The US Federal Reserve, investor confidence and volatility

The US Federal Reserve, investor confidence and volatility

Key points

- The US Federal Reserve’s (Fed) move to cut its discount rate has aided credit market stabilisation and caused a partial share market rebound.

- Credit markets remain dysfunctional, indicating that further easing is required by the Fed.

- Shares appear to have reached their lows, but will likely remain volatile over the coming weeks, ahead of a sustained fourth quarter rebound.

The Fed blinks

The Fed’s policy has reversed from inflation-focused to occupied with credit turmoil and risks to growth. The bank’s decision to cut its discount rate by 0.5% to 5.75% clearly acknowledged the risks to the economic outlook. The shift also raised expectations for a cut in the federal funds rate (the Fed’s targeted cash rate) at the bank’s next meeting. The Fed’s concern is warranted and, as recent history demonstrates, they could make a move at any time.

From sub-prime to high yield to short-term debt

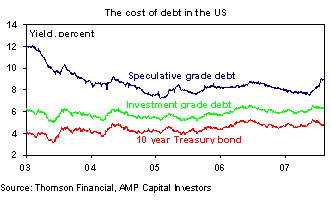

Credit market problems have developed in phases. The first involved sharp declines in the value of securities invested in sub-prime mortgages. By July, these declines spread to longer-dated corporate debt. Consequently, investment funds exposed to sub-prime losses were selling liquid corporate debt. The decline in government bond yields has now stabilised the cost of longer-term corporate debt.

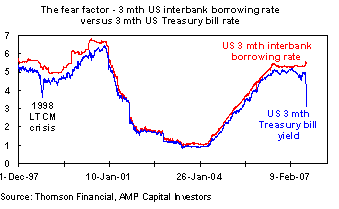

These credit woes then infected US and European interbank lending markets, which affected the supply of short-term corporate debt, such as asset-backed commercial paper (a debt instrument with a term of less than a year). In the US, half of these loans are asset-backed, rather than bank-guaranteed, and used to fund mortgages, car loans and the like. Loss of confidence among financial institutions has been the key driver of the sub-prime debt contagion that has affected short-term credit provision. The financial system can manage sub-prime losses, but the impact on institutions that are highly exposed to these losses may be considerable. The problem is – no one knows who is exposed. Consequently, institutions are concerned about what sub-prime skeletons may dwell in the cupboards of their counterparties. The lack of funding available for asset-backed commercial paper has seen lenders and investors pile into safe assets such as US Treasury bills. This has prompted a rise in the three-month US dollar (US$) interbank lending rate and a sharp decline in three-month US Treasury yields. Despite narrowing in recent days, the gap between these yields has expanded notably, and remains wider than that which existed after the 1998 LTCM collapse.

Many institutions are now finding it difficult to access the asset-backed commercial paper market, and this could potentially undermine day-to-day economic activity. Problems in the short-term corporate debt market suggest the Fed has more to do. The credit crunch that followed LTCM’s demise supports this argument, as it was only after the Fed cut interest rates twice in 1998 that credit markets normalised. Recent improvements appear to be predicated on the Fed reducing the federal funds rate. In fact, the Fed may have to make several cuts before credit markets normalise. Investors and lenders are very cautious, so the restoration of confidence and normal flow of short-term credit will therefore require greater borrower disclosure.

Shares and volatility

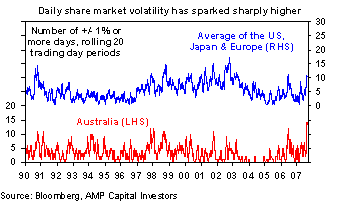

The Fed’s signal towards lower interest rates caused share markets to rebound strongly over the last week. After falling nearly 15% to their nadir last week, Australian shares bounced back to within 4% of their all-time high. Nonetheless, credit market problems and the likelihood of soft US economic data suggest share market volatility is likely to persist over the coming weeks. August has experienced massive share market volatility. Thirteen of the last 20 trading days saw the Australian share market move by 1% or more, the most volatile since 1990. As illustrated below, there has been a similar global spike in share volatility.

Subsequent to the stable 2004-05 period, this rise in share market volatility is part of a general trend of greater volatility, evident since early 2006. August’s extreme share market vacillation is likely to settle, but we have entered a more volatile period overall. This is consistent with higher corporate borrowing, softer profit growth and an increasing dependence on rising price-to-earnings (PE) multiples for share market gains.

Interest rates and the US share market

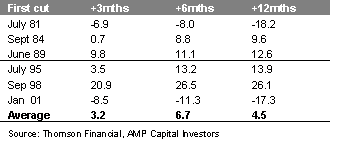

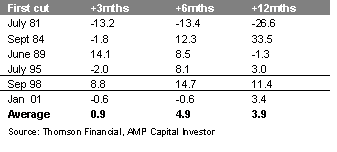

Beyond extreme short-term uncertainty and volatility, the shift to lower US interest rates should ground share markets and underwrite a December quarter rebound. Falling interest rates tend to be positive for shares as they facilitate profit growth and make shares relatively more attractive than cash. This is why they are usually associated with higher PE multiples. The table below shows US share market responses to the first rate cut after a major tightening cycle.

US equity performance (S&P 500), % change, months after first Fed cut following a major tightening cycle

In four of the Fed’s last six easing cycles, the US share market rose over the subsequent six to 12 month period. The only exceptions occurred in 1981 and 2001, during periods of recession and extreme share market overvaluation. Historically, Australian share market reaction has been similar, although this market was less exposed to the post-2000 tech bubble burst.

Australian equity performance (ASX 200), % change, months after first Fed rate cut

Hard landing or soft landing?

The key issue is whether the US economy will experience a hard or soft landing. The primary difference between bulls and bears centres on this very question. Our view remains that the US economy will avert recession because:

- the corporate sector is solid;

- consumer balance sheets are healthy;

- approximately 80% of US mortgages are at fixed rates, which should limit debt-servicing problems;

- the rest of the world is in good shape;

- the Fed is determined to avoid recession.

Overall, we are of the view that the US economy is in a classic mid-cycle slowdown, as seen in the mid 1980s and mid 1990s. Profit growth will likely slow, but profit levels will not collapse. A potential PE re-rating means Fed easing should be positive for shares.

Signs of a sustainable share rebound

One can be confident that the following events will signal that shares are reverting to a sustainable upswing:

- Fed easing policy;

- clear evidence of the passing of the credit crunch;

- a decent decline in bond yields;

- lower oil prices;

- greater confidence in the sustainability of US growth;

- seasonal timing (August to October is traditionally weak for share markets)

Bond yields and oil prices have declined, and the Fed is falling into place, however clearer evidence is still required on the other factors. Volatility will likely continue, but lower US interest rates and bond yields, normalisation of credit markets, attractive valuations and extremely bearish sentiment should see sustained upward movement of shares on a six to 12 month view. This should become apparent through the December quarter. The US share market’s positive lead should also benefit most markets, including Australian shares. Additionally, solid profit reporting results in Australia provide strong support for the local share market. This explains why it has rebounded more sharply than most global markets in recent days.

Conclusion

Credit markets are yet to return to normal, which suggests that further monetary easing in the US is required. Volatility will likely persist over the next few weeks, but a sustainable recovery is expected by year end.

Dr Shane Oliver

Chief Economist and Head of Investment Strategy

AMP Capital Investors