China’s economy, share market and the world

China’s economy, share market and the world

Key points

Introduction

China is now the biggest contributor to global growth and its share market is the world’s fourth largest. China’s rapid growth has produced considerable scepticism about its sustainability. This note examines the key issues.

China remains on track for strong long term growth

China is being propelled by very strong structural forces that have decades to run. These include:

- Strong productivity growth – due to privatisation, deregulation and the application of new technology.

- Rapid urbanisation – which is sustaining investment, contributing to productivity growth and keeping labour costs down via the supply of cheap labour. The argument that China has run out of cheap labour appears weak as its urbanisation rate is still only 40%.

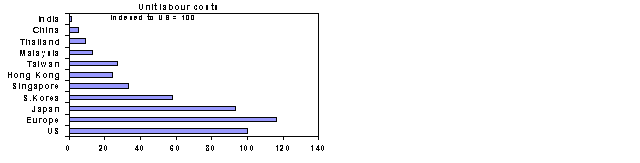

- Huge competitive advantages. These are built around low unit labour costs, scale advantages and good infrastructure. The average salary of manufacturing employees is 5% of US and European levels. Unit labour costs are a fraction of those in developed countries and manufacturing unit labour costs are falling despite rising wages.

Source: Citigroup, AMP Capital Investors

- Consumer demand – which is growing strongly and will be boosted by Government policy for the re-establishment of a social safety net. There are also plans to double the percentage of the workforce covered by pension plans and medical insurance to almost 70% by 2010. Consumer spending comes from a low base. For example, there are less than 20 cars for every 1000 people (this was the level in the US in 1918). This compares to about one car for every two people in Australia and the US. Living space per person in China is 10% of US and Australian levels.

- China’s rate of investment is likely to remain strong due to urbanisation, low levels of capital (relative to the population), strong profit growth, high level of retained earnings and policies to narrow the income gap between the eastern and inland provinces.

China’s per capita income remains far below that of rich nations and its rapid growth phase has decades to go. This means China’s export penetration into the consumer (and capital goods) markets of developed nations has much further to go, as does the resources boom.

Growth is very strong, but no sign of overheating

There is no doubt that Chinese economic growth, running above 11% so far this year, is a little too strong. As a result, we are likely to see more attempts to slow it down to between 9% and 10%. It is also true that monetary policy in China is unnecessarily stimulative – the one-year benchmark borrowing rate of 7.29% is extremely low relative to nominal gross domestic product (GDP) growth of around 15%. Keeping the Renminbi cheap is leading to economic distortions and adding to the difficulties of monetary management. Rapid growth is also creating social and environmental tensions. However, there are several points to note about all this.

First, the normal signs of overheating are not present.

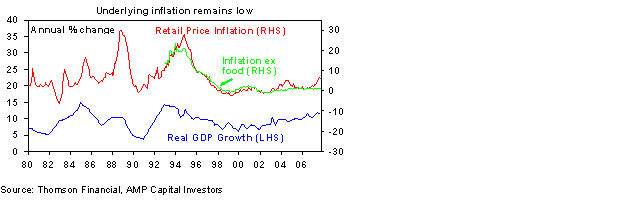

- Non-food inflation is just 1.1%.

- There are no major energy or transportation bottlenecks.

- The current account is in surplus, thus China is not reliant on foreign capital inflow.

- Property prices are rising strongly, however aggregate Chinese property prices have been rising at a slower pace than nominal GDP (which is running around 15%).

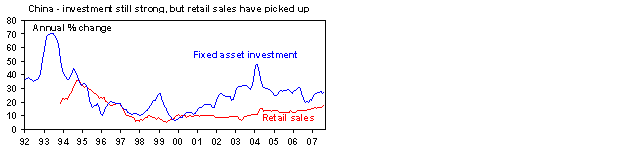

- Investment is running at 26% year-on-year, which remains too strong, however retail spending has been accelerating and recent strength in investment growth reflects strength in the inland provinces, both of which are targets of Government policy.

Source: Thomson Financial, AMP Capital Investors

These considerations suggest that while further measures are likely to slow growth down, there is no need to crunch it. Policy tightening is therefore likely to remain measured.

Second, while Chinese interest rates are low relative to nominal GDP growth, it should be remembered that China is not yet a fully developed laissez-faire economy. In most developed countries, interest rates are the key policy lever. However, China also actively uses a range of measures such as administrative controls, including restrictions on investment projects or pressuring banks to slow loan growth, as is the case now. In this regard, it should also be remembered that loan growth of 18% per annum is not strong relative to nominal GDP growth of 15%. Recently, loan growth in rich countries (including Australia) has been running at much higher levels, relative to GDP growth.

Third, while China may speed up the appreciation of the Renminbi, it is unlikely to go too fast given authorities’ fears that it could stifle exports and make it difficult to absorb rural workers. Their approach is likely to remain gradual.

Finally, China’s serious environmental problems and product standards concerns (product recall issues have ranged from toxic toothpaste to excessive lead in children’s toys) are arguably just part of a stage in the country’s economic development.

Will China withstand a US downturn?

The impact of the US downturn on China depends on how far the US economy slides. China is well placed to handle a slowdown in US growth to circa 1% to 2%, which is our base case. China’s export growth to the US has slowed and now amounts to only 19% of total exports. Conversely, exports to Europe (23%), Asia (47%) and other developing markets have been rising. Similarly, consumer exports to the US are declining in importance relative to capital goods. Of course, if the US experiences a hard landing, China will be much more vulnerable.

Is China still a force for global disinflation?

With US import prices from China starting to rise there has been much debate around whether China’s dampening impact on global inflation is over. Our assessment is that this is unlikely. Chinese wages are rising, but unit labour costs remain very low and are falling due to productivity gains. The rise in US import prices from China reflects both a fall in the US dollar against the Renminbi and better quality Chinese exports. The level of Chinese prices remains well below competitors, forcing export prices from the rest of Asia down. As China moves into higher value adding production, it will push prices down in these areas.

The Chinese share market

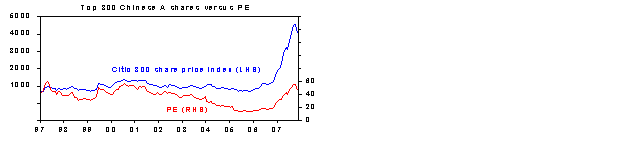

So far this year, the Citic/S&P index of the 300 largest Shanghai and Shenzhen listed companies is up 145% and has increased 477% over the last two years. This rate of increase is unsustainable. The last few weeks have seen Chinese shares embark on another correction, falling around 18%.

Several points are worth noting:

- Much of the rise since 2005 reflects a re-allocation away from bank deposits by individual Chinese investors. It does not reflect gearing into shares.

- Profit growth for listed companies over the last year has been a very strong 70% (or around 60% excluding share market related investment gains).

- The price earnings (PE) ratio for Chinese shares is high, however it is still far below the peak levels reached during previous share market bubbles. For example,

Nasdaq shares reached a PE of 160 in 2000.

Source: Thomson Financial. AMP Capital Investors

The regulatory restrictions on Chinese investors putting their money abroad means that the share market has been benefiting from a captive market. This is only likely to change gradually.

For a market that rises so rapidly, major corrections are inevitable and healthy so high volatility is expected. However, the longer-term trend is likely to remain up, reflecting China’s strong growth prospects, albeit more moderate.

What’s the risk of economic damage from shares?

A collapse in Chinese shares is unlikely to have a major economic impact. Over the last decade, China’s economy and share market have moved in different directions. The relationship between the Chinese share market and economy is loose because the equity market only accounts for 12% of capital raisings and only a small proportion of Chinese households have any significant share market exposure. Most shares are held by state authorities.

Conclusion

China’s economy and share market face risks and speed bumps that make for occasional volatility. However, there is no sign of a major disruption to China’s strong growth any time soon and the long-term outlook remains strong. This should be positive for Chinese shares as well as indirect plays such as commodities. The key risks are a US recession, a rise in non-food inflation and the adoption of tightening measures that are too heavy-handed.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

- China’s economy is running slightly faster than desired, so further tightening measures are expected.

- Investors should expect speed bumps, however there are no signs of major problems ahead. China’s long-term growth outlook remains very strong.