Market Update

Fear creates potential opportunities

When the sub-prime loan crisis in the United States (US) first hit the headlines, the word “contagion” was being used to describe the possibility that a relatively isolated event (ie increased delinquencies on a specific type of mortgages in the US) could generate instability across global financial markets.

The possibility of “contagion” has since become a reality. First we witnessed a general widening of credit spreads, which meant lenders were demanding higher interest rates or risk premiums to compensate for making loans in more uncertain times. Share markets then became nervous over the possibility that a tighter credit market would impact on lending volumes and therefore economic growth. This nervousness rose to fear in August when liquidity in money markets dried up as financial institutions held off lending to each other in the absence of any real certainty over how serious problems had become.

Despite central banks around the globe injecting liquidity back into money markets, fear has not been erased. Whilst there have been brief periods of market support, equity markets have moved lower in a series of large downward steps.

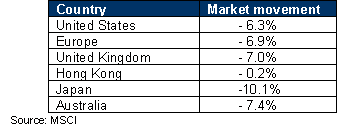

The table below shows the movement in global equity markets between the beginning of July and August 15:

In addition to the losses being generated on share markets, investors with exposure to credit markets may have also had a rough ride. An expansion in credit spreads will reduce the capital value of credit instruments and this has impacted on the position of some retail investment vehicles, particularly those which had large internal borrowings to leverage their position. Other more mainstream Australian investment funds in this sector have proved relatively resilient, but may face an extended period of increased volatility.

Has it gone too far?

It is often the case when fear takes hold of a market that prices correct too far and rebound relatively quickly. The fact that this current sell-off stems from credit and liquidity issues, rather than change in the real economy, provides some support for the notion that the sell-off in equity markets has been over done. Corporate balance sheets around the globe are generally strong with low levels of debt. The great global growth catalyst, China, is also somewhat removed from the heart of the financial markets’ woes. In addition, the household sector in the developed world is generally enjoying low unemployment and relatively low interest rates.

The environment is therefore supportive of continued strong company earnings. With global share market prices far from excessive, a continued downward spiral in prices appears unlikely. As with any period of volatility, however, the precise turning point is near impossible to predict.

In the case of Australia, there may be cause for a little less optimism than should exist elsewhere. Over the course of the past month, the outlook for interest rates here has worsened whilst there has been some correction in commodity prices. Compared with overseas markets, the Australian share market has a very high concentration of banking and resource stocks, and the current environment is far from ideal for both these sectors.