Federal Budget 2007 – an overview

The 2007 Federal Budget was handed down on 8 May. Some of the proposals that may impact your financial plans are set out below.

Taxation

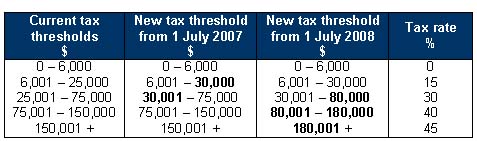

Personal income tax cuts phased in over 2 years

- From 1 July 2007, the 30% threshold will increase from $25,001 to $30,001.

- In addition, from 1 July 2008, the 40% threshold will increase from $75,001 to $80,001 and the 45% threshold will increase from $150,001 to $180,001.

New personal tax rates

Low income earner tax offset

- From 1 July 2007, the low income earner tax offset will increase from $600 to $750 and will begin to phase out from $30,000, up from $25,000.

- Individuals will not pay tax until their annual income exceeds $11,000 (up from $10,000).

- A child could earn $1,667 annually and not pay any tax.

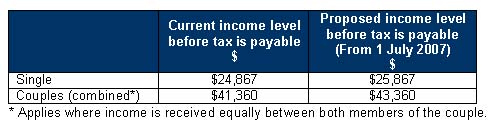

Senior Australian Tax Offset

- Senior Australians eligible for the senior Australian tax offset and the low income earner tax offset currently do not pay tax until they reach an annual income of $24,867 for singles and $41,360 for couples (depending on the income received by each member of the couple).

- The tax cuts lift these income levels (see table).

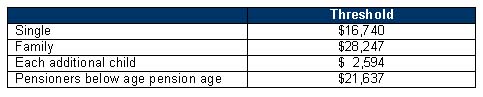

Medicare Levy

The thresholds will be as follows:

- The Medicare Levy threshold for senior Australians will also be increased to ensure that they do not pay Medicare Levy until they begin to incur an income tax liability.

- The Government will make a one-off additional co-contribution into the superannuation accounts of people who made personal after-tax contributions in the 2005-06 income year.

- The measure will double the co-contribution paid in respect of personal after-tax contributions that were made in the 2005-06 year. For example, if a person was eligible for a co-contribution of $1,500 in respect of the 2005-06 year they will now receive an extra co‑contribution of $1,500, so that the total co-contribution in respect of that year would be $3,000. If they were eligible for a $500 co-contribution they will receive an extra $500, giving them a total co-contribution of $1,000 for the year.

- The measure has no application to personal after-tax contributions made in the 2006-07-income year.

-

From 1 July 2007, the rates of Child Care Benefit (currently $2.96 per hour) will be increased by 10% on top of annual indexation.

-

From 1 July 2007, families will be able to receive their Child Care Tax Rebate - up to a maximum of $4,000 (indexed) per child – as a direct payment through Centrelink shortly after the financial year in which they incur child-care costs. This represents a bring-forward in the timing of the Child Care Tax Rebate on current arrangements.

-

Families who incur out-of-pocket child care costs in both 2005-06 and 2006-07 will receive 2 rebates in 2007‑08. They will receive one rebate for 2005-06 expenses as part of their tax assessment under existing arrangements, and the other, for 2006-07 expenses, as a direct payment. As part of the new arrangements, lower income families who previously had insufficient income to receive their full rebate entitlement will now be able to benefit fully from the Child Care Tax Rebate.

From 1 January 2008, there will be a number of enhancements to the Pension Bonus Scheme (PBS):

- The surviving partner of a deceased member of the PBS will be able to receive the bonus that their deceased partner had accrued, but had not claimed, before their death;

- PBS members who take recreation leave, long service leave or unpaid leave, will be allowed to continue in the scheme as non-accruing members for up to 26 weeks without failing the scheme's work test;

- A 'top up' will be made to bonuses where the rate of pension a person receives increases in the 13 weeks after it was granted, because the person's assessed income and / or assets decrease in that time; and

- The discretion Centrelink and Department of Veterans' Affairs decision makers already have will be broadened to extend the period in which people must claim their bonus after failing the PBS work-test.

Funeral bonds means test exemption — increased threshold

- The existing social security income and asset test exemption threshold for funeral bonds will increase from $5,000 to $10,000 per person or couple.

- This will apply to both existing and new funeral bonds taken out from 1 January 2008.

Simplified income-tested care fees

- Currently, self-funded retirees pay higher income-tested fees because nearly all of their income is counted under the income test. However, pension income is currently not counted under this test.

- A new simplified income test will apply to new and existing residents from 20 March 2008. It will include both pension and private income in assessable income. Fees for existing residents will not be increased as a result of this measure, but they may be reduced.

- A one-off non-taxable bonus payment of $500 will be paid to each person who currently qualifies for either the Utilities Allowance or Seniors Concessions Allowance.

- Recipients of the Carer Payment will receive a $1,000 bonus payment while those who receive the Carer Allowance will be given a $600 bonus payment.

- Additionally, the $1,000 bonus will be paid to those who receive both the Carer Allowance and either the Wife Pension or the Veterans' Affairs Partner Service Pension.

- The bonuses will be paid by 30 June 2007, be tax free and not treated as income when calculating social security payments.

Please contact us if you have any questions about how the 2007 Federal Budget may affect your situation.