The per capita recession

Possibly the most direct way in which demand within an economy can be increased is via an increase in population. The higher the number of people, the more needs and wants there are in the economy to be fulfilled.

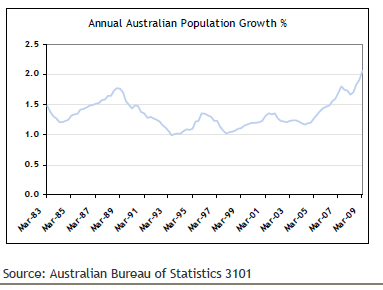

In recent times, Australia has been through a period of significant population growth. The impact of this growth on aggregate economic output numbers should not be underestimated.

Output per person

Although Australia has avoided a recession based on the technical definition of “two consecutive quarters of negative economic growth”, on a per capita (per person) basis, the growth performance has been less impressive. For each of the 4 quarters between the end of March 2008 and March 2009, the level of economic output (after adjusting for inflation) grew more slowly than the population level. That is, economic growth per capita was negative over this period. Real economic growth in the year to March 2009 was just 0.3%, compared with a rise in population of 2.1%.

Whilst official population estimates are not available for the June quarter of 2009, if the population grew by the same quantum in this 3 month period as it did in the March quarter, then the June quarter would have also recorded negative per capita growth.

The extent of the rise in population also places a different perspective on employment data. Whilst headline employment levels have held up well in recent periods, there has been significant substitution of full-time with part-time employment. The overall number of hours worked in the economy has declined by 2.3% in the past 3 quarters; implying that the ratio of hours worked per person has dropped nearly 4%.

Negative movements in employment and output per person are ultimately indicative of a decline in average living standards. Households have been protected against this decline by factors such as the Government fiscal stimulus program and low interest rates. However once the impact of these factors ceases, there is a risk that the required adjustment in household spending may be more serious than is implied by aggregate economic data.

Contributors to population growth

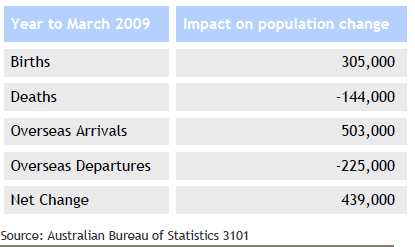

As shown in the table below, the recent increase in Australia’s population has been driven by both natural increase and net migration.

While there has been some rise in the number of births in recent periods, the greatest contribution to the increased rate of population growth in Australia has come about via a higher level of overseas arrivals. The 503,000 in overseas arrivals recorded for the year to March 2009, compares with 438,000 in the previous 12 month period.

Investment implication of recent population trends

Although the lift in the rate of population growth may have masked the true extent of economic weakness in Australia on a per person basis, the increase in population has still created real new demand, which contributes to economic growth and company profitability. For those businesses with high and entrenched market shares, high rates of population growth can underpin a natural or automatic increase in revenue. This may increase the attractiveness of companies with high domestic market shares, particularly in the consumer staples sector, where economic cycles have less influence on revenue changes.

The increase in the rate of population growth also adds to the level of pent up demand for new housing, where supply conditions are already very tight. Therefore, there is an increased probability that housing construction activity will ultimately have to lift from current levels, creating opportunities for companies exposed to the domestic housing industry.

Published by Hillross Financial Services Limited ABN 77 003 323 055. We are part of the AMP Group of companies. No remuneration or other financial benefits are paid to us or our related companies or associates for providing this publication. Any advice in this publication does not take account of your personal circumstances. Before relying on it to make a decision, you should consider how it applies to your overall circumstances or speak to a financial adviser. Before deciding whether to buy or continue to hold any financial product including those referred to in this publication, you should obtain and consider the Product Disclosure Statement for the product, which is available from your financial adviser. Although this information was obtained from sources considered to be reliable, we do not guarantee it is accurate or complete. Past performance is not an indication of future performance.