The Australian Economy - Heading for a Better Place

Content

- The Australian economy is set to grow by around 4% through this year, reflecting the lagged impact of monetary and fiscal stimulus, high levels of business and consumer confidence, the rebound in wealth, and higher export prices. This is likely to push unemployment back below 5% over the year ahead.

- The long-term outlook for the Australian economy is also bright reflecting Australia’s exposure to high growth Asia, strong population growth, low public debt, and a reasonably healthy financial sector.

- This provides a relatively favourable backdrop for Australian assets.

Introduction

While the worry list for the global outlook is still significant – Chinese tightening, high public debt levels, a shift towards populist policy making in the US, etc – there is plenty of reason for optimism concerning the outlook for Australia. This is both in terms of the coming cyclical economic recovery, and also from a longer-term perspective.

From growth slowdown to growth rebound

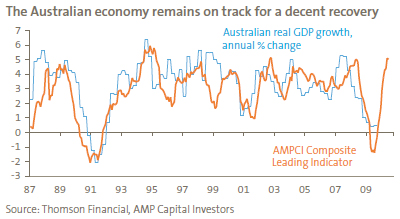

After its worst slowdown since the early 1990s recession, Australia’s economy is set to rebound over the year ahead. In 2009 the Australian economy is estimated to have grown by 0.9%. This seems low but far better than expected a year ago, and significantly better than what occurred in other developed countries where gross domestic product (GDP) contracted 5% in Japan, 4% in Europe and the UK, and 2.5% in the US. Australia’s relative resilience is owed to a range of factors, including: tougher bank lending standards and a stronger financial system; a shortage of houses; the quick application of significant monetary and fiscal stimulus; the relative resilience of demand from China; and a sharp fall at the height of the crisis in the value of the Australian dollar which acted as a shock absorber.

Over the year ahead Australia is likely to see a strong recovery in growth reflecting:

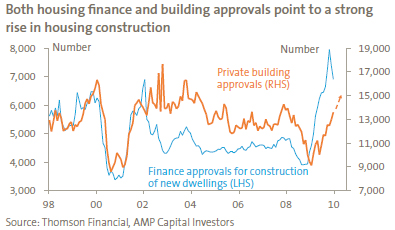

- A rebound in housing construction activity – finance approvals for the construction of new dwellings and significant growth in building approvals point to a strong increase in housing construction this year. While housing finance has recently dipped, it fell from a very high level and it is likely to remain strong on the back of the improving job market. Housing starts this year are likely to be around 165,000 dwellings – up from 135,000 in 2009, but still well down from underlying demand which is now around 200,000 dwellings per annum (pa);

- National income is likely to rise strongly supported by a 40% plus increase in prices for iron ore and coal;

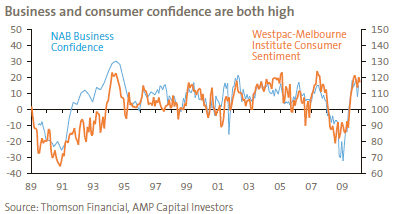

- A solid turnaround in business investment – on the back of stronger profits which are expected to rise 20% this year, the recovery in business confidence from the 2008-09 slump, and a large number of mega-projects;

- Solid consumer spending – on the back of high levels of consumer confidence (see the chart above), an improving labour market, more tax cuts from July, the recovery in wealth over the last year thanks to higher house and share prices, and still low interest rates. While mortgage rates are on the rise, they are still low; and

- Strong growth in public investment – as stimulus spending on infrastructure and schools flows through.

Our leading indicator for the Australian economy is pointing to growth of around 4% over the year ahead.

This has a number of implications:

- Interest rates have further to rise but with inflation likely to be around 2.5% by year-end, thanks to the strong Australian dollar and spare capacity in the economy, the process is likely to be gradual taking the cash rate up another 1% or so;

- Unemployment is likely to fall back below 5%; and

- The budget deficit is likely to improve faster than projected by the Government, as growth comes in faster boosting revenue and cutting spending. The 2009-10 budget deficit is likely to be A$20 billion less than the November projection for a A$57.7 billion deficit, bringing forward the return to surplus to around 2013-14.

The lucky country rides again

At the end of the 1990s Australia was seen as an ’old economy‘, lacking much exposure to the ’new economy‘ driven by information technology. Partly reflecting this, the Australian share market had been a relative underperformer versus global shares for the previous decade or so and the Australian dollar was sinking to new historic lows versus the US dollar. By contrast, as we commence a new decade, Australia is looking a lot brighter. This is reflected in a range of factors:

- The Australian dollar has recovered from a record low of just US$0.48 cents to near parity in recent times;

- Australia is the only Organisation for Economic Co-operation and Development (OECD) country not to have had a ’recession‘ in 2008-09; and

- The price Australia receives for its exports relative to what it pays for its imports (i.e. the terms of trade) is back up around levels not seen since the 1950s.

There are four reasons to remain optimistic about the relative long-term economic outlook for Australia.

Firstly, Australia’s major export markets – with the dominance of high growth Asian countries – have relatively strong growth prospects compared to the world has a whole which is dragged down by debt constrained advanced countries. The potential here is highlighted by China, which is now Australia’s biggest export market. China’s industrialisation process still has a long way to go – per capita GDP is still just over US$3000, the percentage of the population in urban areas is still just 45%, and despite being the world’s biggest car market, per capita car ownership is only where the US was in 1917. The upshot is demand for raw materials is likely to remain strong for several decades as China continues to industrialise. The same goes for other emerging countries such as India and Brazil. This suggests the boost to Australia’s national income from the resources boom has a lot further to go.

Secondly, Australia has relatively favourable demographics compared to other developed countries. While Australia’s population is aging, thanks to a higher fertility rate and high levels of immigration, it is growing faster than most countries and this is projected to remain the case at least to 2050. As a result, Australia’s labour force (which is a key driver of economic growth) will keep growing solidly, whereas in many developed countries, including Japan and parts of Europe, it is already declining.

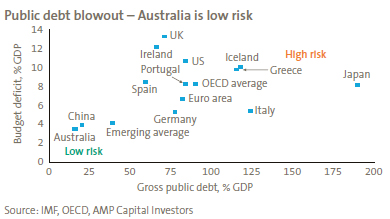

Thirdly, Australia is not lumbered with a massive public debt overhang. The following graph shows budget deficits against public debt, as a percentage of GDP. The countries most at risk have high budget deficits and high public debt levels, including Greece, Iceland and Japan, i.e. countries in the top right corner of the chart. By contrast, Australia is in the bottom left corner in the very low risk category.

Finally, the Australian financial system is relatively strong with low levels of non-performing loans and signs that the bad debt cycle is likely to have peaked. With the Australian financial regulatory framework performing well through the recent global financial crisis, a significant re-regulation of Australian banks is unlikely, compared to the US for instance where a tougher approach is being proposed. So apart from international influences, the supply of credit is unlikely to be as constrained in Australia as in other advanced countries.

All of these considerations point to relatively strong growth in Australia in the decades ahead.

Concluding comments

None of this is to say Australia does not face problems and risks – household debt and house prices are relatively high, manufacturing and some service industries will be under pressure as a result of the resources boom, the two speed economy is alive and well, productivity growth needs to be boosted (as the Government has noted), and there is always a danger of hubris setting in. However, unless things go terribly wrong, these problems should be manageable and allowing for the normal cyclical ups and downs, the big picture outlook for Australia is pretty positive. This should bode well for the relative performance of Australian assets – bonds, property, infrastructure, equities and the Australian dollar.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors