rising living standards to their constituents and therefore aim to be in office beyond one term. This has been particularly the case in recent decades after the failure of the huge ramp up in welfare spending funded by budget deficits, the onerous top marginal tax rates of the 1960s and 1970s and as it has become obvious that allowing a little extra inflation as a way of reducing unemployment simply does not work.

The Labor Party’s election campaign policies indicate that macroeconomic policy will be little different to the generally pragmatic and sensible approach of the previous Coalition Government. The Labor Party is committed to; an open and competitive economy; the Reserve Bank of Australia (RBA) remaining independent and continuing to target 2-3% inflation; and to maintaining budget surpluses of around 1% of gross domestic product (GDP) when the economy is recording reasonable growth. Like the Coalition, big income tax cuts were the centrepiece of the ALP’s election promises, but its total spending promises since the last Budget were more than A$15 billion less (over four years) than those of the Coalition. Given the upwards pressure on inflation and interest rates coming from the strong economy, it’s also possible that on advice from Treasury and the RBA, the new Government may decide to find extra savings to help reduce the size of the net fiscal stimulus over the next few years in order to minimise the pressure on interest rates.

The only area of significant policy difference with the potential to affect the macroeconomic outlook relates to industrial relations. The ALP is committed to rolling back parts of Work Choices and abolishing Australian Workplace Agreements (AWAs – or individual contracts). The fear is that this will contribute to higher wages growth given the tight labour market. However, assuming the changes even pass through the Senate, the economic impact is likely to be less than some fear:

- Firstly, it is not clear how important Work Choices has been in ensuring benign wages growth in recent times. The decentralised wage setting system, increased global competition, increased immigration and tax cuts dampening pay demands may have been the key drivers.

- Secondly, ALP industrial relations policy is seeking to maintain labour market flexibility. It is not proposing a return to the centralised system of the past.

- Thirdly, only about 10% of the workforce is on AWAs. Many of these are in the mining industry earning more than A$100,000 per annum (pa), and are simply likely to switch across to common law contracts.

- Finally, there will be a lengthy transition period as existing AWA’s will take time (up to five years) to expire.

As such, it is doubtful that the rolling back of Work Choices will result in a wages breakout.

What does history tell us?

History also provides little reason to think the change of government will have much impact on the Australian investment outlook. Over the period since 1945, the average return from Australian shares under Coalition and Labor governments has not differed all that much. Due to the current global bull market, the average return under the Coalition of 13.5% pa has edged ahead of that under Labor governments of 12.7% pa. However, there is not much in it.

While the more ideological and less economically rational Whitlam Labor government (1972-75) was associated with tough economic times and shares lost an average 5.8% pa, the economically rational Hawke/Keating Labor period (1983-1996) saw very strong share market gains with an average return of +17.3% pa. In any case, the bear market during the Whitlam period was part of a global malaise.

It is also worth noting that while real gross domestic product (GDP) growth averaged 3.6% pa under the Coalition from 1996, it also averaged 3.6% under Hawke and Keating. While inflation has averaged 2.5% under the Coalition from 1996 compared to 5.2% under Hawke and Keating, it averaged 10.3% pa under the Fraser led Coalition government of 1975 to 1983. Also, the 2 to 3% inflation target was actually introduced under the Keating Labor government in 1993.

Shares and the Australian dollar (A$) around elections

None of this is to deny that investment markets may undergo a bit of uncertainty as the new Government settles in. In particular, foreign investors who constitute a third of the market may be less well informed. However, the absence of any major changes in macroeconomic policy suggests that any near term uncertainty will be short lived.

The behaviour of the share market and the A$ around elections is somewhat ambiguous. The next chart shows Australian share prices from one year before till six months after Federal elections since 1983. This is shown as an average for all elections (but excluding 1987 given the global share crash three months after the election), and the periods around the 1983 election, which saw a change of government to Labor, and the 1996 election, which saw a change of government to the Coalition.

Interestingly, there is some evidence that shares track sideways in the run-up to elections and then pick-up thereafter. However, the two episodes in the last 25 years where there was a change of government show surprising results. Soon after Labor’s victory in 1983 shares took off, probably reflecting the global recovery at the time, but after the Coalition’s 1996 victory shares just range traded.

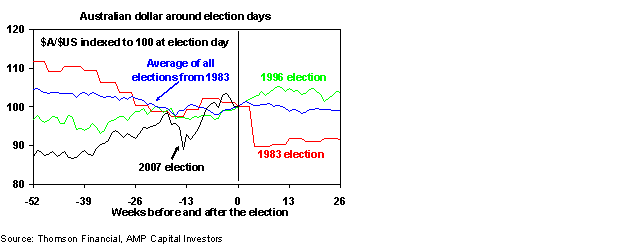

The next chart shows the same analysis for the Australian dollar. In the six months or so prior to Federal elections there is some evidence that the A$ experiences a period of choppiness which is consistent with uncertainty about the policy outlook. However, the magnitude of change is small (just a few percent) and in any case on average the A$ has drifted sideways to down after elections. This may simply reflect the fact that the broad trend for the A$ over most of the period since 1983 was down. While the A$ fell soon after the 1983 Labor victory this was a policy devaluation in the dying days of the fixed exchange rate system.

Throughout the election campaign both the Australian share market and the Australian dollar largely ignored the election with gyrations in the US and global share markets being the key driver. This is likely to remain the case now that the election is out of the way.

Expect more action at the sector level

Our broad assessment is that a Labor government won’t alter the overall outlook for the share market. However, there is more potential for a sectoral impact. Sectors and shares which might be positively affected by a Labor government could include:

- construction - via increased infrastructure spending;

- building materials – via policies to improve housing affordability, although the impact is likely to be small as most policies are focused on demand, not supply;

- renewable energy stocks – via a more aggressive renewable energy target;

- telcos – via the proposed high speed broadband network;

- child care – via increased child care funding;

- asset managers – if the superannuation guarantee is increased to 12 or 15%;

- retailers – via tax cuts, but this would have occurred under the Coalition as well.

Sectors that may be negatively affected include:

- miners and most sectors – on the back of a windback of Work Choices. However, as noted earlier the impact is likely to be minimal;

- energy utilities, transport stocks and heavy power users – via more aggressive action on climate change via carbon trading.

Conclusion

Broad macroeconomic policy in Australia is unlikely to change under the new Labor Government, so the longer term outlook for the economy and Australian investment markets will be little changed. Any near term uncertainty in markets associated with the change of Government is likely to be short lived. The key policy impact of the change of Government is more likely to be felt at the sectoral level in the share market.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors