The Australian economy - recession, recovery or both?

Key points

• Australia has so far had a very mild economic downturn compared to other countries and its own history.

• It’s likely that the Australian economy went backwards in the June quarter and that this will continue into the current quarter. This, along with falling inflation and rising unemployment, is likely to prompt more interest rate cuts over the next six months.

• Later this year and through 2010 a sustained recovery is likely to kick in, driven by the rebound in China, housing and public investment. In the meantime, economic indicators are likely to be a mixed bag.

How does this recession compare?

While the global economy is going through its worst recession in over 70 years, the Australian economy has held up remarkably well, so far at least. The following table compares the current downturn to past recessions.

What happened in past Australian recessions?

.bmp)

* It can be argued that the mid-1970s recession was much longer as GDP peaked in 1973 and spent several quarters just bouncing up and down in a declining trend.Source: ABS, RBA, AMP Capital Investors

Recent data has painted a confused picture

Recent economic data has been somewhat confusing. March quarter GDP surprisingly rose, housing finance and auction clearance rates have increased, consumer and business confidence readings are well off their lows, retail sales are up 7% year-on-year (yoy) and car sales look like they may have bottomed. However, business investment appears very weak, the trade balance is deteriorating again, building approvals have fallen back and unemployment is still rising. There is also a concern that monetary and fiscal stimulus is the only reason for the positives, and that it will soon fade. So where are we?

Expect things to get worse in the short term…

There are several reasons to expect economic conditions, as measured by GDP, to contract in the short term:

• Exports now appear to be weakening. Rural and gold exports, which supported a surprise rise in March quarter export volumes, are reversing and some of the fall in Asian manufactured exports will likely flow through to Australia;

• The slump in export prices and the flow through to national income is just getting underway, with prices for coal and iron ore coming down by 30% to 60%;

• Business investment looks set to fall further on the back of a slump in profits, low levels of capacity utilisation and the tougher credit environment (with business credit now going backwards). The weakness in business investment is highlighted by a 61% fall in the value of non-residential construction approvals from year ago levels; and

• While households are currently being supported by the government’s cash payments, July tax cuts and low interest rates, this will be offset in the short term by uncertainty about the labour market, as unemployment continues to increase, and the desire to reduce debt in the face of the 15% or so loss of wealth.

For these reasons GDP is likely to fall in the June and September quarters. Our leading indicator for the Australian economy suggests more weakness in the short term before growth resumes later this year and into 2010.

The leading indicator is based on consumer and business confidence, building approvals, money supply growth and the yield curve.

.bmp)

Source: Thomson Financial. AMP Capital Investors

In terms of the labour market, it’s worth stressing that it always lags the economic cycle. This is because it takes a while for businesses to swing from hiring to firing (and vice versa). Thus, the slump in growth over the past year is yet to fully impact employment and this (combined with a contraction in activity in the near term) is likely to push unemployment up to around 7% by year-end and probably up to a peak of 8% next year. While June employment data still indicated a relatively modest rate of deterioration in employment, the 50% slump in ANZ job advertisements over the last year and the sharp fall in business hiring plans (as evident in the National Australia Bank’s business survey) point to a sharp fall in employment still to come. Refer to the chart below.

.bmp)

Source: Thomson Financial, AMP Capital Investors

… before they get better

While we anticipate a lurch back into negative growth in the June and September quarters, we remain of the view that the economy is on track for a sustained recovery from later this year.

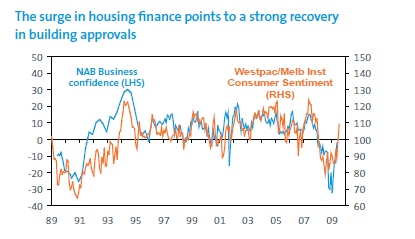

Firstly, due to the kick start from the first home owner’s boost and more fundamentally from lower mortgage rates, the housing construction cycle is likely to turn up from later this year. Sure, the first home owners boost will tail off as we go through next year. However, with mortgage rates remaining low and with pent up demand having built up after years of housing commencements running below underlying demand, it’s likely that the housing construction upswing will continue through next year and into 2011. There is a danger in reading too much into the slump in building approvals in May, as it was largely driven by a 43% fall in normally volatile approvals for apartments. Housing finance commitments for the purchase or construction of new homes is still rising solidly and this normally leads housing approvals. See next chart.

Source: Thomson Financial, AMP Capital Investors

Secondly, a range of business surveys point to a recovery in global economic activity from later this year. At the forefront of this is a solid upswing now getting underway in China. This should help drive a recovery in exports.

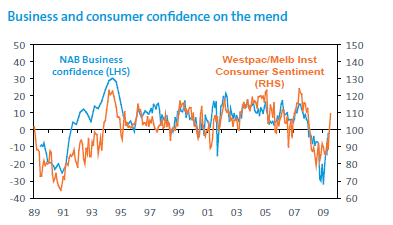

Thirdly, stronger public spending (particularly on infrastructure) will start to kick in from later this year, and this will provide an offset to weak business investment.This is all consistent with the rise in business and consumer confidence that we have seen over the last six months, which normally feeds through to growth with a lag.

Source: Thomson Financial, AMP Capital Investors

During recessions there is always a concern that any boost provided by fiscal stimulus will be temporary. However, historically it has always been successful, along with low interest rates (which will remain low well into any recovery), in sparking a pick up in private sector demand. This time around the problems of excessive household debt are much greater, but against this the fiscal stimulus has also been greater than normal.

Implications for interest rates

With unemployment likely to rise well into next year and excess capacity in the economy continuing to expand, it’s likely that inflation will fall well below the RBA’s 2% to 3% inflation target over the year ahead. In fact, June quarter inflation data to be published later this month is likely to show inflation at 1.7%. With inflation falling below target, unemployment drifting steadily higher and worries that the fiscal stimulus to consumer spending may wear off, it’s likely that the RBA will want to drip feed more good news into the economy in the form of further interest rate cuts over the next six months or so. As a consequence, we remain of the view that the cash rate can, and will, fall further to around 2.25% or 2.50% by year end.

Concluding comments

We are now in the stage of the economic cycle where economic indicators paint a confusing picture. Some indicators are still signalling weakness, such as the rise in unemployment, but others are pointing towards an eventual economic recovery from later this year. The cross currents in economic indicators also reflect the constraints around high debt levels on the one hand and massive monetary and fiscal stimulus on the other. Unfortunately, this confused picture is likely to remain for a while. However, the key is that even though the June and September quarter GDP readings will likely be negative, the economy remains on track for a recovery from later this year.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors