Australian versus global shares – time to go more global?

Key points

-

There is a theoretical case for Australians to have a higher allocation to global shares on a very long term view and the recent out performance by Australian shares and the loss of their valuation advantage has made the case for global shares a bit stronger.

-

On a three to five year view Australian shares still provide better return prospects than mainstream global shares due mainly to the China boom and higher dividends.

Introduction

Australian shares have dramatically outperformed global shares so far this decade – returning 14.2% per annum (pa) over the last seven years versus 1% pa from global shares in local currency terms. Once allowance is made for the rise in the A$, global shares have lost 2% pa over the past seven years. After such a strong run it is natural to wonder whether investors might be wise to allocate a greater portion of their savings to global shares. This note looks at the key issues.

The theoretical case to go global

Most Australian investors have a hefty bias towards Australian shares in their investment portfolios. This is evident in typical super funds which have a benchmark exposure of 35% in Australian shares compared to 25% in global shares. However, there is a strong case for Australians to have a higher international exposure.

1. Local shares are just 2.6% of the global share market.

2. Greater exposure to global equities and foreign currency provides diversification benefits (i.e. having more assets that do not move perfectly together can help reduce the volatility of an investor’s portfolio).

3. The Australian market is under represented in key sectors such as technology and over represented in others such as financials and materials.

4. A significant international exposure provides an offset to our high foreign liabilities and our high exposure to domestic assets via residential real estate.

5. The practical barriers to offshore investing are minimal.

6. Global shares offer more scope to “add value”.

These points can be used to argue that Australians should have 60-70% of their total equity exposure in global shares. But they are also well known. They were all the rage at the end of the 1990s after the huge relative out performance of global shares in the tech boom convinced many that global investing was the way to go. The trouble is that such arguments are somewhat theoretical. The benefits of global diversification are hard to explain when global shares lost 2% pa over the last seven years and Australian shares returned 14.2% pa. They are also rather long term arguments (i.e. ten years plus) whereas the investment horizon for most investors is only three years or so. It is also debatable whether the extra opportunities offered by global equity investing have ever been consistently realised by fund managers with similar or less value added relative to benchmark returns over time compared to Australian equity funds. For these reasons we have favoured taking a medium term (three to five year) view and on this basis have continued to favour Australian shares over the last few years. But is it time to move into line with theory and go more global?

The medium-term view is now more mixed, but still favours Australian shares

The case to go more global that is now being raised by many is far more practical and short term, provided the following.

- Australian shares are no longer good value compared to global shares because they no longer trade on a lower forward price to earnings ratio (PE) than global shares. See next chart.

-

The hefty out performance of Australian shares over the past few years is vulnerable to a reversal.

-

The huge cash flows into Australian shares from takeovers, super, etc, risk pushing them to overvalued extremes and the proceeds some investors will receive from takeovers provide an opportunity to invest globally.

-

The strong A$ makes global shares “cheaper”.

However, while these considerations have certainly strengthened the case for global shares our assessment remains that Australian shares are still better placed strategically.

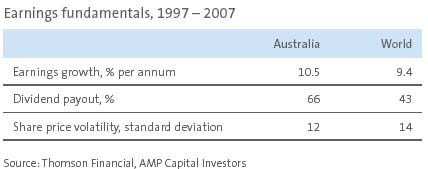

Firstly, the PE discount for Australian shares in the past reflected a combination of factors that are no longer relevant. These included: a perception that Australian shares were more volatile than global shares, post 1987 concerns about the quality of Australian companies, Australia’s past high inflation status and Australia missing out on the late 1990s IT bubble. None of these are now valid. In fact, over the past decade or so, Australian listed companies have generated better earnings growth than global shares, despite paying out a higher proportion of earnings as dividends and with lower risk. See table below.

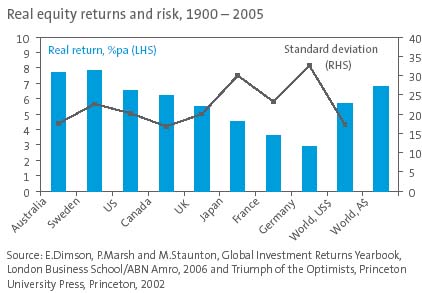

On this basis there is no reason why Australian shares should be trading on a PE discount. In fact, perhaps they should be trading on a premium. It is worth noting that despite Australian shares lacking the breadth and diversification of global shares, over the last century they have had better real returns with similar volatility. The next chart shows real returns since 1900 and standard deviations (a measure of volatility) for key share markets. In other words, there is no long term evidence of under performance on a risk return basis by Australian shares.

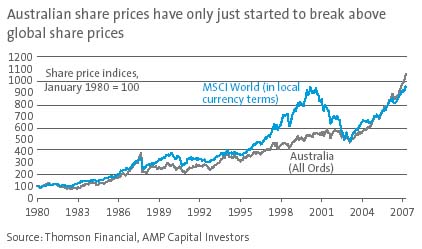

Secondly, while Australian shares have outperformed global shares so far this decade, until recently this was really just a catch up to their chronic underperformance through the 1990s. The next chart compares price indices in order to abstract from the out performance in Australian shares which has been due to higher dividend payments and the rising A$ which are separate issues.

It is only recently that the price index for Australian shares has broken out above that for global shares. With the China/India boom having a lot further to go the resources heavy Australian share market is likely to be in favour for some time to come. Similarly, if due to strong inflows and takeovers the demand for Australian shares is likely to exceed its supply over the next few years then it is probably a good market to be overweight in.

Thirdly, despite outperforming in recent years Australian shares pay a dividend yield, well above mainstream global shares. The average dividend yield on Australian shares is 3.6% versus 2.1% for global shares. While some argue the high dividend yield in Australia reflects a lack of growth opportunities, this is unlikely as Australia has a higher growth potential than the US, Europe or Japan (which dominate global equity portfolios). All the evidence suggests high dividend yields augur well for future returns.

Fourthly, the Australian economy offers a higher growth potential than those underpinning mainstream global share markets, which tend to be constrained by lower labour force growth. This should augur well for higher earnings per share growth for Australian listed companies.

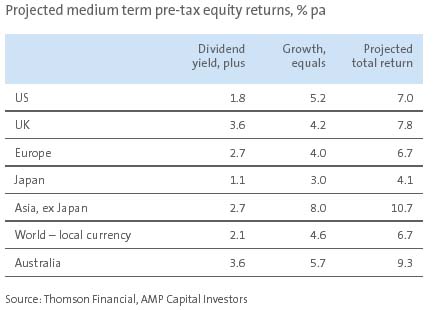

Reflecting the last two points return projections (see below) based on current dividend yields and likely earnings growth tend to favour Australian shares. Over the medium term, a good starting point to project likely returns is to add current dividend yields to likely long term nominal gross domestic product (GDP) growth. This of course assumes that earnings and dividends grow in line with nominal GDP growth, and that share prices grow in line with earnings.

Australian shares still come out ahead of global shares, with the exception of Asian shares.

Finally, franking credits should not be ignored because they add over 1% to the post tax return from Australian shares for Australian investors. The higher dividend yield from Australian shares and franking credits mean Australian shares automatically have around a 2.5% to 3% pa return advantage over global shares.

As for the argument that the strong A$ justifies allocating more funds internationally, relying on currencies to justify an asset allocation decision is difficult as they are notoriously hard to get right. And while it is fair to say that the $A is expensive relative to its trading range over the last 20 years, it will still have more upside if commodity prices continue to trend up (or just remain high) as we think is likely. If this is the case then investors in unhedged international equity funds will see the value of their investments reduced.

Concluding comments

While the case for a higher allocation to global shares has been strengthened by the recent out performance by Australian shares, we think that on a strategic, or 3 to 5 year basis, the combination of better likely returns and franking credits suggest investors should maintain a bias towards Australian shares over global shares.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors