The upcoming Australian election and investment markets

Key points

- The upcoming federal election has the potential to create short-term share market uncertainty, but with key macro economic policies of Coalition and Labor being broadly similar it’s hard to see a lasting impact.

- Historical records indicate largely similar share market gains under Coalition and Labor governments.

The looming federal election

Uncertainty associated with the potential for a change of government following the upcoming Australian federal election has the possibility to impact financial markets, notably shares. There are basically three ways elections may impact investment markets. Firstly, there may be an impact as a result of policy changes flowing from a change of government. Secondly, elections themselves engender a degree of uncertainty for investors regardless of any actual policy change. Finally, there is often thought to be a cycle in share markets associated with the political cycle.

Policy change and shares

History provides little reason to think the outcome of the election later this year will have a lasting impact on the share market. Over the period from 1945 to 2006, the average return from Australian shares under Coalition and Labor governments has not been very different. With the current global bull market, the average return under the Coalition has been 13.5% per annum (pa) edging ahead of that under Labor governments, of 12.7% pa.

Source: Thomson Financial and AMP Capital Investors

While the Whitlam Labor government was associated with tough economic times and shares lost an average of 5.8% pa, the Hawke/Keating period saw very strong share market gains with an average return of +17.3% pa. In any case, the bear market during the Whitlam period was part of a global malaise. It’s interesting to note that in the US, since 1945, shares have actually done better under Democrat presidents (returning an average of 15.1% pa) than under Republicans (11.6% pa), belying simplistic political notions.

On this basis, investors should not be too worried about a change in government. Once in government, political parties of either persuasion are usually forced to adopt sensible macro economic policies if they wish to deliver rising living standards to their constituents. Both the Coalition and Labor agree on the key macro fundamentals - the need to keep inflation down and the budget in good shape, and the benefit of free markets. The key policy impact of a change of government in Australia is more likely to be felt at the sector level than at the macro level.

But there is potential for uncertainty

However, elections can sometimes have a short-term impact on investment markets. This stems mainly from the fact that investors don’t like the uncertainty associated with the prospect of a change in government. The looming election offers scope for short-term investor uncertainty for several reasons. Firstly, opinion polls are still showing Labor ahead of the Coalition. Secondly, the challenger is relatively unknown. In Australia, investors may simply assume that a Coalition government is more market- friendly, favouring deregulation, privatisation and lower tax rates compared to Labor (even though it was Labor that kicked off de-regulation in the 1980s).

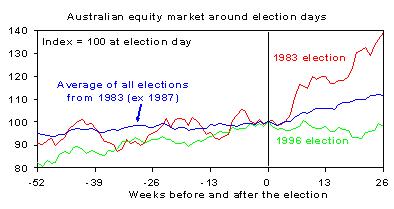

The next chart shows Australian share prices one year before until six months following Federal elections since 1983. This is shown as an average for all elections (except 1987 given the global share crash three months after the election), the periods around the 1983 election, which saw a change of government to Labor, and the 1996 election, which saw a change of government to the Coalition.

Source: Thomson Financial and AMP Capital Investors

There is some evidence of a period of softness in the run up to elections followed by a relief rally soon after. However, it is interesting to note the difference in share market performance following the 1983 poll when Labor won, compared to that following the 1996 poll when the Coalition won. Contrary to what might be regarded as conventional wisdom, the Labor victory of 1983 was soon followed by a surge in the share market, whereas the 1996 Coalition victory was followed by period of range trading. While more fundamental considerations drove this divergence, it highlights that it is not obvious which party is best for shares!

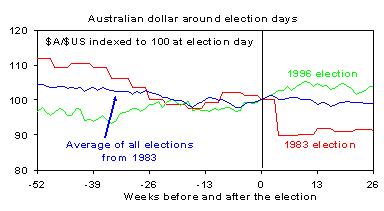

The next chart shows the same analysis for the Australian dollar (A$). In the six months or so prior to federal elections, there is some evidence that the A$ experiences a period of choppiness which is consistent with uncertainty about the policy outlook, but the magnitude of change is small – just a few percentage points. In any case on average the A$ has drifted sideways after elections. While the A$ fell soon after the 1983 Labor victory this was a policy devaluation in the dying days of the fixed exchange rate system.

Source: Thomson Financial, AMP Capital Investors

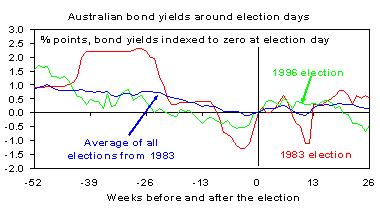

The next chart shows the same analysis for Australian bond yields. Interestingly, on average, bond yields have drifted down over the six months prior to Federal elections since 1983. The average decline has been around 0.75% which is contrary to what one might expect if there was investor uncertainty regarding the policy outlook. However, the tendency for bond yields to decline ahead of federal elections appears to be more related to the aftermath of recessions, growth slowdowns and/or falling inflation prior to the 1983, 1984, 1987 and 1993 elections and the secular decline in bond yields through the 1980s and 1990s in general. More broadly, it’s hard to discern any reliable affect on bond yields from Federal elections.

Source: Thomson Financial, AMP Capital Investors

The political cycle and shares

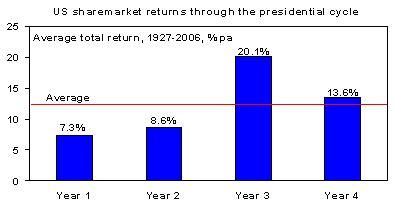

The best example of a political cycle impacting investment markets is that associated with the US presidential cycle. The US presidential election is held every four years in November and there is clear evidence that this affects the US share market. The chart below shows the average return since 1927 for US shares for each of the years within the four-year presidential cycle (where year four is the last year of the President’s term).

Source: Thomson Financial and AMP Capital Investors

It can be clearly seen that year three is the strongest as this is when the President stimulates the economy to aid his party’s election chances in year four. Years one and two are the weakest. We are now in year three of President Bush’s second term and the US presidential cycle suggests this year should be solid for US shares – so far so good – and this should be positive for global shares including the Australian share market.

In Australia there is no evidence of any regular share market cycle around federal elections because, unlike in the US, there is no regular election cycle in terms of timing.

Sector impacts

Our broad assessment is that a Labor government would have little lasting impact on aggregate share price levels overall. However, there is more potential for a significant sectoral impact. Sectors which might be affected by a Labor government include construction and building materials (via increased infrastructure spending), stocks exposed to education and training and fund managers (via policies to boost superannuation/national savings and contend with an ageing population). Faster action on climate change also has the potential to have a big impact on energy stocks and heavy power users.

Conclusion

While the Australian federal election may result in some short-term investor uncertainty particularly in the share market, our analysis suggests that if there is share price softness around the election this should provide a buying opportunity. Past experience, along with the more pragmatic and rational macro economic policy approach of both sides of politics these days, suggests little lasting impact on investment markets overall from elections whether there is a change of government or not. The key policy impact of a change of government is more likely to be felt at the sector level.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors