View from the Hill - Low wages growth – is it a pre-election mirage?

Low wages growth – is it a pre-election mirage?

Few, if any, forecasters would have predicted 10 years ago that the Australian economy would experience a “golden decade” of economic growth in which unemployment would fall to 30-year lows. Economic forecasters would have deemed even more unlikely that this scenario encountered very modest wages growth, despite acute labour shortages in a number of industries.

More surprising still, would have been the presence of growing industrial relations “peace” in an environment where there was a monumental shift in the relative share of national income going towards corporate profits. Remarkably, this lack of significant industrial action by workers was also maintained through Government reforms of the industrial relations system that led to the curtailing of the power of collective worker organisations.

A more believable forecast would have had the increased demand for labour producing a swing in bargaining power to workers, who then leveraged this power to demand higher wages. The ensuing rise in businesses costs, would then lead to higher inflation prompting the Reserve Bank to lift interest rates and slow the overall rate of economic growth. This course of events has been played out regularly over time in Australia.

Luckily for Australian corporations, and investors with shares in these corporations, it has been the former, more surprising, scenario that has played out over the past decade.

The election - a potential turning point

However, there must be some doubt as to the sustainability of this current scenario. The laws of supply and demand dictate that shortages in the supply of labour will ultimately lead to higher wages. It is possible, though, that these economic forces have been suppressed – at least temporarily. For example, the bargaining position of workers may have been impacted by changes in the industrial landscape. The acceleration in the globalisation of labour markets may have also tempered wages growth as offshoring to cheaper wage nations becomes a reality.

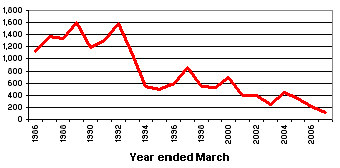

It is also possible that the trade union movement in Australia has been more focussed in recent times on the forthcoming Federal Government election than on bargaining for higher wages. For trade unions, the election represents an opportunity for a change in Government, and presumably then some change in the industrial relations system. Hence, rather than taking industrial action to secure higher wages in the lead up to the election, which may make trade unions and the labour party electorally unpopular, unions may be holding off taking significant industrial action to secure higher wages until after the election. This may explain the relative “industrial peace” implied by the chart below.

Working days lost in industrial disputes (‘000s per year)

Source: Australian Bureau of Statistics 6321

There is a danger for Australian corporations, therefore, that the industrial relations landscape will change following the election, regardless of who wins power. If the Government is returned, the focus of trade unions may switch towards taking leverage from the strong demand for labour in order to bring about higher wages growth. Alternatively, if the Opposition secures power, industrial relations law changes may provide unions with the additional scope to bargain on a collective basis and secure higher wages.

Implications for investors

As wages are the most significant operating cost for the majority of firms, any upward shift in the rate of wages growth will have negative implications for profit margins. With share price valuations already stretched and reliant on an assumption of continued net earnings growth, potential post election wage outcomes need to be considered by share investors as one of the key risks on the not too distant horizon. This risk may be more relevant for the large employer industries such as retailers and banks, and less relevant for the mining sector.

In addition to directly impacting company profitability and possibly share prices, higher wages growth may also have implications for the wider economy. To the extent that increased wages are passed on by business in the form of higher prices, a jump in wages can be expected to lead to higher inflation. In response, the Reserve Bank would normally raise interest rates to bring about a slowing in demand. Higher interest rates generally have negative implications for property investors and those with in long dated fixed interest investments.

Whilst post election wage outcomes are a risk to Australian share, property and fixed interest investors, there is some cause for optimism. Recent economic cycles have been characterised by sound economic management and responsible actions by workers. Providing the shift in the industrial relations landscape leads to moderate and not excessive wage outcomes, then there may well be sufficient momentum in company earnings and productivity growth to absorb any change - without negatively impacting investors. None-the-less, with the looming election being an Australian specific event, there is a heightened rationale for investors to diversify internationally.