The Blowout in Public Debt - How Big an Issue?

- A global blowout in public debt has been a key outcome from the global financial crisis. Aging populations are also playing a role.

- Debt crises in peripheral countries such as Greece and Dubai probably aren’t enough to create a major global problem, and default is highly unlikely in key advanced countries such as the US, UK and Japan. However, high public sector debt and/or measures to deal with it will act as a significant medium-term constraint on growth in advanced countries.

- Fortunately, emerging countries generally have low public debt levels, as does Australia.

The blowout in public borrowing

The blowout in sovereign debt, as a result of the global financial crisis, is proving to be a major issue. This is already evident in various countries in Europe, with particular concerns that Greece won’t be able to finance its budget deficit and could default leading to contagion to other high debt countries. But how big an issue is it really?

Which countries are most at risk?

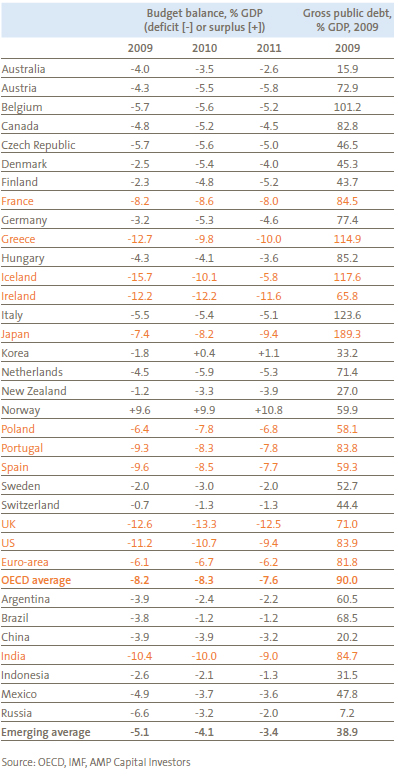

The table on the right shows budget deficits and public debt levels relative to gross domestic product (GDP) for Organisation for Economic Co-operation and Development (OECD) countries and key emerging countries. Generally speaking, to prevent public debt as a percentage of GDP from spiralling higher, a budget deficit needs to be around 3% of GDP or less. However, many countries are now well above this. The countries with budget deficits above 6% of GDP last year are highlighted in orange.

Developed countries most at risk include:

- Peripheral European countries such as Greece, Iceland, Ireland, Poland, Portugal and Spain – where investor confidence in

- public policy has tended to be skittish;

- The UK, US and France – mainly due to big stimulus programs; and

- Long-term budget deficit country, Japan.

The deterioration in public finances in developed countries largely reflects the severity of the recent recession, which of course has tended to lead to reduced public sector revenues and increased spending. This is even more pronounced for countries that were running high budget deficits and public debt prior to the recent crisis, such as Greece. However, it also has a structural component reflecting the pressures on budgets from aging populations boosting spending on health and pensions. This is particularly evident in Japan and parts of Europe where labour force growth is already in decline and the population is aging rapidly. But it is also an issue in Australia - albeit less so - as the Treasury’s third Intergenerational Report highlights.

The public debt blowout

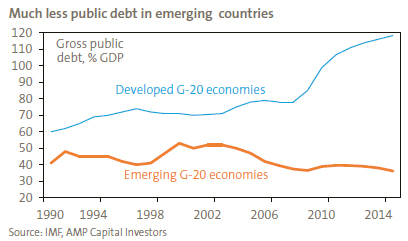

In the emerging world, there are pockets of concern, but the overall picture is more favourable. Whereas the International Monetary Fund (IMF) is projecting gross public debt in advanced countries to rise above 100% of GDP this year, in the emerging world it is likely to have peaked below 40% of GDP.

Finally, public borrowing is really a non-issue in Australia compared to other countries. The budget deficit is less than half the average OECD levels and gross public debt of around 16% of GDP is trivial compared to an OECD average of 90%. Upgrades to Australia’s growth outlook suggest budget deficit projections will be revised down, particularly as stronger employment boosts tax revenue.

Why is high public debt a worry?

While fiscal stimulus was absolutely necessary to combat the global financial crisis a year ago, there are four reasons to be concerned about ongoing high public debt levels:

- Firstly, as public borrowing competes with private borrowing it will boost interest rates over time. A rough guide is that if budget deficits are 5% higher relative to GDP over time then bond yields will be 1% higher.

- Secondly, moves to cut public borrowing via tax increases or spending cuts will likely be a dampener on economic growth and could lead to a more volatile economic cycle.

- Thirdly, high levels of public borrowing reduce the flexibility to respond to a downturn in the economy, so it makes sense to cut

this as economic conditions improve. - Finally, extreme levels of public borrowing can lead to concerns about sustainability, default etc, which, if not dealt with, can

cause losses for investors and a potential contagion to the debt of other high borrowing countries.

It is this last worry that is affecting Greece right now, and contributing to turbulence in global financial markets. While the Greek Government has committed to reducing its budget deficit, there is uncertainty about its achievability and there is concern Greece will not be able to finance its budget deficit or may default. This nervousness is contributing to fears about other European countries with high public borrowing levels such as Portugal and

Spain. Furthermore, the relatively strong Euro is making life tougher for Greece (and other problem countries in the Euro-zone) because the ‘one-size fits all’ currency is preventing a currency depreciation which would normally be one way to ease the pain. The situation in Greece could take some time to resolve itself,which along with other problem countries in Europe could cause occasional market jitters. However, two points are worth noting.

Firstly, Greece is not big enough to derail the global economic recovery - it is only 2.6% of Euro-area GDP. Secondly, while mixed messages are so far emanating from the rest of Europe, it’s unlikely that France and Germany will allow Greece to default threatening a wider contagion to other Euro-zone countries which in turn could threaten the survival of the single currency Euro. More significant are the high public borrowing requirements in the US, UK, wider Euro-zone and Japan. Reversing the crisis-related fiscal stimulus will help, but this will only reduce the budget deficits in these countries by around 2% of GDP, which will still leave them at high levels. Default is most unlikely in these countries given their taxing power, but one way or another, their budget deficits will have to be reduced over time or bond yields will rise sharply.

While US President Obama’s 2010 Budget projects a reduction in the deficit over time, it does entail tax increases for high-income earners and seems to be reliant on optimistic economic growth assumptions. It also projects a widening in the budget deficit in the short term. With the US recovery still tenuous and mid-term congressional elections later this year, it’s hard to see the US announcing significant moves to cut its budget deficit this year.

Overall implications

This analysis suggests several implications for investors. First, the problems in Greece and other small countries are unlikely to derail the global recovery overall, but they could continue to cause occasional financial market jitters. Also, the public debt problems in Greece and other European countries are negative for the Euro compared to the US dollar. Combined with a sluggish recovery in Europe, the bottom line is the European Central Bank will have to run easier monetary policy relative to the US Federal Reserve. Further, high public sector borrowing requirements, notably in the US, will over time start to put upwards pressure on government bond yields globally. Additionally, measures to reduce high public debt levels in key advanced countries will likely slow their growth potential, and potentially result in a more volatile economic cycle. Finally, the lower level of public debt in emerging countries is positive for their relative growth outlook and for emerging market bonds. This in turn supports a relatively more favourable outlook for emerging market shares compared to shares in advanced countries. The same applies in relation to Australia’s growth outlook and government bonds.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.