Feature Article Higher Inflation is no surprise

Higher inflation is no surprise

The combination of low unemployment and low inflation that Australia has enjoyed for most of the past decade is an economic state that all policy makers aspire to; yet it is a state that economic theory suggests should be particularly rare and difficult to achieve.

The Phillips Curve Theory

One of the better known economic theories, described as the “Phillip’s Curve” relationship, deals specifically with the trade-off between inflation and unemployment. The theory developed by A.W. Phillips (who was born in New Zealand and was Chair of Economics at the Australian National University), suggests that the objectives of low unemployment and low inflation may be inconsistent. This could be because when unemployment is low, demand is typically strong and labour is in short supply; placing both demand and supply (via wage costs) pressures on inflation. This implies that there is an inverse relationship between the two variables, as depicted by the “Phillips Curve.”

Does the theory hold?

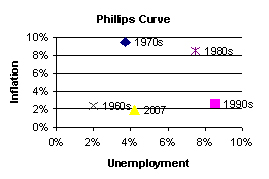

Like most economic theories, actual experience doesn’t always deliver the outcomes that prove the theory correct. The chart below compares the average unemployment and inflation rates of recent decades.

Source: Australian Bureau of Statistics & Hillross

It can be seen from the chart, that the outcomes for the 1970s, 1980s and 1990s do roughly depict some form of trade-off between inflation and unemployment. The 1970s was a period of very high inflation with relatively low unemployment; the 1990s had low inflation but high unemployment; and the 1980s were somewhere in the middle of this trade-off.

However the current period, like the 1960s, doesn’t support the Phillips Curve theory as low inflation and low unemployment have been simultaneously achieved.

One factor that is no doubt contributing to the current dual inflation and unemployment achievement is the influence of low global inflation. With the cost of imports being held down

by a strong dollar and the increasing dominance of cheap manufacturers like China, there has been an external influence on our economic system that has pushed inflation down to levels lower than would have otherwise been achieved.

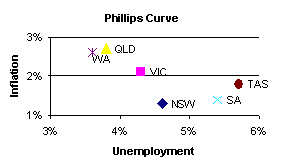

Whilst changes in the economic landscape, such as the impact of global inflation, may make the Phillip’s Curve relationship unstable over time, this does not mean the theory has no relevance. One example of where the Phillip’s Curve relationship holds quite tightly is in explaining the relative position of the Australian States in relation to inflation and unemployment.

Source: Australian Bureau of Statistics & Hillross

As shown on the chart above, those states with the highest rates of inflation also currently have the lowest rates of unemployment. Hence, whilst potentially unstable over time, the Phillips Curve relationship may still have strong relevance in explaining contemporary economic patterns.

Implications of the theory for investors

The Phillip’s Curve predicts that the current 30-year low unemployment rate of 4.2% should be accompanied by rising inflationary pressure.

Whilst this pressure may have been absent for some time, there are now clearer signs that prices and costs within the economy are trending up. As a result, interest rates are being forced higher. Rising interest rates will lead to a decrease in price of fixed interest investments and will typically be a negative influence on equity and property investment values.

Hence, one of the reasons investment markets have been so buoyant in recent years is because the economy has been able to expand strongly without the constraint of higher inflation and interest rates. To the extent that the Phillip’s Curve relationship holds true, investors should be mindful that this economic scenario will not last indefinitely - suggesting the economy, and investment returns generally, may return to more normal patterns.