Just how worrying is the 'worry list' for investors?

Key points

• There is a long ‘worry list’ being thrown up in regards to the outlook for shares and other growth oriented assets: indebted consumers, inflation off the back of ballooning budget deficits and central banks pumping money, worrying demographic trends, etc.

• While most of these cannot be ignored, and some will likely constrain returns over the medium term in mainstream global equity markets such as the US, they are not as worrying as they appear.

Introduction

Shares have just wrapped up two consecutive years of big losses. After such a slump the list of worries is long and the outlook is viewed with some trepidation. The temptation is to assume more of the same. This note looks at why the ‘worry list’ might not be so worrying.

The ‘worry list’ for investors

The past year saw its fair share of extremes, including the worst financial crisis and global recession since the 1930s, one of the worst bear markets ever and the biggest fiscal and monetary easing since World War 2. Add to this less favourable demographic trends and it is possible to paint an endless list of problems. While it is wrong to ignore the risks, there is a danger in getting carried away. The main worries are addressed in turn below:

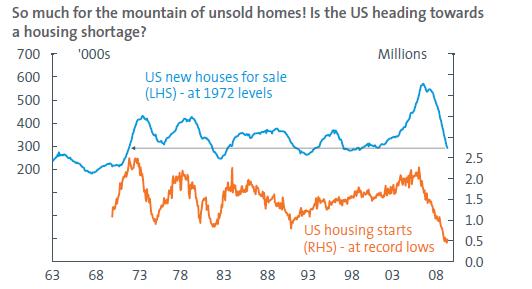

‘Reluctance by households to take on more debt and by banks to lend will prevent any economic recovery’

This is the most common worry. However, there are several points to note. Firstly, consumers do appear to be responding to fiscal stimulus and lower interest rates. This is certainly evident in Australia where retail sales are up 7% year-on-year, car sales appear to have turned the corner and various housing indicators have improved dramatically. These trends suggest that consumers have not lost the inclination to consume. In the US, retail sales have not collapsed (despite the rise in unemployment), car sales are showing signs of recovering and consumer sentiment has started to improve. While a more cautious attitude towards debt will likely constrain the recovery in consumer spending, so far there is nothing to suggest consumers are just focused on debt reduction. Secondly, some indicators such as car sales and housing starts have fallen below the level consistent with underlying demand, suggesting that sooner or later there will be a spring back. In fact, the number of US new houses for sale has collapsed and housing starts at record lows may soon lead to a housing shortage if construction doesn’t pick up soon.

Source: Bloomberg, AMP Capital Investors

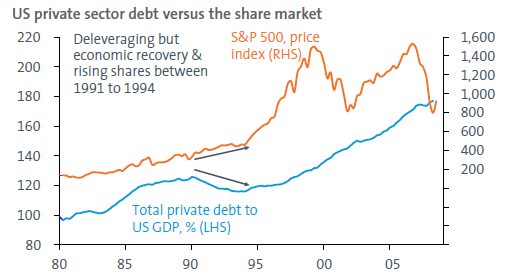

Thirdly, the experience in the early 1990s indicates debt deleveraging won’t necessarily stop a recovery. For example, the fall in private debt in the US in the 1990s didn’t prevent an economic and share market recovery.

Source: US Federal Reserve, Thomson Financial, AMP Capital Investors

In fact, private sector credit normally lags an economic recovery. This was evident in Australia in the early 1990s.

.bmp)

Source: Thomson Financial, AMP Capital Investors

‘The blow-out in budget deficits is a major concern’

Currently, the increase in budget deficits globally is appropriate because without it we would be having a worse recession. Also, budget deficits are unlikely to boost interest rates yet, as higher public borrowing is being offset by less private sector borrowing. Hence, it is not a major issue right now. However, in several years once recovery has occurred governments will have to unwind their borrowing which could cause increased economic volatility.

‘Easy money means the US will be the next Zimbabwe’

Many worry that quantitative monetary easing will create inflation. However, comparisons with Zimbabwe are ridiculous. Zimbabwe’s inflation rose 250 million percent because it wiped out its productive potential and the government turned to printing money to finance spending and pay public servants. Simply put, no goods plus lots of money meant prices surged. At present, the main concern in the US and elsewhere is deflation, as the global recession is resulting in idle factories and rising unemployment queues putting downward pressure on prices. In fact, consumer prices are already falling in the US, Japan and Europe (where inflation is below zero). In Australia, inflation is just 2.1%. While narrow money supply measures have surged, this is because central bank easing has boosted bank reserves. Only when this feeds through to a broader increase in credit and economic activity returns to more normal levels will inflation be a serious risk. However, given the amount of excess capacity that has to be worked off, this is likely to be at least two or three years away. At this point, the inflationary impact will depend on how quickly central banks soak up the extra money. However, that is an issue for several years down the track. It is also doubtful independent inflation targeting central banks will simply acquiesce to permitting higher inflation as a means to reduce public debt burdens.

‘Expect a double dip recession’

Worries about a double dip are common towards the end of most recessions. The main fear is that once the policy stimulus wears off, growth will collapse anew. Our view is that it is too early to talk about a double dip because we haven’t emerged from this recession yet. Also, given the impact of fiscal stimulus still to occur, particularly via infrastructure spending, and the likelihood that we will start to see a housing recovery in both the US and Australia next year, a double dip next year appears unlikely. That said, it is likely that the unwinding of fiscal and monetary stimulus could result in renewed weakness, but this is several years away.

‘The US dollar (US$) will crash, creating renewed financial panic’

This worry seems to appear every time a government suggests diversifying its reserves away from US$. However, while a further improvement in global confidence may result in more downward pressure on the US$, a collapse is unlikely as the two most traded alternatives (the Japanese yen and the euro) are no more attractive and China will not allow a sharp rise in the renminbi.

‘Demographics is destiny’

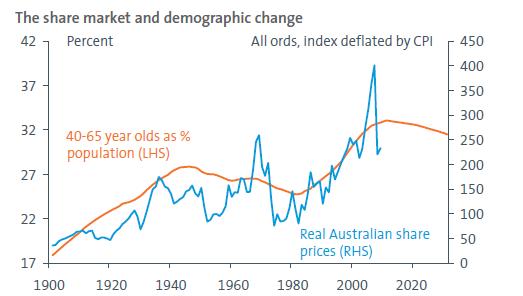

Using demographics to predict the share market is back in the headlines following Harry Dent’s latest book “The Great Depression Ahead” in which he predicts, largely on the back of demographic trends based on the number of people in the peak spending age of 45 to 49 in the economy, America will enter a Great Depression in 2010 and shares will not bottom until 2012. I have a lot of time for Harry Dent’s work and he made a great call in the early 1990s. However, there are dangers in relying on it too much to make grand calls. The relationship between demographic variables and share markets is very rough and encompasses only a few big 30 to 40 year swings. This can be seen in the chart below which tracks the percentage of the Australian population in the peak middle aged savings bracket versus the share market.

Source: ABS, AMP Capital Investors

Additionally, the combination of having children later, living longer and delaying retirement all mean the relationship between demographics and economic and financial variables will change over time. Finally, demographics indicated that US shares should have boomed over the last decade. Harry Dent’s book “The Next Great Bubble Boom” from three or four years ago predicted that the Dow Jones will reach 40,000 by 2010. However, so far it has been a terrible decade (the Dow is now at 8500 or 1998 levels). Thus, with demographic theories having not worked so well over the last decade, there is a danger in relying on them too much for the next decade in terms of making big calls on shares.

‘Shares are now expensive after their rally’

Shares have had very strong gains from their March lows. Forward price-to-earnings multiples (the ratio of share prices to year ahead consensus earnings expectations) have increased from around 8 or 9 times at the March lows to around 14 times for both global and Australian shares. However, this is still below longer term averages around 15 times. In other words shares have gone from being very cheap at their lows, but they are still not expensive.

Our assessment

The ‘worry list’ is long and mainstream global equity markets will likely face a more volatile and constrained ride over the longer term. Shares may also have a rougher ride through the traditionally weak September quarter than was the case in the last quarter. However, we think that many of the current worries doing the rounds are overblown and are not enough to prevent solid gains in shares over the year ahead. Shares are still cheap, they are attractive relative to low yielding cash and bonds, an economic recovery from later this year is likely to underpin an eventual improvement in profits and most investors are still underweight shares so there is a lot of cash sitting on the sidelines.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors