In contrast to previous years, the Treasurer’s Budget Statement this month contained little in the way of change that would have significant implications for investors. Economically, the Budget produced no surprises either, with financial markets taking the announcements well within their stride.

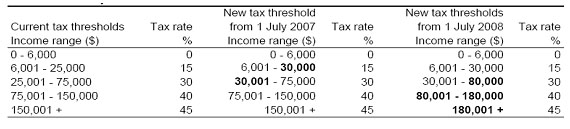

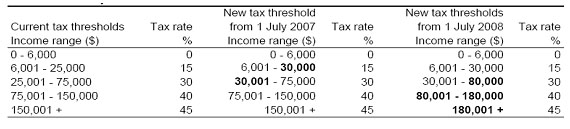

Perhaps of most consequence from a longer-term perspective is the continued program of personal income tax reductions (see table below for details). Of particular significance in recent years has been the raising of the threshold at which the top marginal tax rate is payable. In 1996, the top marginal tax rate kicked in at an income level of $68,000 (in today’s dollar terms after adjusting for inflation). Following the proposed changes to come into effect from July 2008, this threshold will be increased to $180,000.

Such has been the magnitude of the increase in the top marginal tax threshold that Government projections suggest that only 2% of tax payers will be paying the highest rate of tax of 45%. Further, only 20% will be at or above the 40% tier.

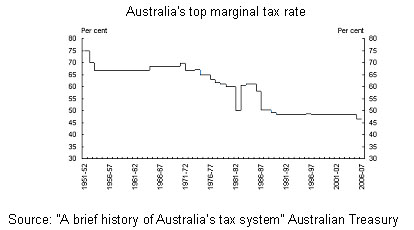

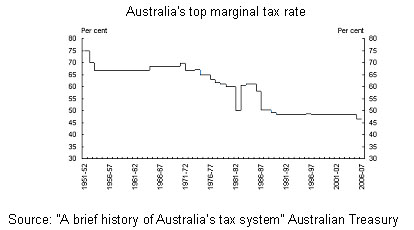

Over past decades, there has also been a large decline in the rate at which the highest income tax is applied. Back in the 1950s, the top marginal tax tier was some 75% and as recently as the mid 1980s, the top tax rate was 60%.

Investment implications of lower tax rates

Given that a large bulk of investment dollars are generated by those on the top tax rates, and that tax is by far the largest cost of investing, the substantial decline in tax costs for many investors will no doubt have implications for investment strategies.

Given past and future tax changes, investors should be more influenced by the underlying performance of an investment, rather than its tax effectiveness. The time costs and risks associated with elaborate tax induced structures and strategies may lead more investors to stick with simplified and mainstream investment options.

A lowering of marginal tax rates will also reduce the attractiveness of capital gains relative to income. A key aspect of the benefit of investment returns achieved via capital gains is the 50% discount factor that applies to gains when determining the tax liability if the investment is held for more than 12 months. The lower the rate of marginal tax, the less significant this 50% discount becomes.

Importantly however, unlike capital gains, franked dividends do not lose any of their relative appeal as a result of lower income tax scales. Investors on low tax rates still benefit at the same level in dollar terms from franking credits as investors on higher tax rates.

Benefits of gearing to become more marginal

The structure of the Australian tax system is such that it contains an inherent incentive for taxpayers to borrow to invest. This is because the interest costs of loans used for investment purposes will often be fully tax deductible; yet investment returns may receive some “favourable” tax treatment, eg the 50% discount on capital gains.

However, this inherent “tax benefit” of borrowing reduces in step with any decline in the marginal taxation rate.

Residential property may become less attractive

Residential property has been a major beneficiary of geared investment strategies over generations in Australia. However, to the extent that lower marginal tax rates reduce the merits of gearing and increase the relative attractiveness of franked dividends over capital growth, then investor support for residential property may start to wane as fewer tax-payers are locked into higher marginal rates of tax.

For cyclical reasons, there has been a lack of support for residential property as an investment in most parts of Australia over the past couple of years. If the entrenchment of lower marginal tax rates does cause a longer-term withdrawal of support from investors, the current issues around a lack of new building and shortage of rental accommodation could become more structural in nature.