Is China a bubble that's about to burst?

China worries

Making the right call on China is critically important in terms of the investment outlook. There is always a lot of scepticism regarding China, but it seems that the ‘China is a bubble about to burst’ camp has grown or at least become more vocal recently. The principal arguments are that China has overinvested, its export potential is exhausted, its assets are in a bubble, bank lending has been excessive, and as stimulus is removed in response to inflation its growth will collapse. Although such a scenario cannot be ruled out, it is unlikely.

Has China overinvested?

Investment in China is now 40-50% of GDP, which is well above comparisons to other countries and there is no doubt it cannot continue at this pace. Yes, there are pockets of excess. However, there is nothing to suggest that China has overinvested on a national basis. For example:

• China is still a poor country, with per capita GDP of just over US$3,000, compared with US$42,000 in Australia and US$46,000 in the US. It still has a lot of catching up to do, and it needs investment to do so.

• The recent surge in investment in China has not been in factories but rather in infrastructure. However, it still has a fraction of the railway length the US had a similar stage in its development. It also suffers from significant transport bottlenecks that, for example, have now forced it to become a coal importer despite having significant coal reserves of its own.

• The surge in investment in recent years has not been in the coastal provinces but rather in inland provinces where the shortage of productive capital, including transport infrastructure, is most intense.

• The stock of productive capital per person is about 5-10% of what it is in the US and other advanced countries, so there is a long way to go before it can be claimed that China is overinvested.

• Despite claims to the contrary there is little evidence investment in China is seeing a lower return in terms of GDP growth than has been the case in the past.

What about China’s reliance on exports?

A common concern is that with China’s wages on the rise and consumer demand in the US, Europe and Japan likely to be subdued, China’s export boom is over. However:

• The importance of exports has been exaggerated. Due to strong import growth, net exports only accounted for 1.2 percentage points of China’s average 11% GDP growth rate over 2000 to 2007, i.e. just 10%.

• China has diversified its export destinations. Ten years ago 49% of China’s exports went to North America, Europe and Japan. Now only 38% do.

• China is doing a lot to encourage consumer spending, including boosting social welfare to reduce precautionary saving. China currently has around the world’s fastest rate of growth in consumer spending.

• Chinese wages are still very low, particularly in the largely untapped central and western provinces.

Are China’s assets in a bubble?

Emerging countries are often prone to asset bubbles given their strong growth potential, more volatile economic cycle and, at times, easier monetary policies. This is made worse in China by interest rates being maintained at an artificially low level and the exchange rate being undervalued. However, right now it is hard to see a broad-based bubble in China.

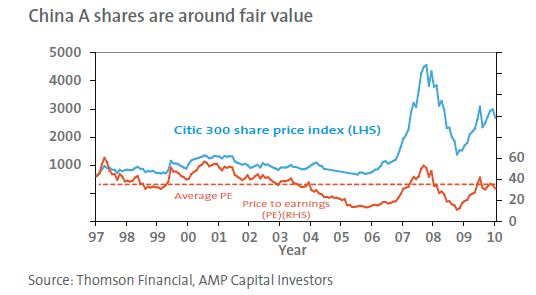

Firstly, although the China A-share market is up strongly from its 2008 lows, since August last year it has been range bound and it is still down 50% from its 2007 high.

Similarly, although Chinese shares are trading at a price to historic earnings multiple of 31 times, this is actually below its average over the last decade or so. Additionally, because earnings are expected to rise by 30% in 2010 and 20% in 2011, the forward earnings ratio is only 18 times. So it’s hard to argue there is a bubble in the share market.

There has also been concern about a bubble in residential property. This is a valid concern in some cities – for example, house prices in Shanghai rose 40% last year. However, China is a big place and it is dangerous to draw conclusions based on the situation in just a few cities. Several points suggest there is no housing bubble overall.

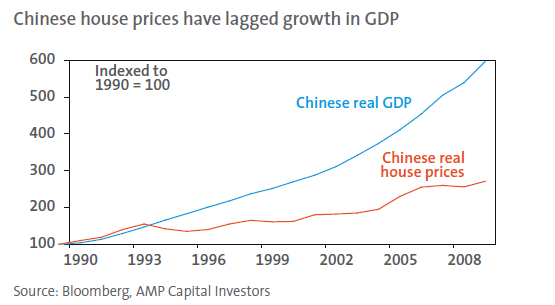

Although China’s average 70-city house price index rose 9.5% over the year to January, this is not that strong given nominal GDP has risen by around 13%. For example, this contrasts with Australian average capital city property prices which rose by 13.6% last year at a time when nominal GDP growth was actually flat. It has been a similar story over longer periods in China, with average house prices not keeping up with growth in GDP as displayed by the chart below. For example, over the last decade, China’s real GDP growth averaged 9% per annum (pa) whereas real house prices only rose by 5.3% pa. By contrast, in Australia over the last decade real GDP growth averaged 2.9% pa, although real house prices rose by an average 6.4% pa. Who has the bubble here?

Household financial indicators that might point to a housing bubble are not present: average deposits are around 30% of values, around 20% of buyers pay in cash and household debt to disposable household income is low at 35% versus 130% in the US and 155% in Australia. So although there may be issues in some cities, nationwide there is no housing property bubble in China at present.

Will the bank-lending boom be followed by a bust?

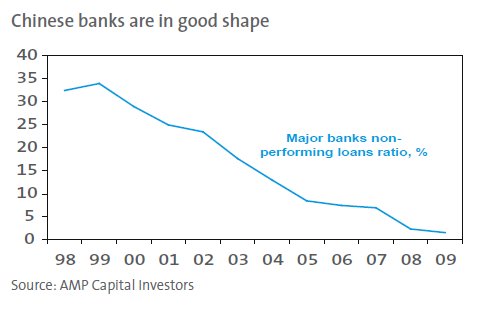

Total bank lending rose by more than 30% last year and many fret that this will lead to a massive rise in bad debts. However, several points are worth noting. First, it followed several years where outstanding credit grew less than GDP. Although private sector credit is now 130% of GDP this is low compared to 173% in the US and 155% in Australia. Second, there is a significant buffer between asset markets and the banking system: mortgage lending has been very conservative with loan to valuation ratios of around 70%, corporate gearing is low and bank exposure to shares is low. Third, the non-performing loan ratio of major banks is very low at just 1.6% compared to 30% a decade ago. A reasonable estimate is that this could rise to 7% as some of last year’s lending turns sour but that would still be low. Finally, because much of the recent surge in bank lending was to fund infrastructure spending, it is arguably a form of government stimulus. Therefore if infrastructure projects run into difficulty, the likelihood is the debt will end up back in the government sector. Public debt in China is just 20% of GDP compared to an Organisation of Economic Cooperation and Development (OECD) average of 90%.

How big a problem is inflation?

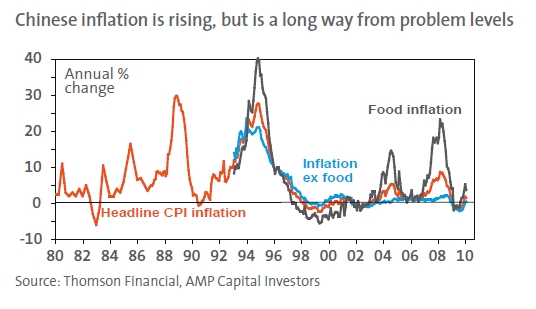

With Chinese inflation running at an annualised rate of 4% over the last six months, it is likely the year-ended rate – currently 1.5% – will rise in the months ahead. As a result, Chinese authorities have started to unwind the stimulus put in place to combat the global financial crisis. However, it would be wrong to say China has a major inflation problem. Much of the increase is due to food, with non-food inflation near zero and likely to remain low given spare capacity in some industries. The current situation is radically different to the 25-30% inflation rates of the late 1980s and mid 1990s, when China suffered from a shortage of productive capacity. In short, inflation will rise further, but a draconian monetary tightening won’t be justified and, given the political imperative to keep growth strong, won’t occur.

Concluding comments

In a fast growing country like China there will always be pockets of excess and bouts of overheating. But right now there is no evidence of generalised overinvestment: China’s reliance on exports is overstated and likely to diminish, it is hard to argue there is an asset bubble and China’s banks are in reasonable shape. Although inflation is on the rise, it looks to be manageable without the need to crunch the economy. This all suggests that a collapse in China is not imminent and that it will remain a strong contributor to global growth and hence the demand for commodities.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors