Why is the gold price so strong and can it continue?

Key points

- The price of gold has reached a new record high driven by a combination of factors including worries about inflation and paper currencies, central bank buying, and a fall in the opportunity cost of holding it.

- While there is a risk of a short-term correction in the gold price, more upside is likely over the medium term.

- However, given gold’s highly speculative nature, a better approach for investors would be to consider a broad commodity exposure.

Introduction

While many assets have risen in value this year, most are still well below record levels. Gold, however, has surged to a new record high in US dollars and has also been rising against most other currencies. One of the most common questions I get from clients is: “Won’t the printing of money by central banks, like the US Federal Reserve, just result in inflation?”. While it is understandable that many see the surge in the gold price as a forewarning of inflation to come, in reality it’s not that simple. So what is driving the surge in the gold price, what is it telling us, and can it continue?

Putting the gold price into a long-term perspective

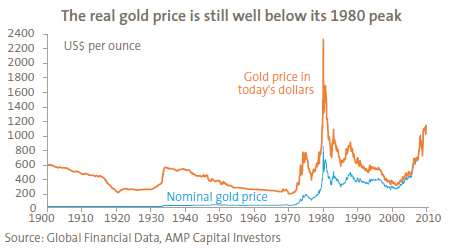

The chart below shows the price of gold since 1900 both in nominal and real terms:

Up until the early 1970s the US dollar was fixed against gold, albeit subject to periodic devaluations. From the early 1970s to 1980 gold was in a secular upswing as investors turned to gold for protection against inflation. However, from 1980 to 1999 the secular trend was down as inflation was brought under control. This decade though has seen gold enter another secular upswing in line with other commodities.

Interestingly the gold price still remains below its inflation-adjusted peak of 1980, when gold reached US$2,318 an ounce in today’s prices. This perhaps partly explains the recent references to gold rising to US$2000.

Why the breakout to new nominal highs?

Several factors are driving the surge in the gold price:

- Firstly, fears that the massive monetary and fiscal policy stimulus that has been pumped into the global economy will generate inflation. So gold is in demand as a hedge against such an eventuality.

- Secondly, gold is seen as a good alternative to paper money. While there are fears about the future of the US dollar, the outlook for other major currencies is not much better. Europe’s economy looks worse than the US, the strong yen looks unsustainable given the damage it has already caused the Japanese economy, and the renminbi is not really an option as it’s not convertible. So gold is seen as a good alternative to holding paper money.

- Thirdly, central bank selling of gold appears to have come to an end and in fact central banks in emerging countries are becoming buyers as part of a strategy to reduce the exposure of their foreign exchange reserves to paper currencies. This has been most recently highlighted by the Reserve Bank of India purchasing gold from the International Monetary Fund (IMF). 63% of global foreign exchange reserves are in US dollars and this is likely to decline over time, probably in favour of gold given the mixed outlook for alternative currencies to the US dollar.

- Further, some still fear an even worse financial meltdown still lies around the corner and see gold as a hedge against such an outcome.

- Finally, the opportunity cost of holding gold versus cash or government bonds as an alternative store of value has collapsed. Interest rates are near zero in the major developed countries and government bond yields are averaging around 3.5% or less. So with cash and bond yields so low the missed income from holding a non-income producing asset like gold (putting aside the potential yield achieved from rolling gold futures contracts over) is very low.

Is it a sign of inflation to come?

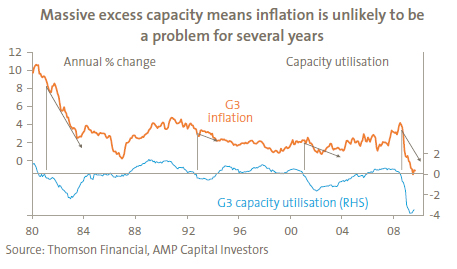

Our assessment is that the surging gold price is not a sign of inflation to come. Massive global spare capacity suggests the bigger risk remains one of deflation. The chart below shows that capacity utilisation in the G3 (US, Europe and Japan) is extremely low and it will likely take many years to recover to a level where corporate pricing power returns such that inflation is a problem.

While narrow money measures have surged, until banks lend this out and spending returns to normal levels, inflation will not be a problem. And by the time that happens central banks are likely to have turned off the monetary taps anyway. Finally, other measures of inflationary expectations are benign: bond yields remain low suggesting bond investors are not worried about inflation, and consumer inflationary expectations in the US are comfortably stuck around 2%-3%. It is also worth noting that an increase in the gold price is not necessarily a sign of inflation - the 1930s rise in the gold price was associated with deflation, not inflation.

Similarly, I don’t see another economic and financial meltdown just around the corner. But of course if there are enough people worried about an inflation outbreak or economic meltdown, then it will still support the gold price.

Rather, the more significant factors driving the gold price higher include the low opportunity cost of holding gold as highlighted by near-zero interest rates, and the heightened wariness of paper currencies on the part of both investors and emerging market central banks.

Can it continue?

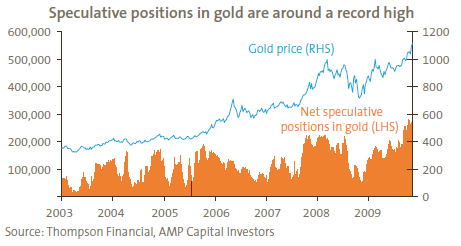

After another huge surge gold is yet again vulnerable to a short-term pullback. Interest in gold is now very high - this is evident in net speculative positions in gold running at extreme levels, which is negative from a contrarian perspective.

However, worrying too much about a short-term pullback risks missing the bigger medium-term picture which remains very positive for gold. We are still in a very favourable part of the cycle for gold. Interest rates remain low and there are no signs they are about to shoot back up. Further, the outlook for the US dollar remains that it is likely to endure a moderate downswing. In addition, there are enough monetarists paranoid about hyperinflation to ensure reasonable demand for gold as an inflation hedge, and as part of the commodity complex gold will benefit from the ongoing rise in commodity prices as emerging world industrialisation continues to gather pace.

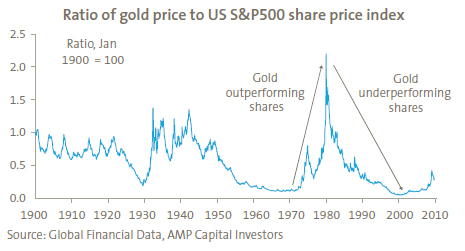

The following chart shows the relative performance of gold versus the US S&P 500 share price index. Gold outperformed shares in the depression of the 1930s, underperformed during the post-war years, outperformed in the high inflation 1970s and underperformed shares during the equity bull market of the 1980s and 1990s. On the basis of this chart, gold may be in the early stages of a secular outperformance phase versus US shares and hence mainstream global shares.

Investing in gold

There are many ways to get exposure to gold, all with their pros and cons: buying physical gold, gold futures, gold exchange traded funds, gold shares and gold funds offered by fund managers. But it is worth stressing that gold is highly speculative. It is not grounded by an income stream like most shares, property, bonds and cash. Virtually all the gold that was ever produced still exists and can potentially come back on to the market. At the same time, actual production and demand for jewellery and industrial use is trivial relative to the huge gold stock. As a result, ‘animal spirits’ can play a huge role in the determination of the gold price. This can make for a volatile ride over time and suggests that gold should not dominate an investor’s portfolio. Rather, a better approach would be to have an exposure to a broad basket of commodities, which includes gold, where the supply and demand is generally more visible and understandable.

Concluding comments

Several considerations suggest that the gold price still has more upside on a medium-term view: interest rates are likely to remain low, scepticism about paper currencies is likely to remain for some time, fears of higher inflation are unlikely to go away anytime soon, and gold will benefit from continued strength in commodity prices generally.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.